April 17, 2025 – Takezo Trading Commentary

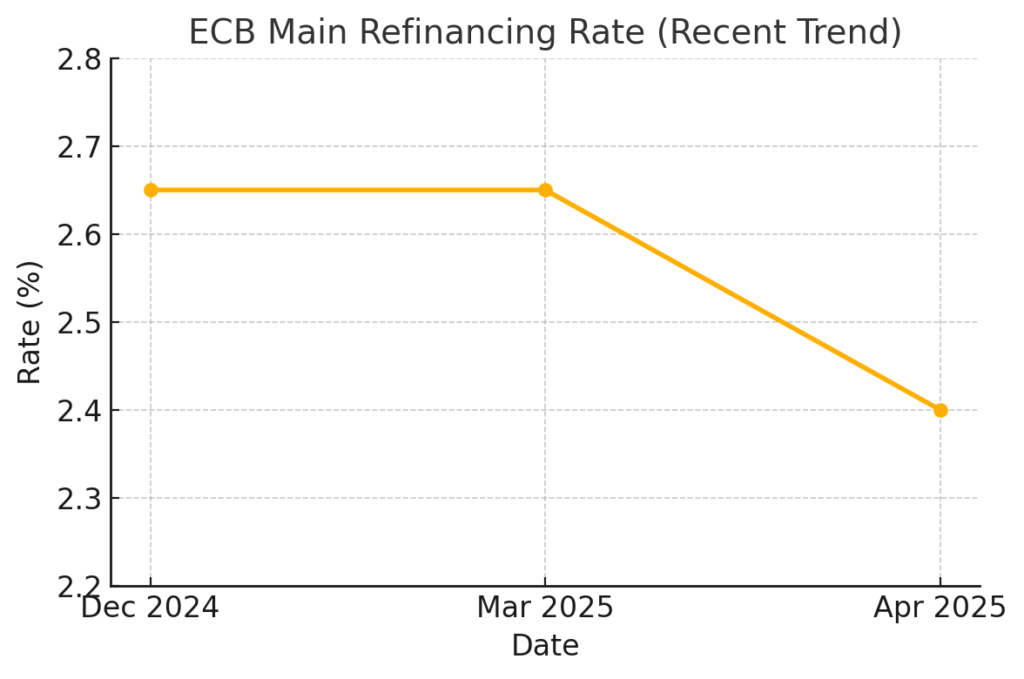

Just one day after the Bank of Canada held firm, the European Central Bank (ECB) took a bold step forward by cutting rates by 25 basis points, bringing the main refinancing rate down to 2.40% and the deposit rate to 2.25%.

This isn’t just a technical move—it’s the first signal that the Eurozone is ready to act proactively in the face of growing global uncertainty, particularly from escalating U.S. trade policies.

Here’s your full breakdown of the ECB’s latest stance, what’s changed since March, and how it affects your macro lens and trading decisions.

The Headline: A 25bps Rate Cut

The ECB lowered all three of its key rates:

- Main refinancing operations: down to 2.40%

- Deposit facility: now 2.25%

- Marginal lending facility: trimmed to 2.65%

The rate cut is effective from April 23, 2025.

While not an emergency slash, the timing sends a message: the ECB is moving ahead of the curve, driven by weakening economic prospects and rising global risk—especially from U.S.-triggered trade turmoil.

March vs. April: What’s Changed?

Back in March 2025, the ECB had taken a cautious tone—watching inflation fall gradually, and beginning to hint that easing could come if disinflation progressed.

Now, that progression is real.

- Headline and core inflation are both declining

- Services inflation has eased

- Wage growth is moderating

- Underlying inflation metrics suggest price stability is achievable

In short: disinflation is “well on track,” according to the ECB. That green light allowed the Governing Council to act.

But what pushed them over the edge? Two words: Trade tensions.

Why the Cut? The Trade Factor

The ECB clearly cited rising trade tensions, particularly due to recent U.S. tariff escalations, as a critical factor in its decision:

“The outlook for growth has deteriorated owing to rising trade tensions.”

Not only do tariffs dampen cross-border demand, but the ECB sees confidence among households and firms weakening as uncertainty escalates. Financial markets have also reacted negatively, which tightens financial conditions even without central bank action.

Rather than risk a stall in recovery, the ECB is moving to front-run the damage.

The Transmission Mandate

This isn’t just about inflation and growth. The ECB has doubled down on ensuring that monetary policy actually works across all member states:

- APP and PEPP portfolios continue to decline steadily

- But the Transmission Protection Instrument (TPI) remains in play to fight disorderly market behavior and ensure rate cuts translate into real economy impact

It’s a coordinated push to keep financial conditions loose across all corners of the euro area.

No Forward Guidance—A Data-Driven Approach

If you’re looking for hints about the next move—there aren’t any.

The ECB is now officially in “data-dependent, meeting-by-meeting” mode. No promises. No forward guidance. Each decision will be based on:

- Inflation projections

- Incoming economic and financial data

- Transmission strength

In their words: “The Governing Council is not pre-committing to a particular rate path.”

This is strategic flexibility in action.

Strategic Angle: Who Blinks First in the Global Chessboard?

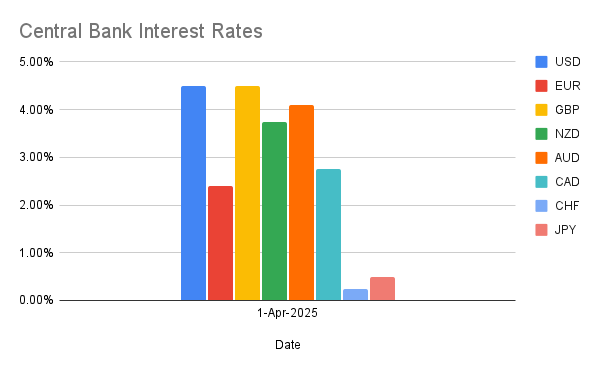

With both Canada and Europe acknowledging the risks of U.S. tariffs in their monetary statements, it’s becoming clear: geopolitical economics is back on the main stage.

But here’s the twist—the ECB has chosen offense over defense.

Instead of waiting for growth data to crash, they’re creating cushion now. In contrast, the Bank of Canada is still assessing. The U.S. Federal Reserve? So far, still holding.

That divergence may create opportunity in FX pairs, yield spreads, and commodity plays. We’re entering an era of asymmetric monetary responses, and traders who spot the imbalances early can gain edge.

Final Thoughts

The April 17 ECB decision wasn’t just about a 25bps cut—it was a signal that central banks are starting to diverge again, not just in policy rates but in philosophy.

The eurozone is easing in response to external shocks. The BoC is holding and watching. The Fed is under pressure but silent. The global chessboard is being reconfigured.

As we always say at Takezo Trading: the best warriors are the ones who adapt, not the ones who resist.

Stay sharp. Stay strategic. Stay ahead.

– Takezo

For ECB release: https://www.ecb.europa.eu/press/pr/date/2025/html/ecb.mp250417~42727d0735.en.html

My pervious post on Bank of Canada’s release: https://takezotrading.com/bank-of-canada-holds-the-line-but-all-eyes-on-u-s-tariffs/