By Takezo Trading | www.takezotrading.com

Last week I was putting more weight on the commercials’ side of the Commitment of Traders report, thanks to an insight from Peter Brandt. This week, I’m pulling things back toward the speculators—still watching what the commercials are doing, but I’m putting a bit more emphasis on speculator flows and %long readings to confirm directional trades.

Let’s get into the data and what it tells us.

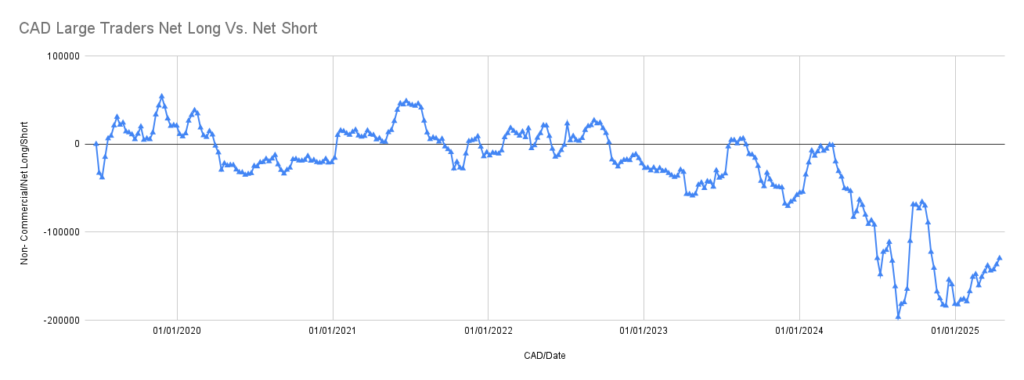

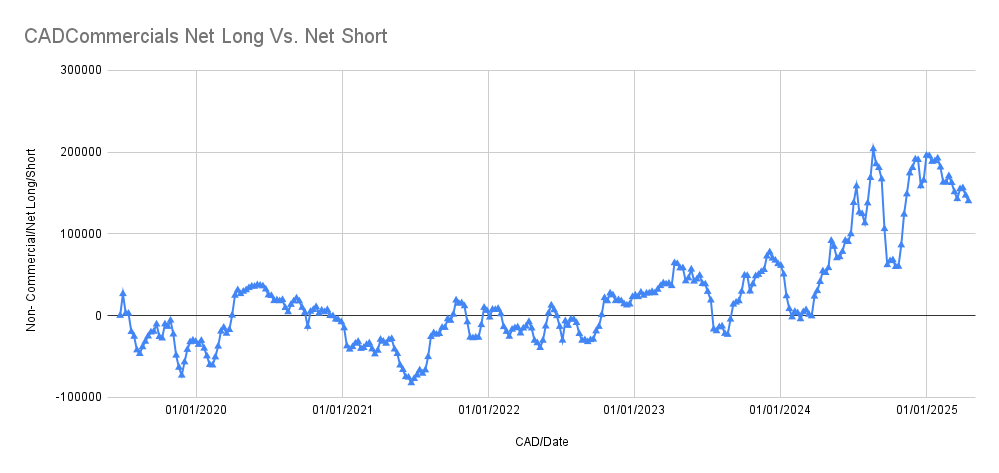

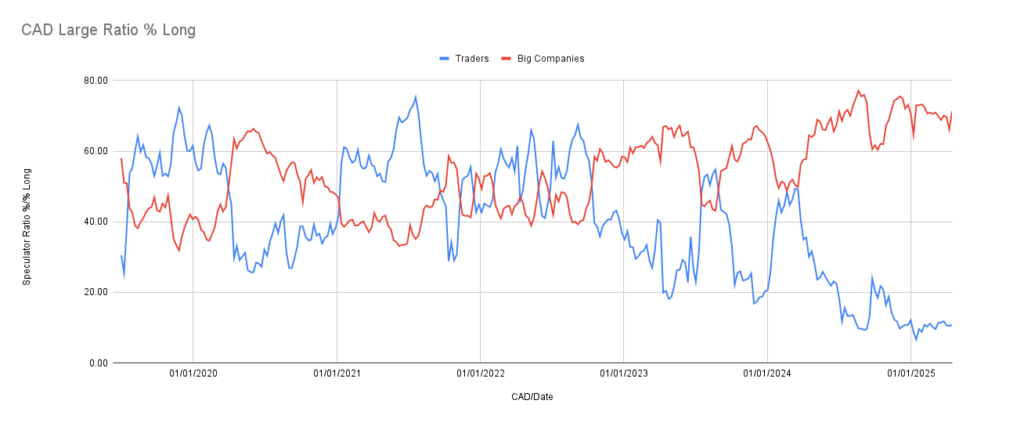

CAD – Canadian Dollar

- Speculators: Net short -83,860 (increased longs by 2,236, decreased shorts by 33,145)

- Commercials: Net long 90,143 (decreased longs by 12,112, increased shorts by 27,205)

The net long reading is still in extreme territory. From the USDCAD chart, the reversal seems to be underway—just like we flagged last week. Speculators are covering shorts, and that’s usually when price starts to turn. Commercials are also starting to hedge less aggressively.

Conclusion: Reversal still looks active. Positioning supports the recent price action.

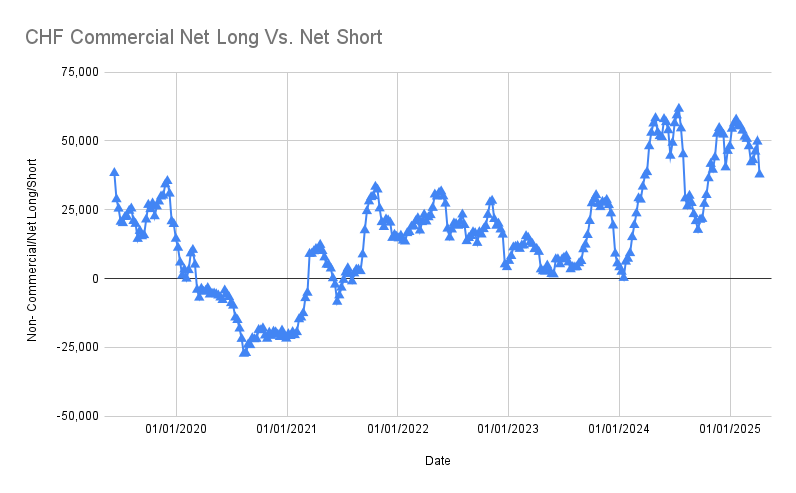

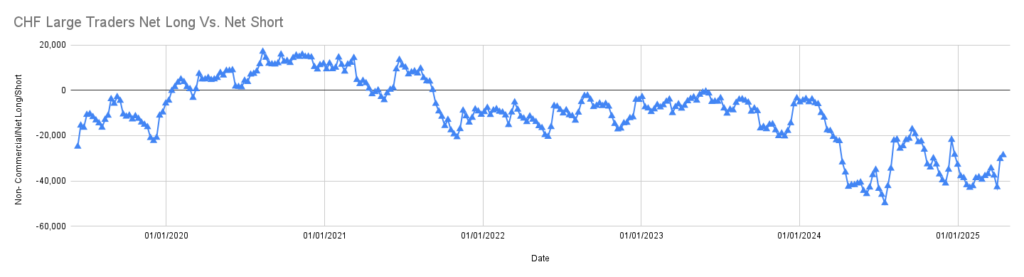

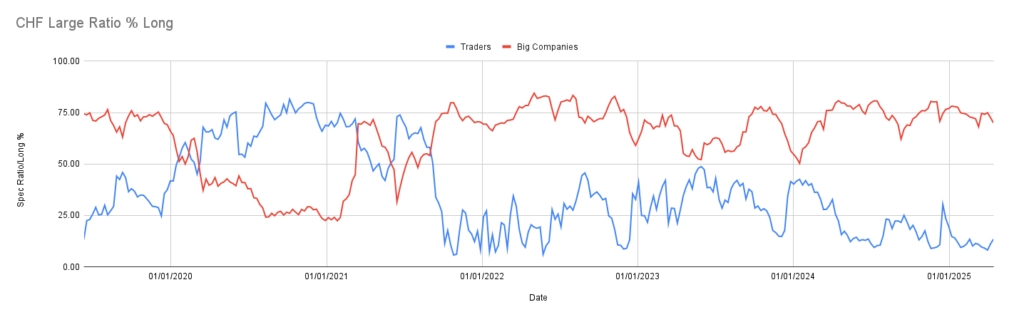

CHF – Swiss Franc

- Speculators: Net short -28,584 increased long positions by 932, decreased short positions by -761

- Commercials: Net long 31,740 decreased long positions by -5,255 and increased short positions by 805

Speculators are adding long exposure, and commercials are slowly unwinding. The %long data has been in extreme territory, which lined up with our expectation for CHF strength.

Knowing the nature of the Swiss economy—and its small size relative to Japan or the US—I wouldn’t be surprised if the SNB steps in soon. The franc is strong, but that kind of strength has limits when your market can’t absorb it.

Conclusion: CHF strength is here, but watch for potential intervention.

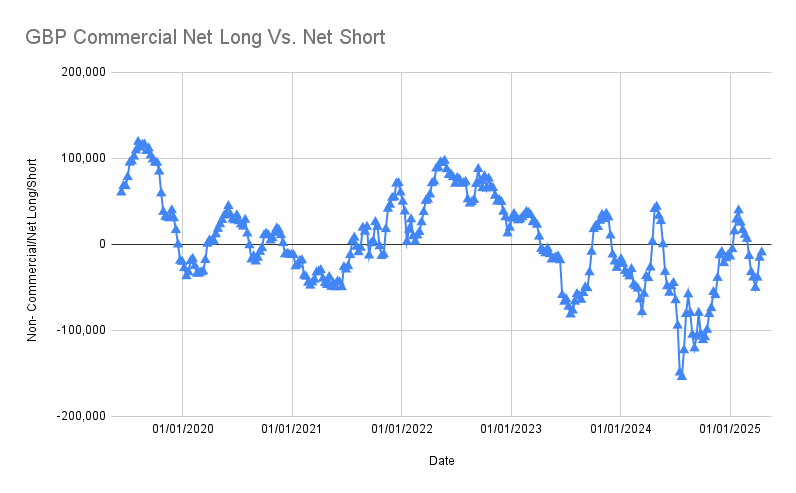

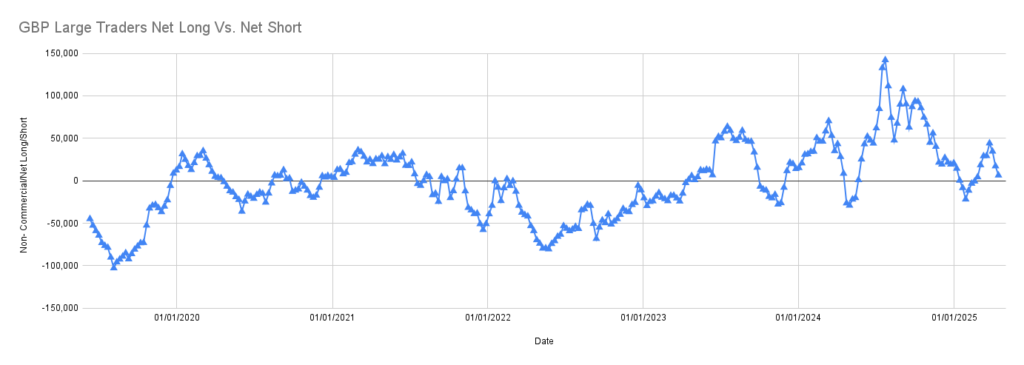

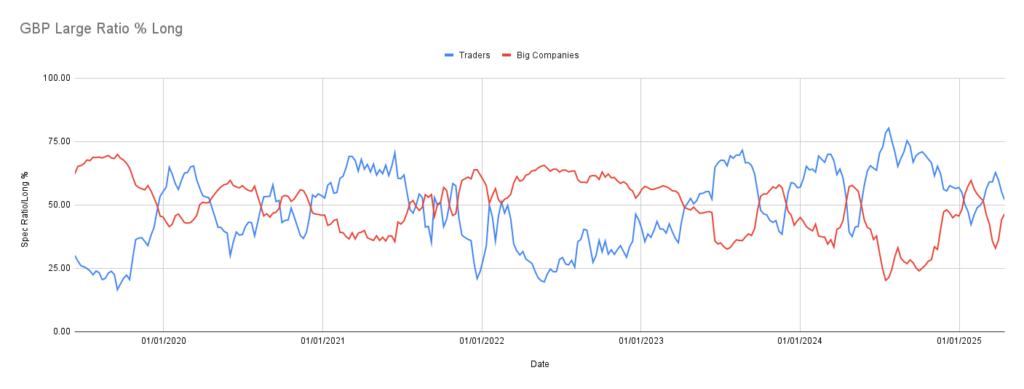

GBP – British Pound

- Speculators: Net long 6,509 (decreased longs by 6,025, increased shorts by 4,776)

- Commercials: Net short -9,489 (increased longs by 2,002, decreased shorts by 4,304)

Not much here. %long data is noisy again, and positioning doesn’t scream anything clear. If anything, commercials are looking like they want to shift net long, and speculators are slowly drifting bearish.

Conclusion: Still unclear. Waiting for cleaner price or sentiment signals.

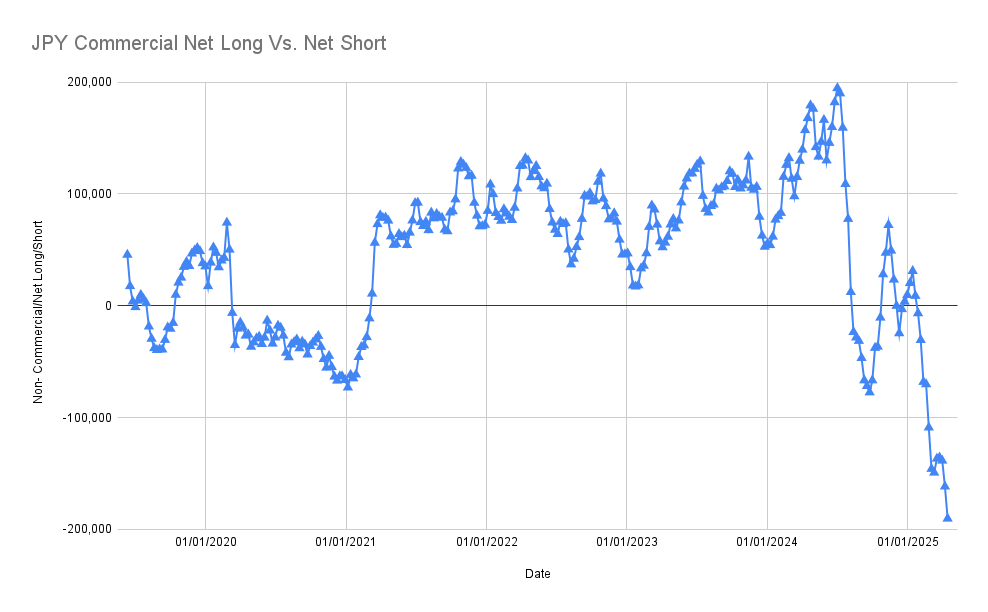

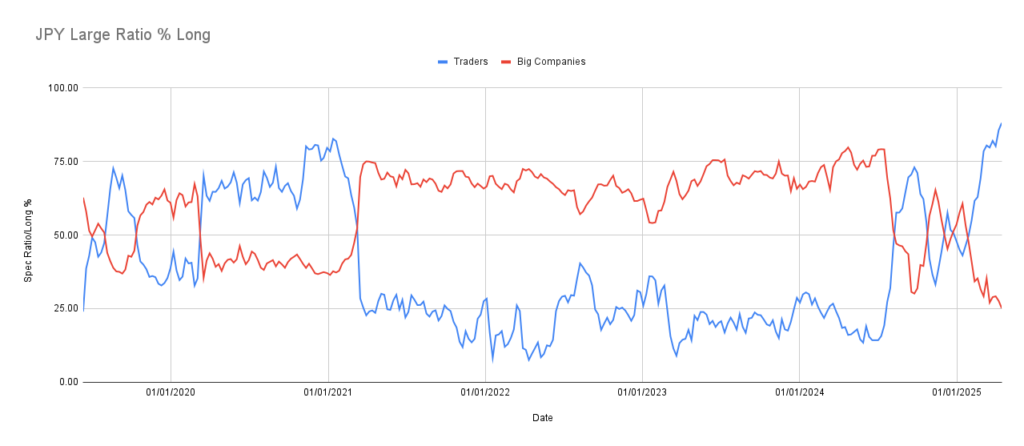

JPY – Japanese Yen

- Speculators: Net long 171,855 (added 22,005 longs, cut 2,783 shorts)

- Commercials: Net short -190,345 (cut 3,541 longs, added 25,135 shorts)

The positioning is deep into extreme territory. But the JPY continues to show strength against the USD.

Conclusion: JPY strength holding, but extreme positioning raises the probability of a correction ahead.

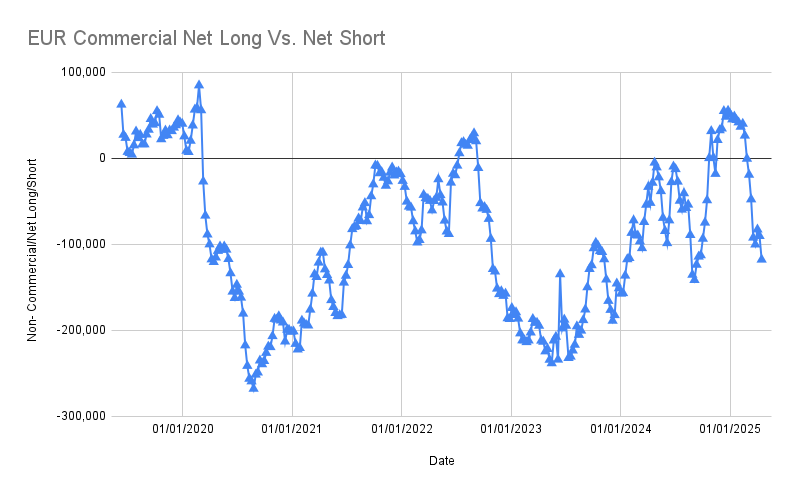

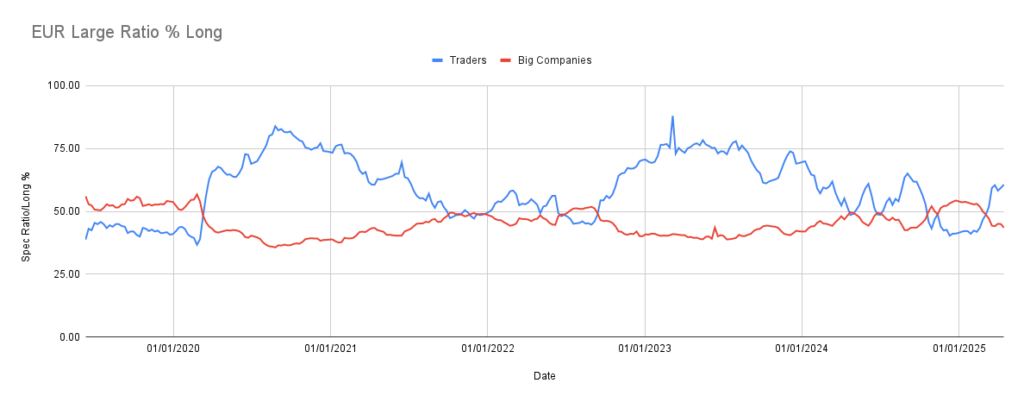

EUR – Euro

- Speculators: Net long 69,280 (added 6,807 longs, cut 2,493 shorts)

- Commercials: Net short -117,915 (cut 6,862 longs, added 20,637 shorts)

Not much to take away here. The positioning is stretched, but it’s not actionable. Commercials are increasing shorts, and speculators are pressing longs—but nothing looks urgent or directional.

Conclusion: Neutral. No significant insight from the data this week.

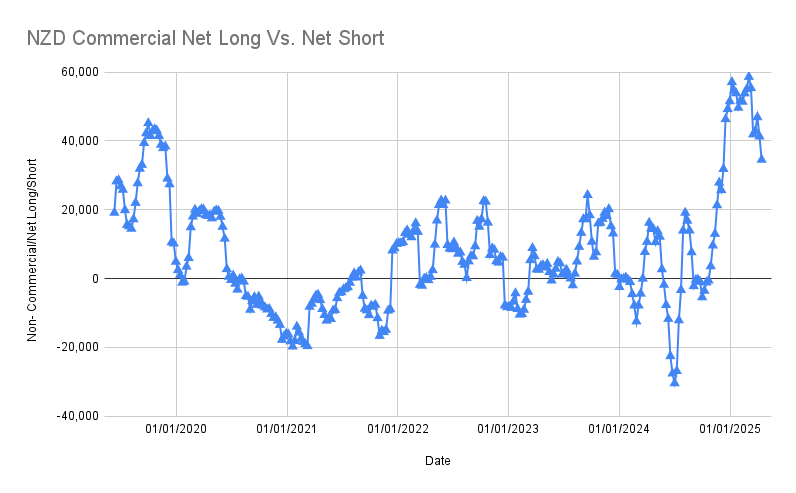

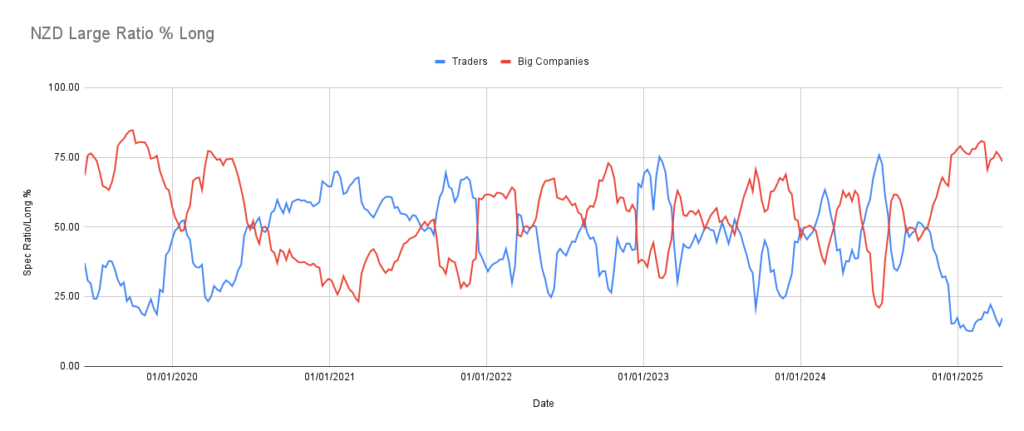

NZD – New Zealand Dollar

- Speculators: Net short -33,078 (added 826 longs, cut 5,248 shorts)

- Commercials: Net long 34,523 (cut 6,975 longs, trimmed 206 shorts)

This one’s clearer. %longs are deep in extreme territory, and we’ve started to see the bounce in the ratio chart. Lets look at the NZDUSD price action and seems like we can trust that the longs are in play now, as the speculators %long are so low (no one else to go short to push price lower).

Conclusion: The reversal is playing out. Speculators are unwinding, and price is responding.

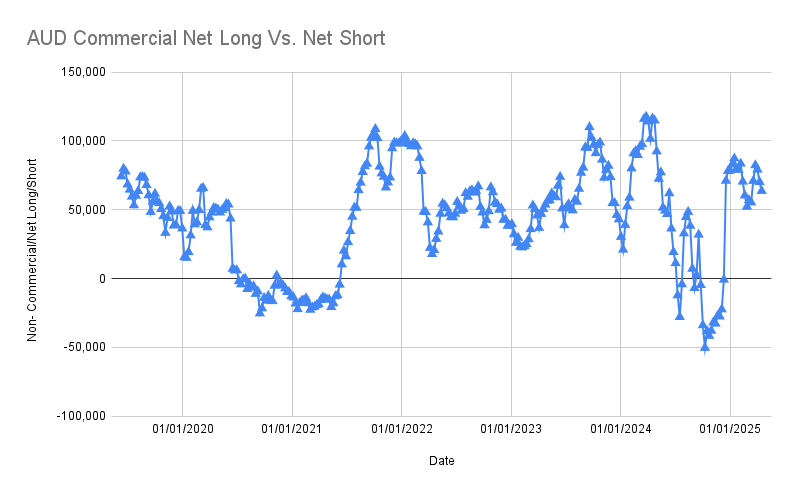

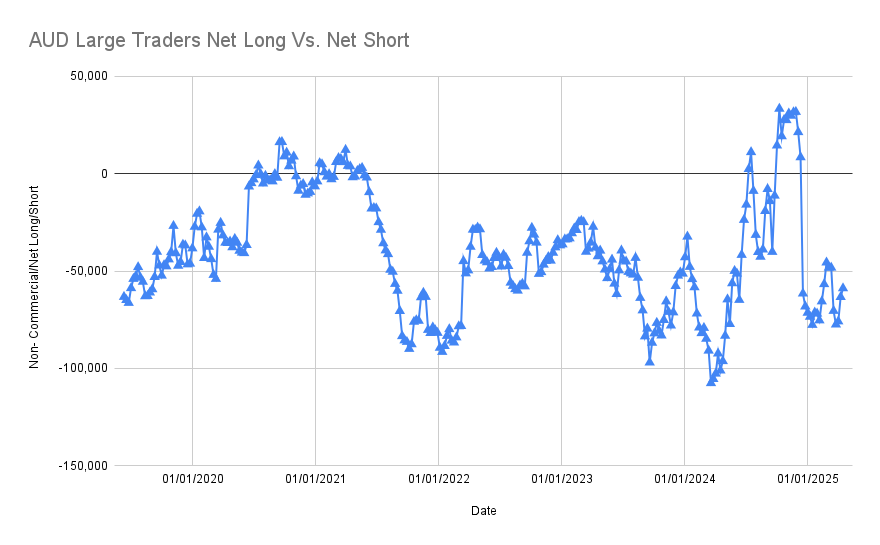

AUD – Australian Dollar

- Speculators: Net short -58,848 (cut 8,753 longs, cut 13,205 shorts)

- Commercials: Net long 63,732 (cut 3,817 longs, added 2,656 shorts)

%long both speculators and commercials are rebounding from the extremes, and looks like the NZDUSD chart.

Conclusion: Reversal underway.

Final Thoughts

This week I’m tilting the lens back toward speculators to help read trend strength, but I’m still using commercials as the pressure gauge—particularly for spotting when the tide might turn.

- CAD and AUD reversals continue to unfold

- CHF is strong, but risk of SNB intervention grows

- EUR and GBP? Still muddied—stand aside for now

We’ll keep adjusting as sentiment shifts.

Stay sharp, stay patient,

—Takezo

Data Source: Commodity Futures Trading Commission (CFTC)

Compare with last week’s analysis: https://takezotrading.com/commitment-of-traders-update-april-8th-2025/