By Takezo Trading | www.takezotrading.com

Trading is a game of constant learning. This week, while reviewing the latest Commitment of Traders (COT) data, I came across an interview with veteran trader Peter Brandt. He mentioned something that struck me: he prefers to position himself with the commercials rather than against them.

It’s a simple but powerful insight—and it’s changing how I read the COT data. Instead of focusing only on potential reversals, I’m also asking: “Which side are the commercials on?”

Here’s the full breakdown of this week’s COT report as of April 18, 2025, and how I’m applying this new perspective.

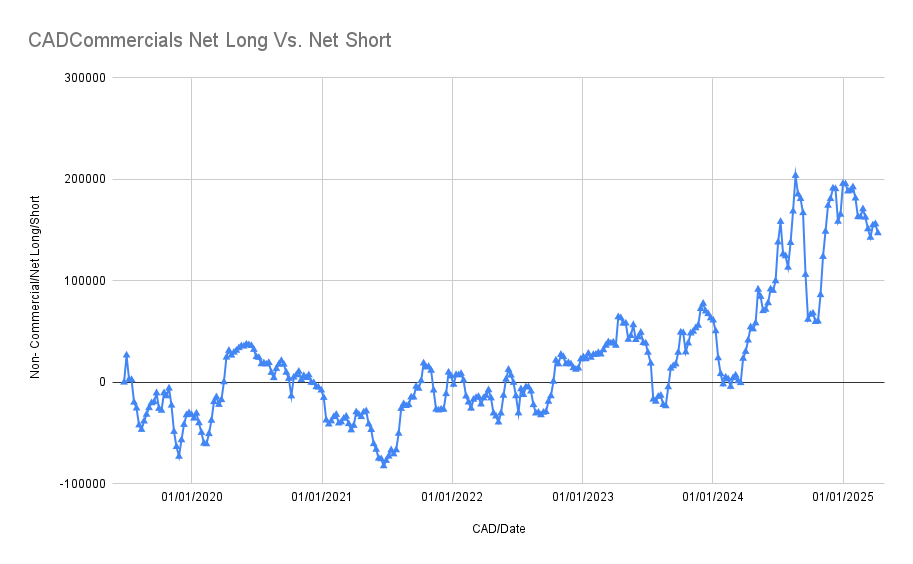

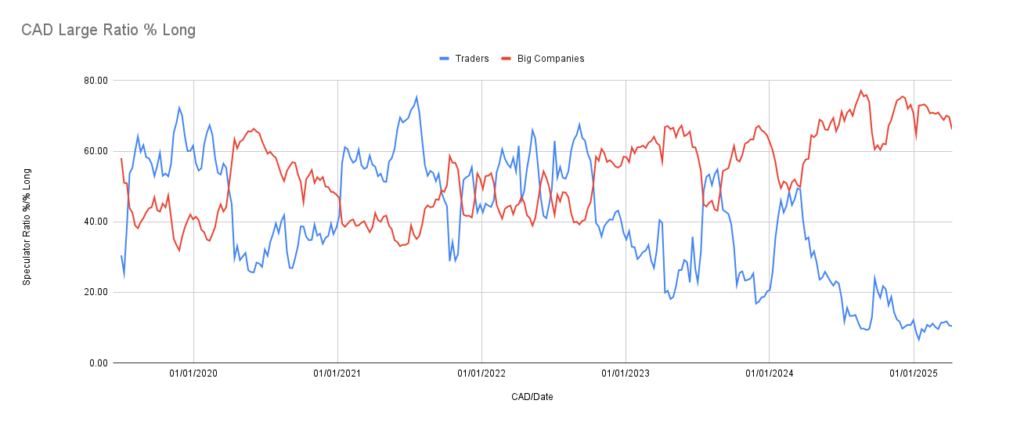

CAD – Canadian Dollar

- Speculators: Net short -119,241 decreased long positions by -1,577, decreased shorts by -12,352

- Commercials: Net long 124,460 decreased longs by -14,837, decreased shots by -979

Net longs are in the extreme territory. As we see from the USDCAD charts, the reversal is on away, as was signaled in the prior weeks before. Commercials are still net long CAD, but they’re starting to reduce their long exposure faster than their shorts. Meanwhile, speculators remain heavily net short. Following the speculators here would’ve had you aligned with the ongoing uptrend in USD/CAD (CAD weakness).

Takeaway:

The shift in commercial behavior suggests the CAD downtrend might be softening. Still, the speculators have been right so far.

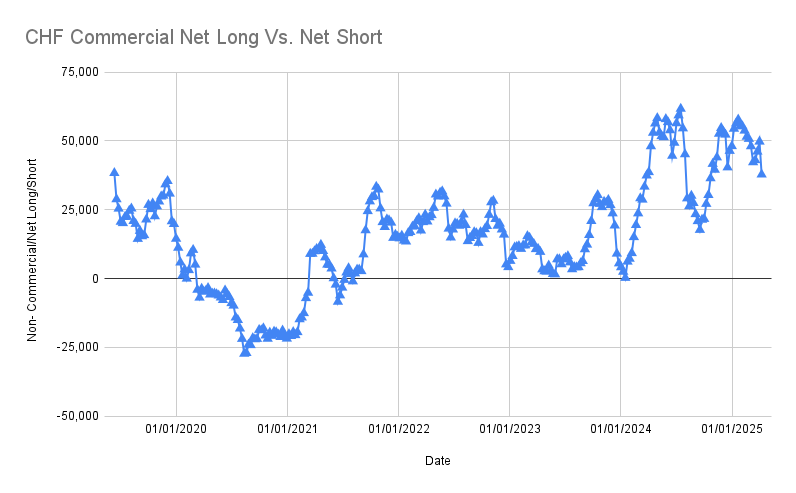

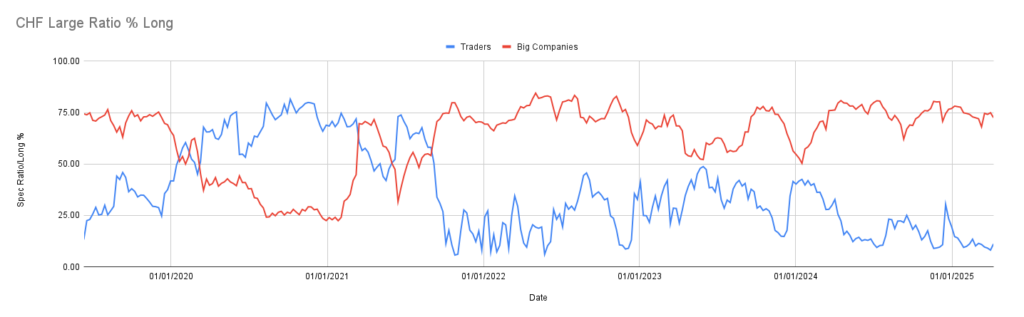

CHF – Swiss Franc

- Speculators: Net short -30,277 increased long positions by 205, decreased short positions by -12,282

- Commercials: Net long 37,800 decreased long positions by -13,925 and decreased short positions by -1,956

As we discussed last week, % longs were already at extreme levels. It’s playing out now: USD/CHF is trending lower, which favors being long CHF. I suppose in this instance it would be advantageous to be long CHF, as seen from the USDCHF chart. Though speculators did offload a lot of their short positions and commercials offloaded a lot of their long positions a week before the big downward candles in the USDCHF

Takeaway:

Commercials have been right here. Staying long CHF is proving to be the better side of the trade.

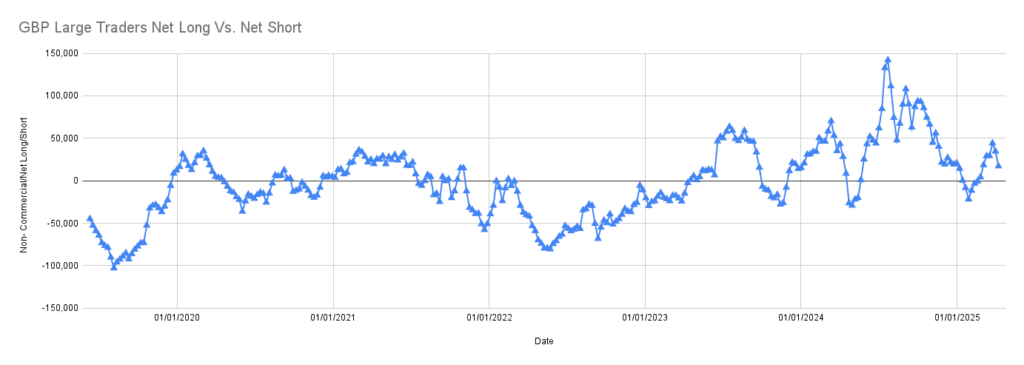

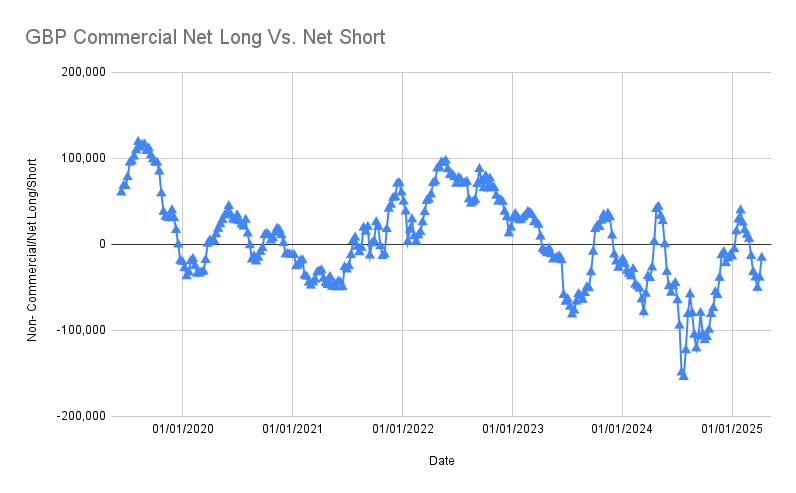

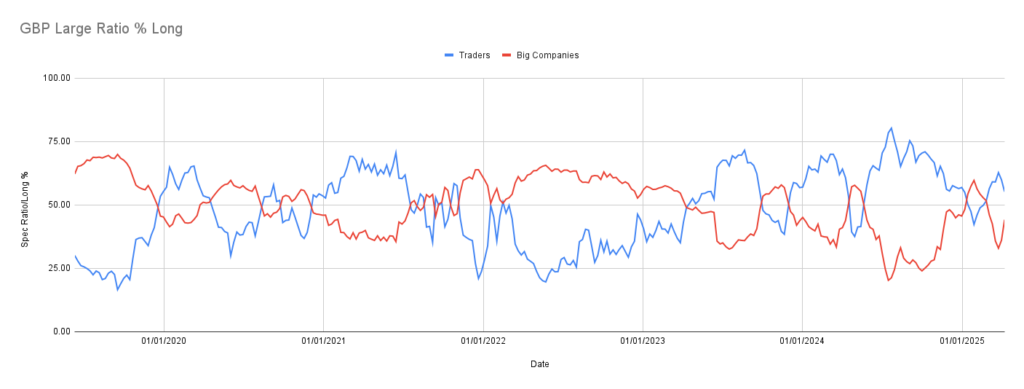

GBP – British Pound

- Speculators: Net long 17,310 decreased long positions by -13,253 and increased short position by 4,063

- Commercials: Net short -15,795 increased long potions 9,399 and decreased short position by -13,596

% long shows noise again nothing jumps out, won’t consider anything of importance, we are looking for possible reversal signs. Speculators are going net short direction. Seems like the GBP shows more bullish momentum. Seems following the commercials are 2 out of 3 so far.

Takeaway:

Following commercials suggests staying cautiously bullish on GBP, but confirmation from price action is needed.

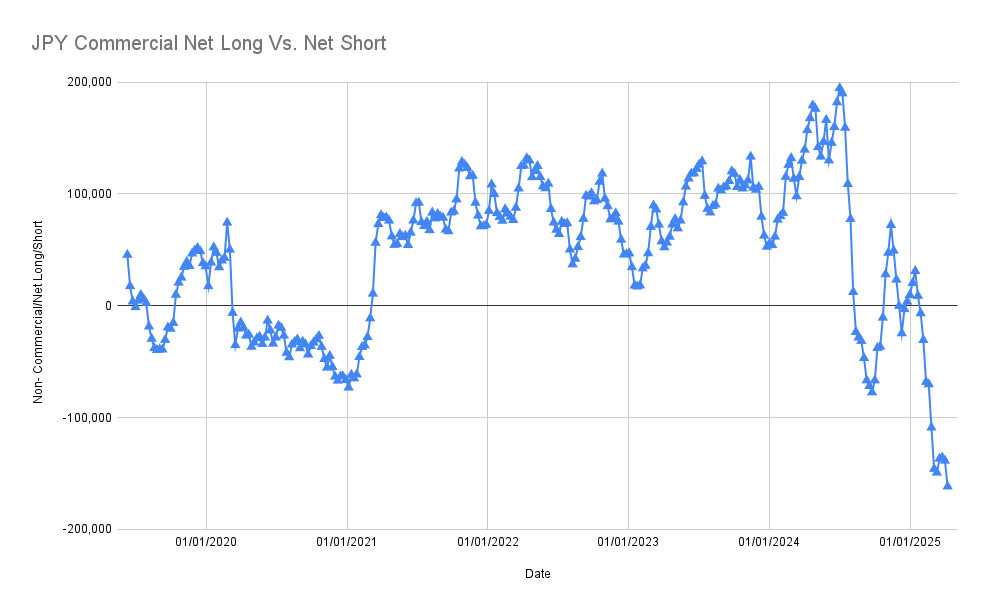

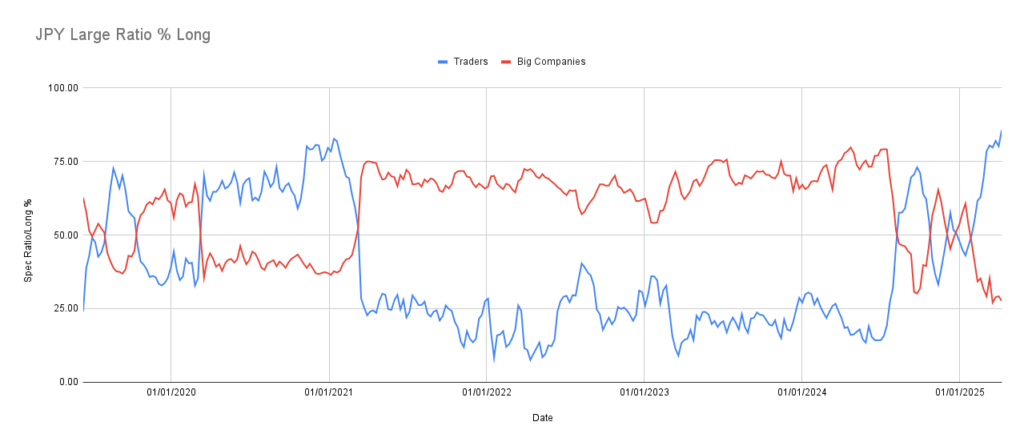

JPY – Japanese Yen

- Speculators: Net long 147,067 increased longs by 14,989 and decrease shorts by -10,304 from the week prior

- Commercials: Net short -161,669 increased longs by 2,688 increased shorts by 25,810

Speculators are heavily long, and the % long shows entry into extreme territory. So far, JPY strength against the USD is aligning more with the speculators’ side.

Takeaway:

For now, following speculators on JPY strength seems right, but given the extreme positioning, be alert for signs of exhaustion.

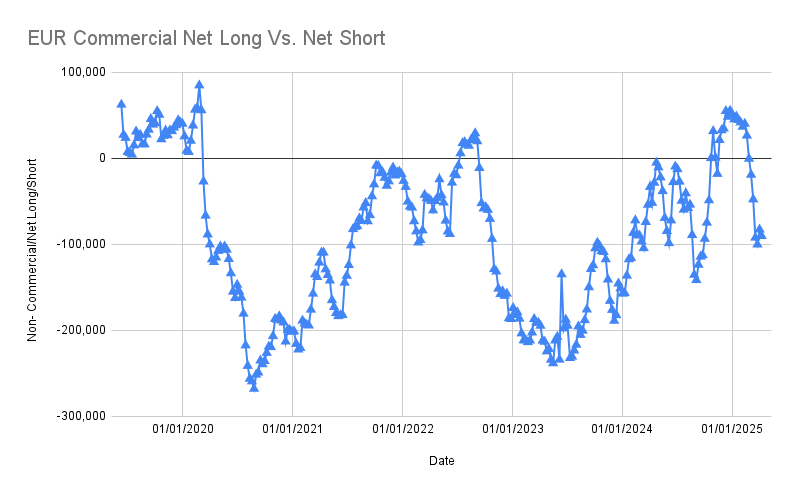

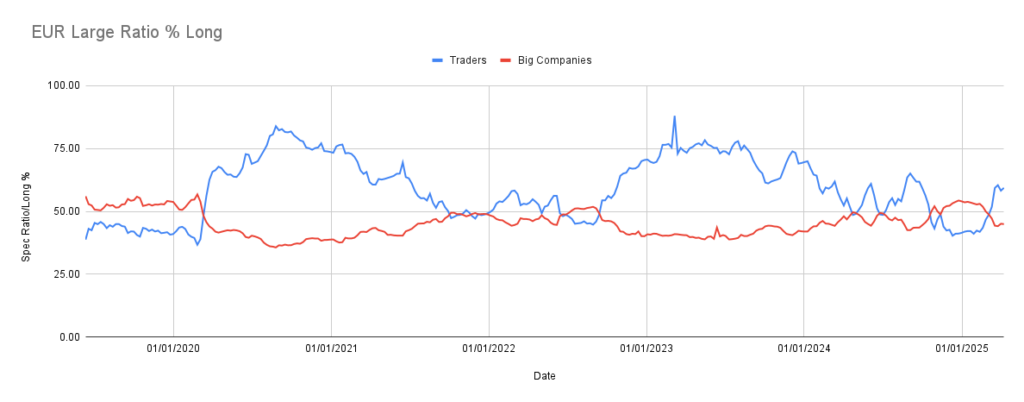

EUR – Euro

- Speculators: Net long 59,980 increased long positions by 7,049 and decreased short positions by -1,096

- Commercials: Net short -90,416 increased long positions by 22,439 and increased short positions by 29,983.

Speculators added longs; commercials expanded their shorts. No strong insights here. Generally, speculators have been on the right side of EUR.

Takeaway:

Nothing decisive. Staying flexible with EUR positioning.

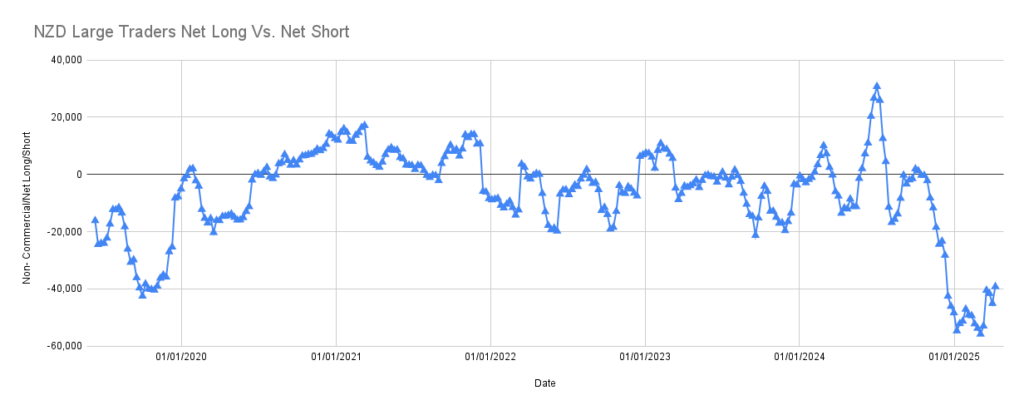

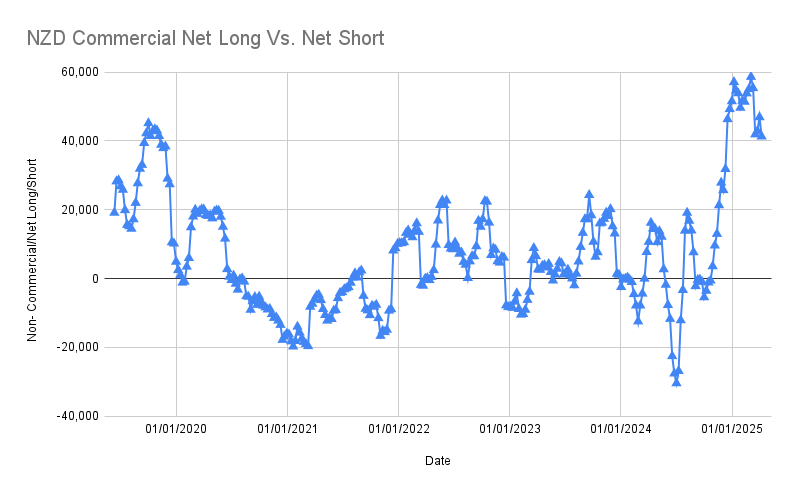

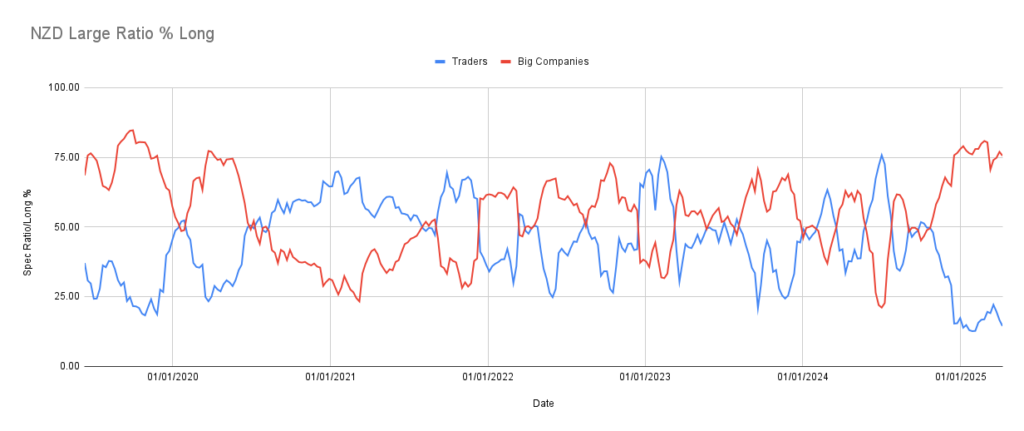

NZD – New Zealand Dollar

- Speculators: Net short -39,152 decreased long positions by -3,229 and decreased short positions by -9,125.

- Commercials: Net long 41,292 decreased long positions by -5,870 and decreased short positions by -269

Finally, some validation. The NZD reversal we anticipated played out beautifully. Being long NZD based on commercials positioning would have worked out very well.

Takeaway:

Commercials were right. Long NZD was the move.

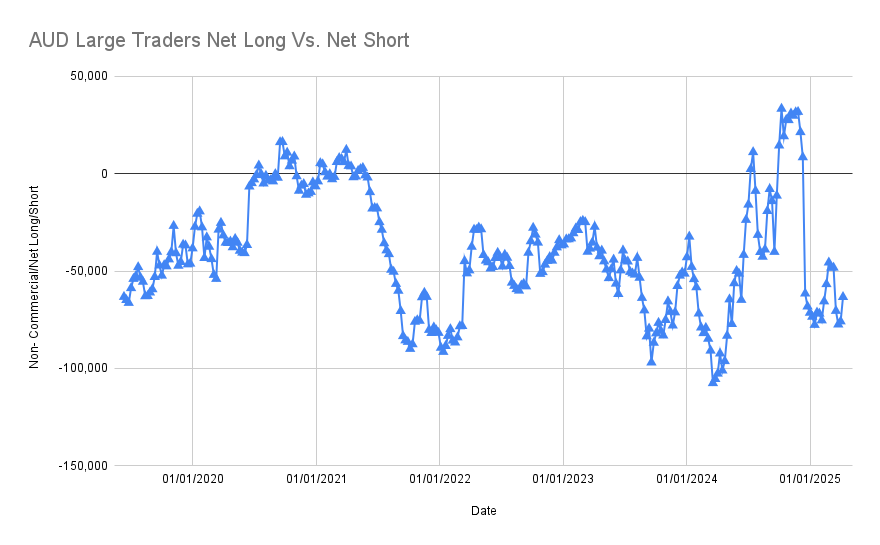

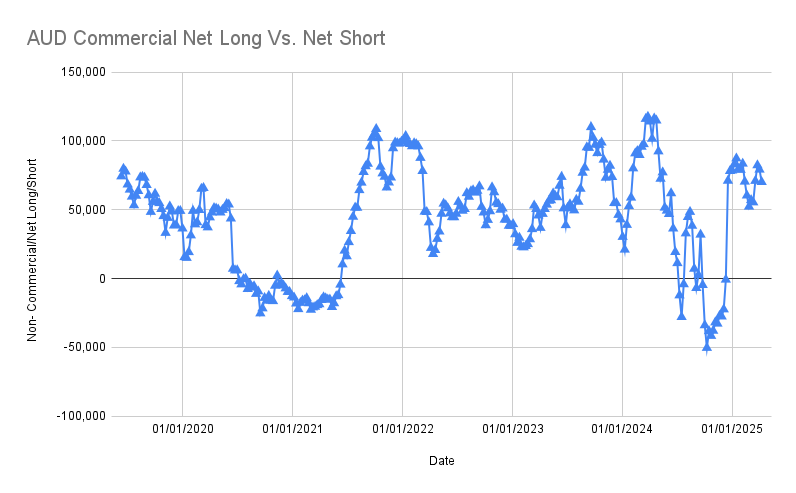

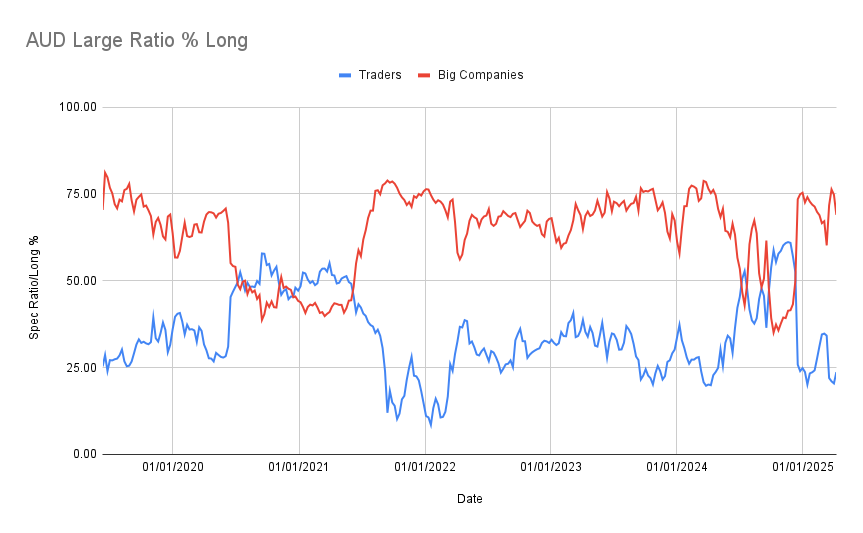

AUD – Australian Dollar

- Speculators: Net short -63,300 increased longs by 2,282 also decreased short positions by -10,281

- Commercials: Net long 70,205 increased long positions 8,173, increased short positions by 17,120.

Both speculators and commercials are sitting at extremes. Similar to NZD, the AUD has started to reverse upward. Commercials stayed long, and now price action is catching up.

Takeaway:

Commercials continue to be a valuable guide—long AUD plays are working.

Final Thoughts

This week’s COT report, layered with Peter Brandt’s advice, offers a powerful insight: following commercials might be a better strategy in certain market environments, especially when sentiment reaches extremes.

- CAD and CHF show early signs of commercial positioning shifts.

- NZD and AUD reversals are already underway.

- EUR and GBP remain murky.

Bottom line: this isn’t about blindly following commercials. It’s about adding another layer to our edge—one based on the behavior of market participants who aren’t speculating for profit, but hedging real-world exposures.

For full interview: https://www.youtube.com/watch?v=02tMCQLFIjg&t=5615s

Stay sharp. Stay adaptable.

Data Source: Commodity Futures Trading Commission (CFTC)