If you’ve ever wondered what the big players are doing — I’m talking hedge funds, asset managers, and other institutional heavyweights — the COT report gives you a rare peek behind the curtain. And in the world of forex trading, where every edge counts, this kind of insight is gold.

Let me walk you through how I use the COT report in my own trading and how you can, too.

What Exactly Is the COT Report?

The Commitment of Traders report is published every Friday at 3:30 PM EST by the U.S. Commodity Futures Trading Commission (CFTC). It shows the positions held by different types of traders in the U.S. futures markets as of the previous Tuesday.

Now I know what you might be thinking: “But I trade spot forex, not futures.”

Totally fair. I do too. But currency futures, especially those traded on the Chicago Mercantile Exchange (CME), are where the big institutional players place their bets. And those bets leave a trail.

The COT report is essentially that trail — a record of who is buying, who is selling, and how heavily they’re positioned. It doesn’t tell you what’s going to happen next, but it does tell you what the heavyweights think is going to happen. And that’s powerful.

Why Should Spot Forex Traders Care About Futures Data?

I used to ask the same thing. But here’s the deal: large players don’t enter positions lightly. Their activity in the futures market reflects macro views, portfolio hedging, or outright speculation — and that sentiment flows into the spot market.

So even though the COT data comes from futures contracts, it has major implications for forex traders like you and me.

How I Read the COT Report

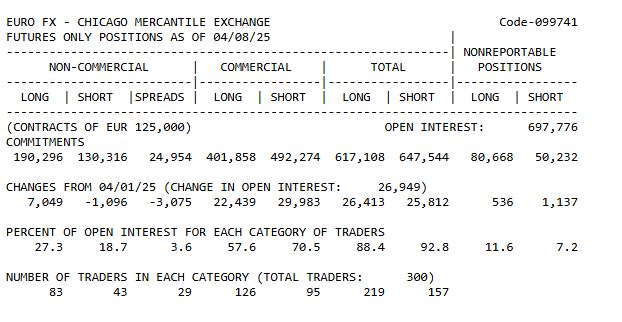

The report is a bit dense if you’re looking at it for the first time, so let me break it down into how I actually use it week to week.

1. Look at the Currency Contracts

The COT report lists currency futures by name: Euro FX, British Pound, Japanese Yen, Swiss Franc, etc. Each is relative to the U.S. Dollar — so “Euro FX” is essentially EUR/USD, but with a futures twist.

Focus on the Non-Commercials

The report breaks down traders into three groups:

- Commercials (Hedgers): Usually corporations hedging currency exposure. I ignore these for the most part.

- Non-Commercials (Large Speculators): Hedge funds and institutions. These are the ones I care about.

- Non-Reportables (Small Traders): That’s retail — folks like us — but I’m not here to follow the herd.

I focus on Non-Commercial positioning because these traders typically move based on directional conviction. They’re not hedging — they’re betting.

Check the Net Position

Here’s where it gets interesting. I take the number of Long contracts and subtract the number of Shorts. That gives me the Net Position.

For example:

Japanese Yen Futures

- Long: 80,000

- Short: 120,000

→ Net: -40,000

That tells me large speculators are net short the yen. If the number is getting more negative week after week, sentiment is increasingly bearish. If it starts flipping — that’s a signal of a potential shift in market dynamics.

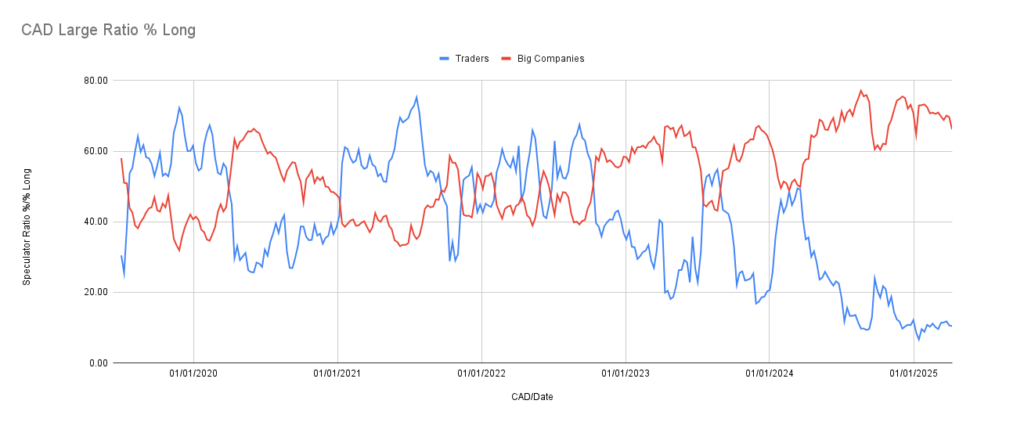

Watch for Extremes

One of the best signals the COT report gives is when positioning hits an extreme.

If everyone and their grandmother is long the euro, and net positioning is at multi-year highs, there might not be much juice left in the rally. Why? Because when everyone is already in the trade, there’s no one left to push it higher.

This is why I keep track of the % long. Out of the total position, what % is long on the commercials vs the % long on the non-commercials. Once they both get to 80%/20% I would consider this extreme and be on the lookout for a reversal of the current trend.

Pay Attention to Weekly Changes

The week-to-week change is also super important. I’m not just looking at the static number — I want to know what changed:

- Did a currency flip from net short to net long?

- Did hedge funds just dump 20,000 contracts in one week?

That’s momentum. That’s information. That’s sentiment shifting right now.

How I Use COT in My Trading Strategy

I don’t use COT in isolation. It’s part of a larger toolkit that includes:

- Macro analysis

- Price action

But the COT report tells me where the crowd was — and that helps me understand where the risk is. If the crowd is heavily leaning one way, I start looking for technical setups and macro catalysts to go the other.

It’s not about being a contrarian just to be different. It’s about timing the moment when the crowd is wrong — and stepping in when the reversal begins. But still remembering that the COT is a lagging indicator.

Where I Get My COT Data

You can get it for free on the CFTC website, but it’s clunky.

I also sell my own bundled raw COT data over on Takezo Trading, which includes historical positioning going back years — a great resource if you want to build your own dashboards or backtest strategies.

Final Thoughts

The COT report is one of the few places where retail traders like us get to see what institutional players are doing. That kind of transparency is rare in this game.

For me, it’s like reading the battlefield — where the armies are positioned, who’s overextended, and who’s quietly gaining ground. If you combine it with solid technical and macro analysis, it becomes a weapon you don’t want to trade without.

If you found this helpful and want to dive deeper, check out my weekly COT updates and sentiment blogs — I break everything down, pair by pair, and share what I’m watching for the week ahead.

Thanks for reading,

—Takezo