By Takezo Trading | www.takezotrading.com

Every week, the CFTC (Commodity Futures Trading Commission) releases the Commitment of Traders (COT) report—a look under the hood of trader positioning across major financial markets. While this data is a lagging indicator, it gives us a strong pulse of where speculative money is leaning. Here’s the latest update as of April 1st, 2025, along with my analysis.

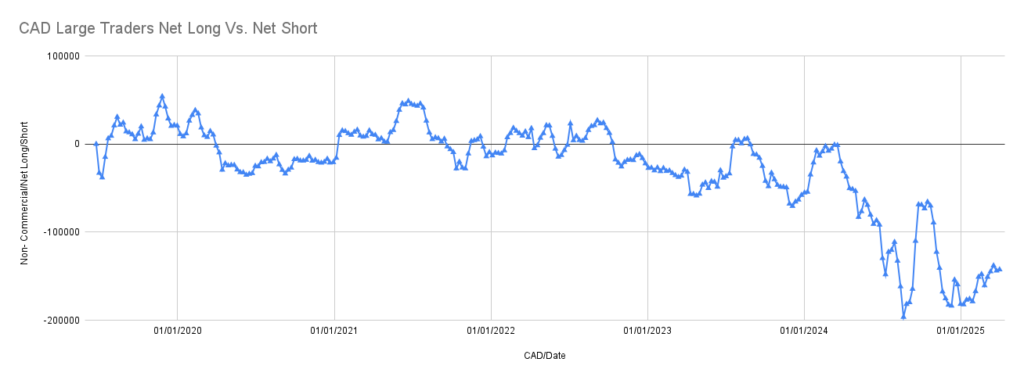

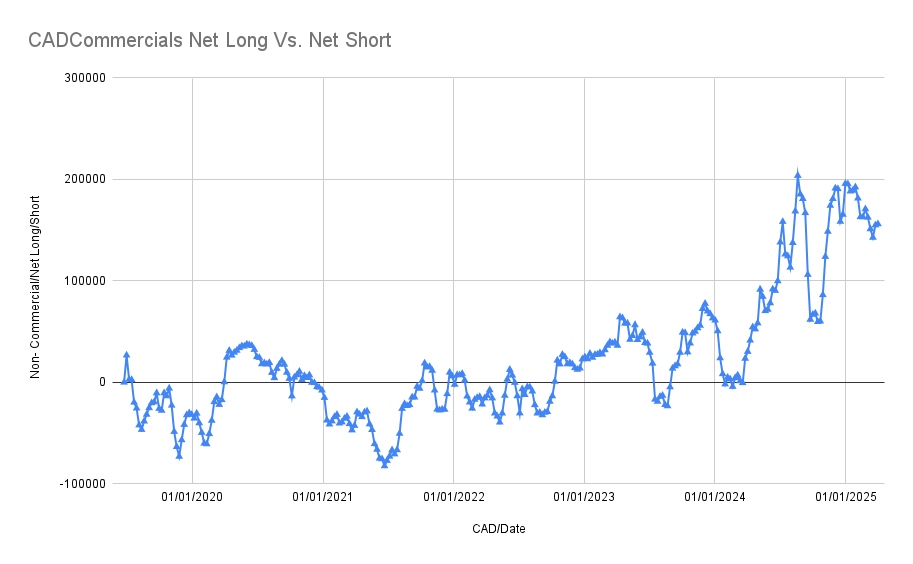

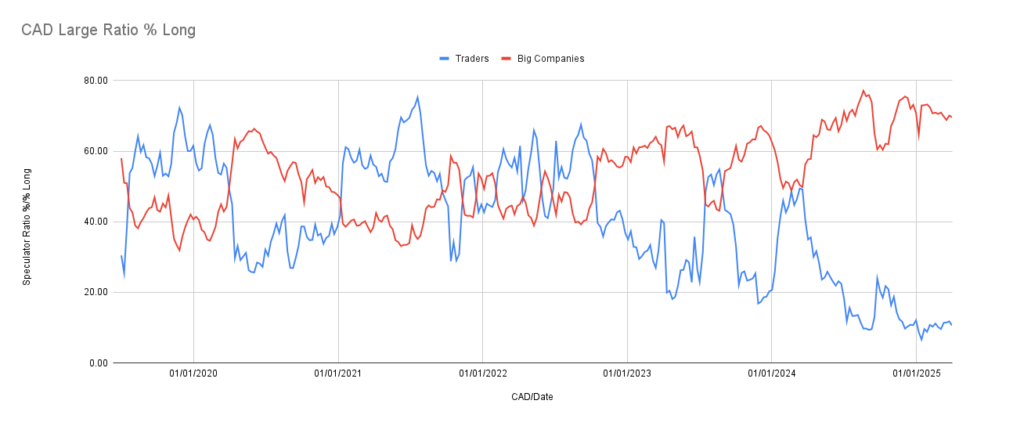

CAD – Canadian Dollar

- Speculators: Net short -130,016

- Commercials: Net long 143,318

The CAD numbers show classic indecision. Speculators remain net short, and commercials are net long. The % long on speculators is sitting deep in oversold territory, while commercials are creeping into overbought. This kind of setup typically precedes a reversal, but with tariffs dominating the headlines, it’s worth watching next week’s data closely.

Verdict: Leaning toward a reversal, but no sharp signals yet.

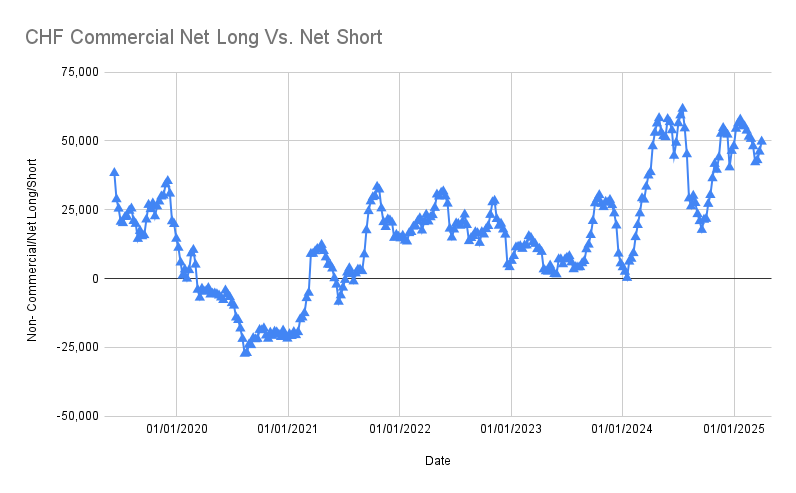

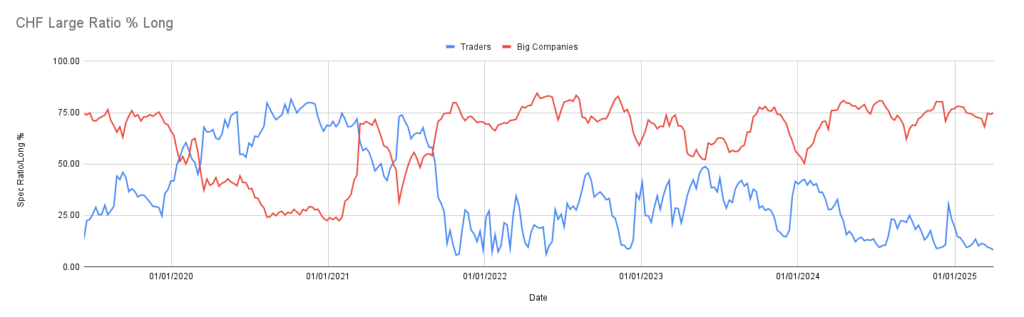

CHF – Swiss Franc

- Speculators: Net short -42,764 (added 5,136 new shorts)

- Commercials: Net long 49,769 (added 3,967 new longs)

Another case of indecision. Speculators keep increasing their short exposure while commercials quietly add to their longs. Both groups are moving deeper into their respective extremes—oversold and overbought. No clear trade signal yet, but price action is worth monitoring for reversal signs.

Verdict: On reversal watch.

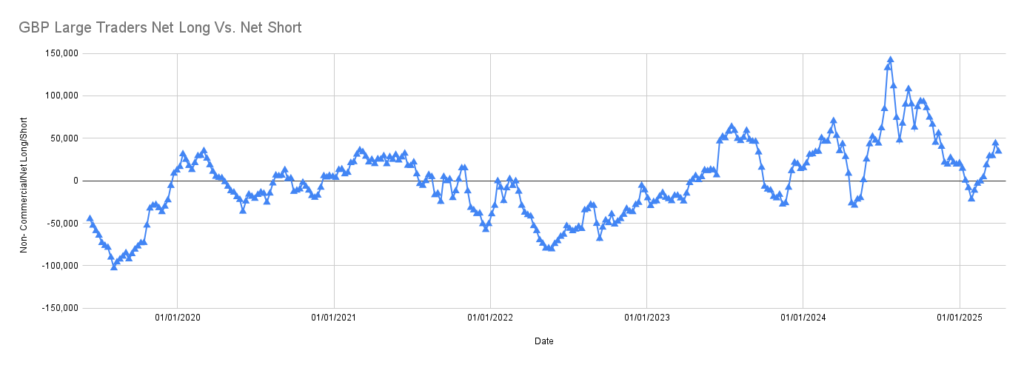

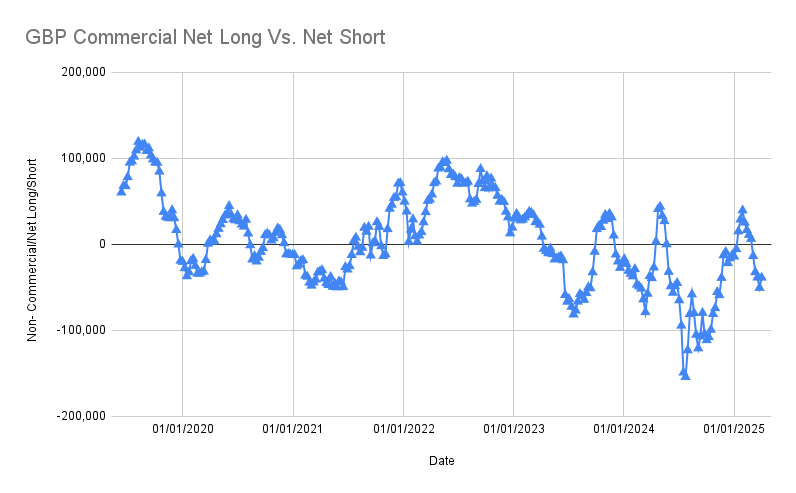

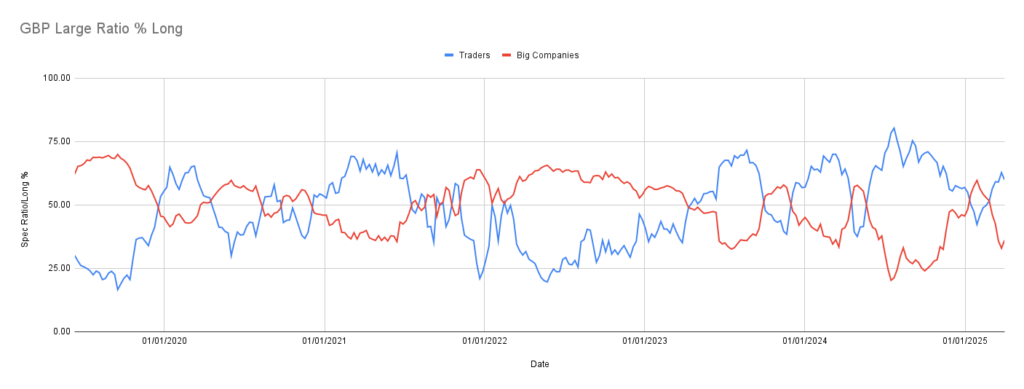

GBP – British Pound

- Speculators: Net long 34,626 (decreased longs by 4,030, increased shorts by 5,627)

- Commercials: Net short -38,790 (increased longs by 1,477, decreased shorts by 10,415)

This is classic “noise” territory. Movements on both sides, but nothing decisive. Speculators trimmed their longs while commercials shuffled their positions around. Without clear directional pressure, there’s not much to base a trade on right now.

Verdict: Stay patient, no strong signal.

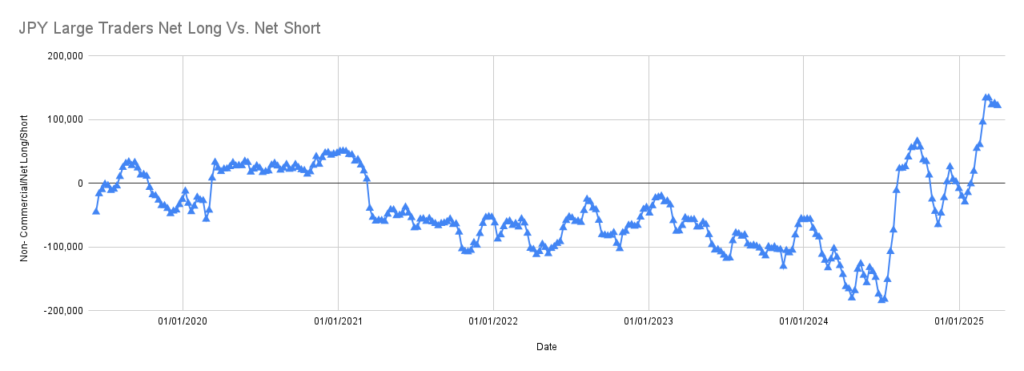

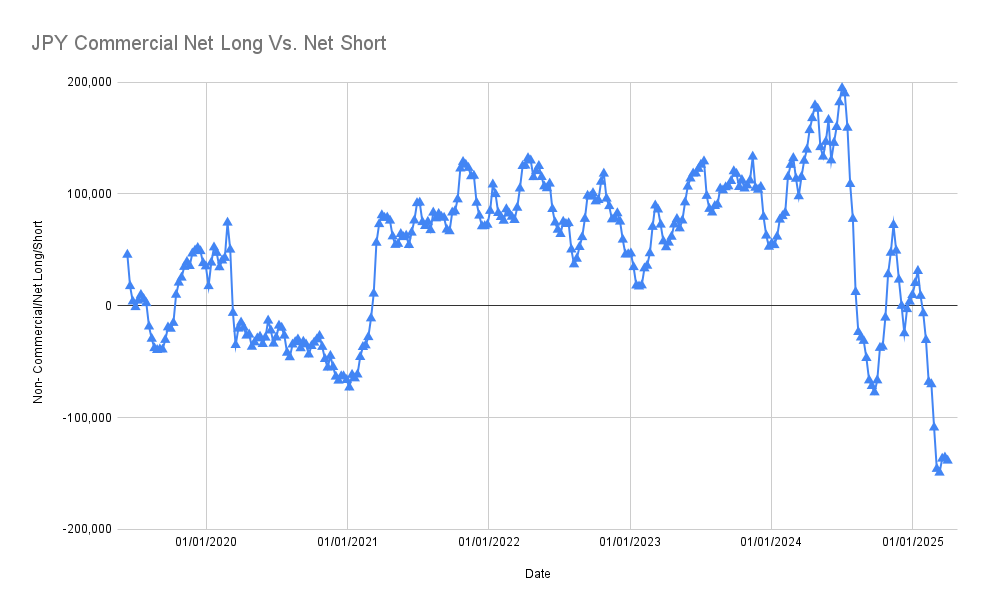

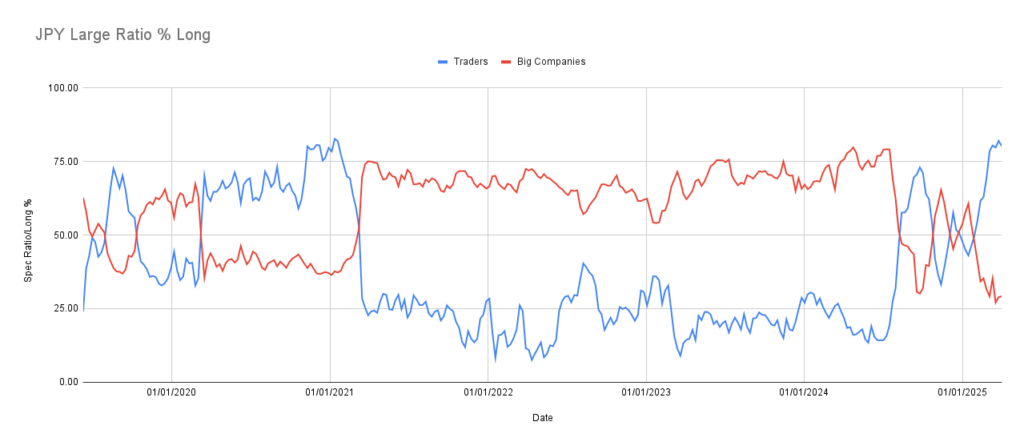

JPY – Japanese Yen

- Speculators: Net long 121,774 (added 1,092 longs, 4,694 shorts)

- Commercials: Net short -138,547 (added 3,972 longs, 6,779 shorts)

Speculators are charging into overbought territory fast. Commercials are still short but have room to go before hitting extreme levels. With traders this enthusiastic, I would tread carefully. Momentum might carry it further, but signs of exhaustion could signal a trend reversal ahead.

Verdict: Bullish but starting to flash caution signals.

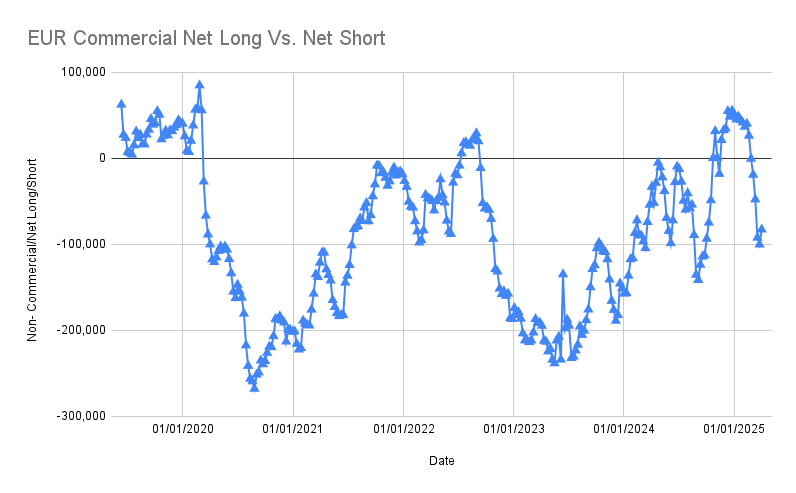

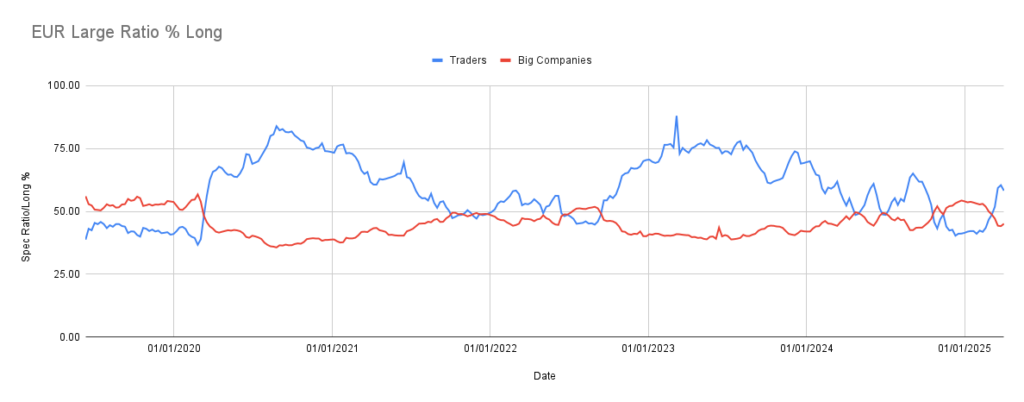

EUR – Euro

- Speculators: Net long 51,835 (decreased longs by 6,549, increased shorts by 7,141)

- Commercials: Net short -82,872 (added 3,666 longs, cut 13,778 shorts)

No fireworks here. Positioning shifts on both sides, but nothing strong enough to hang a trading idea on. The Euro’s positioning remains messy, and it’s best to wait for more clarity.

Verdict: No action for now.

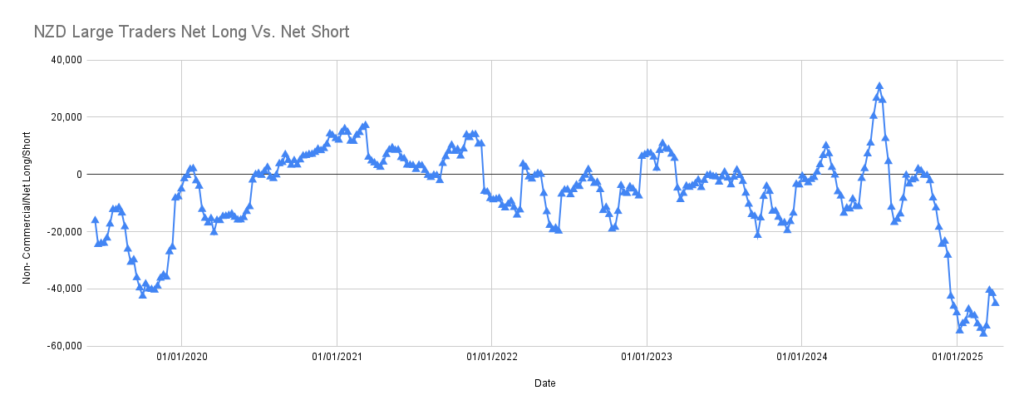

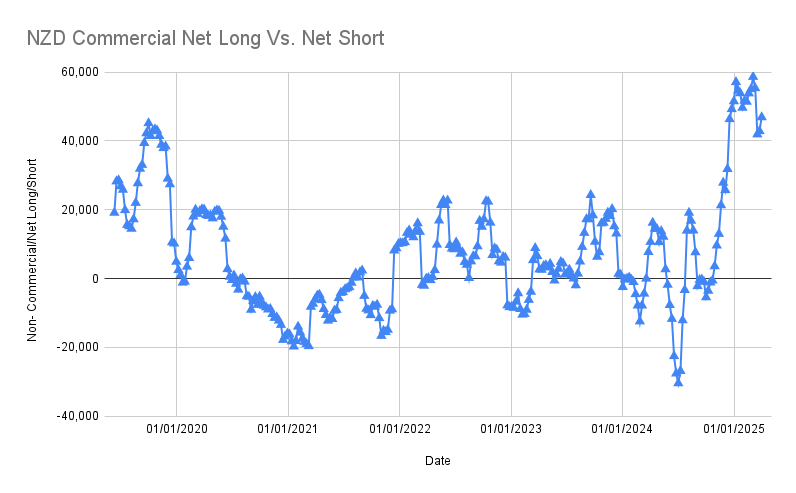

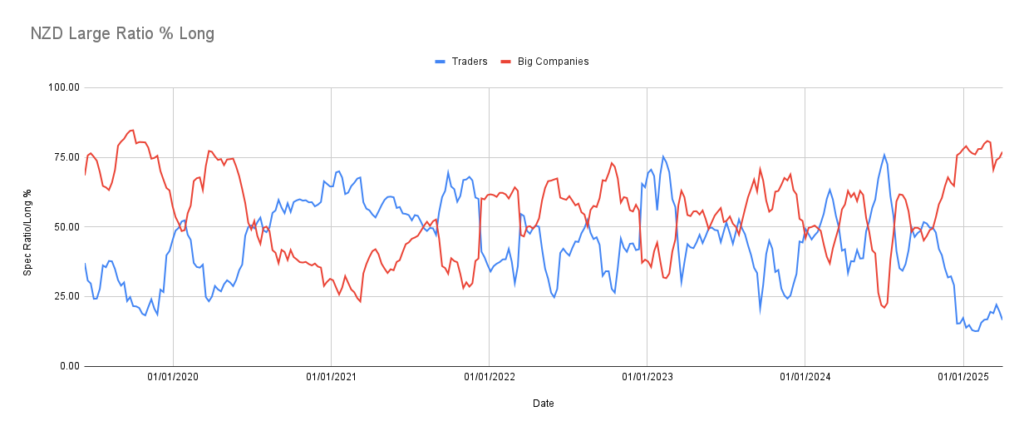

NZD – New Zealand Dollar

- Speculators: Net short -45,048 (decreased longs by 2,271, increased shorts by 1,210)

- Commercials: Net long 46,893 (added 2,275 longs, cut 1,753 shorts)

Both speculators and commercials are at their respective extremes. Speculators are heavily short; commercials are heavily long. This type of setup often signals a reversal coming, but as always, I’ll wait for price action to confirm it.

Verdict: Reversal potential is building.

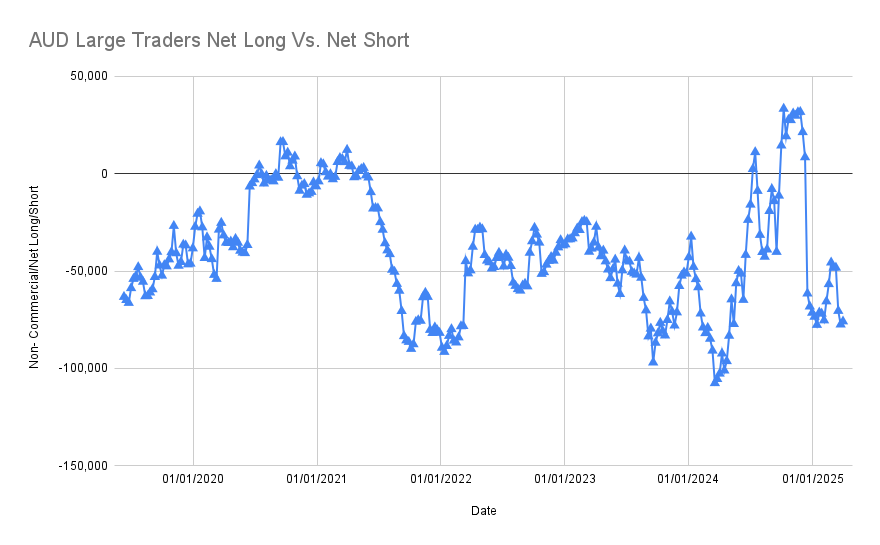

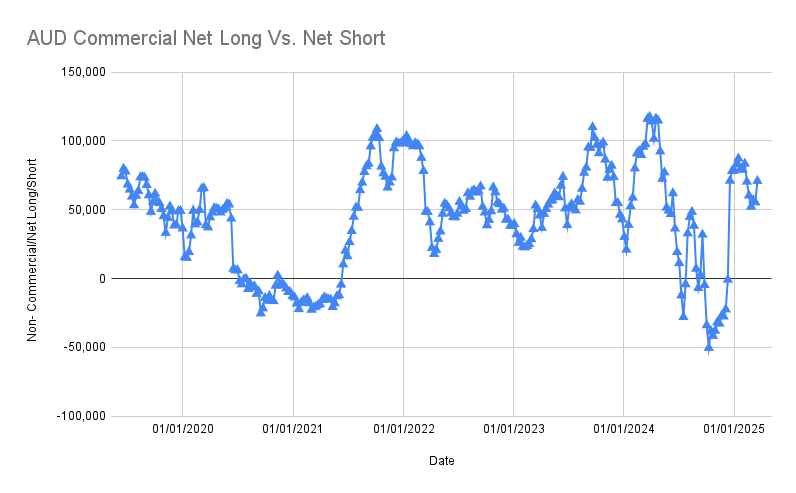

AUD – Australian Dollar

- Speculators: Net short -75,863 (cut longs by 1,913, cut shorts by 3,496)

- Commercials: Net long 79,152 (flat on longs, added 3,169 shorts)

Both sides are nearing their extreme positioning. Whenever speculators and commercials are this stretched, trend reversals become more likely. Another case where price action will be critical to spot the turn.

Verdict: Watch for reversal signals.

Final Thoughts

The Commitment of Traders report this week tells a story of buildup and tension across multiple currencies. Tariffs are rattling the markets, but the COT data hasn’t fully priced in the potential fallout yet. Overall, several currencies (CAD, CHF, NZD, AUD) are flashing potential reversals based on extreme positioning, while others (EUR, GBP) remain muddled.

I’ll be keeping a close eye on how price action develops, especially with so many markets nearing critical points.

As always, patience first, then precision.

Data Source: Commodity Futures Trading Commission (CFTC)