By Takezo Trading | www.takezotrading.com

Welcome back, traders! It’s time for our weekly deep-dive into the Commitment of Traders (COT) data. Here’s exactly what the latest numbers are showing and what I think they mean for our currency markets.

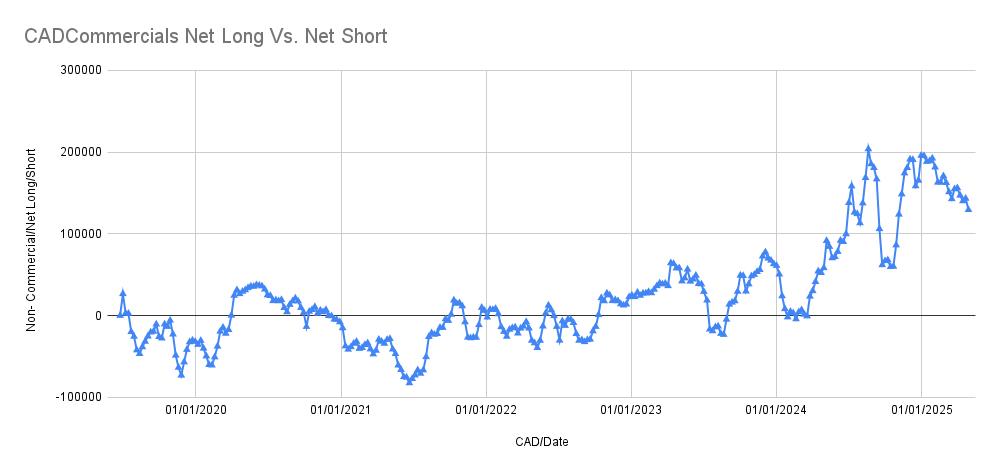

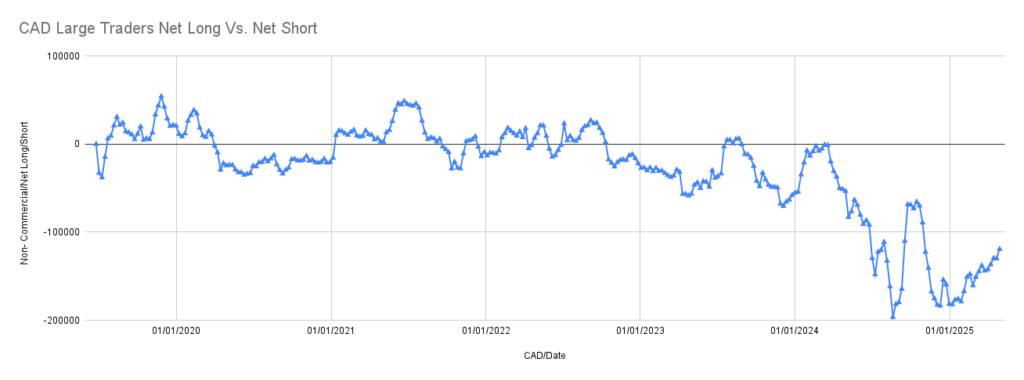

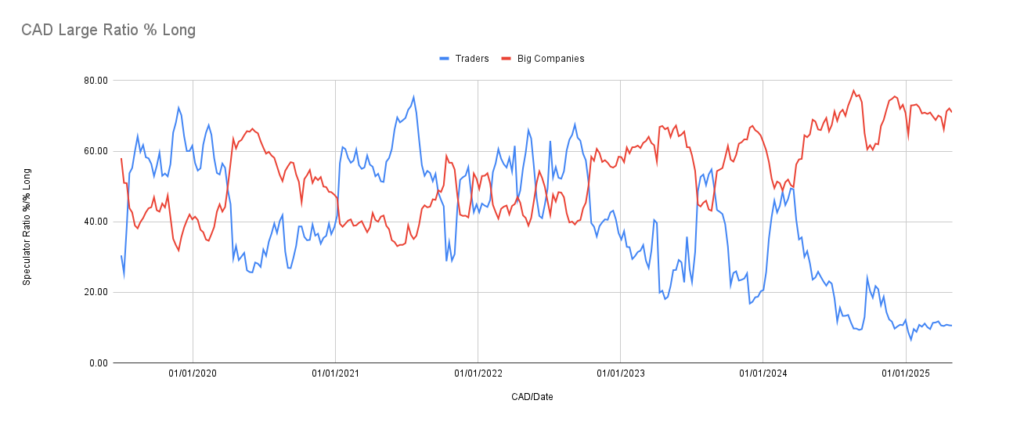

CAD – Canadian Dollar

- Speculators: Net short -67,205 (decreased longs by 2,311, decreased shorts by 2,273)

- Commercials: Net long 75,322 (increased longs by 2,831, increased shorts by 682)

With a % long ratio under 20%, there remains significant room for additional long positions. This setup suggests potential continued strength in CAD, so watch closely for opportunities aligning with bullish signals.

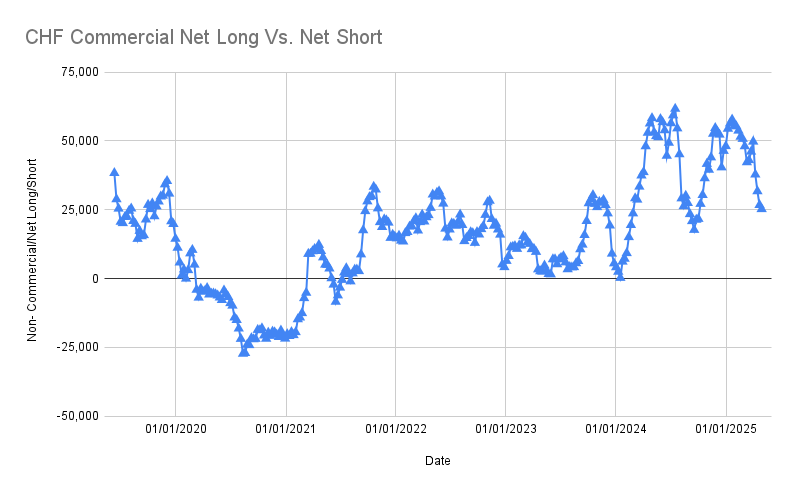

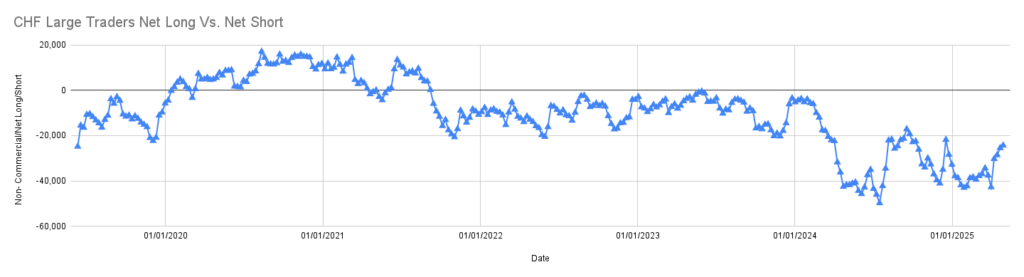

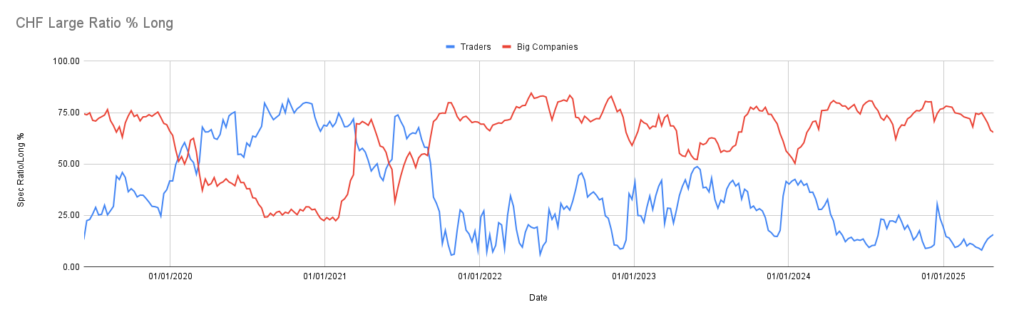

CHF – Swiss Franc

- Speculators: Net short -24,314 (increased longs slightly by 245, significantly reduced shorts by 915)

- Commercials: Net long 25,264 (decreased longs by 606, increased shorts by 872)

Similar to CAD, CHF’s % long ratio remains below 20%, providing ample space for more buying activity. This could indicate further CHF strength, making it a currency worth monitoring closely in the coming sessions.

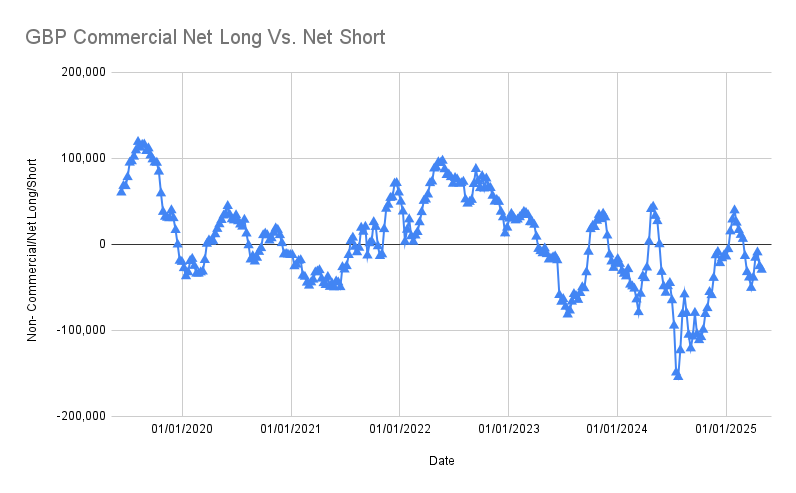

GBP – British Pound

- Speculators: Net long 23,959 (decreased longs by 2,957, reduced shorts by 6,426)

- Commercials: Net short -29,723 (increased longs by 786, significantly increased shorts by 5,070)

GBP’s % long ratio stands at 58%. At this level, the data isn’t particularly helpful for trade confirmations or decisions. It’s best to rely on other indicators and technical analysis to navigate GBP movements for now.

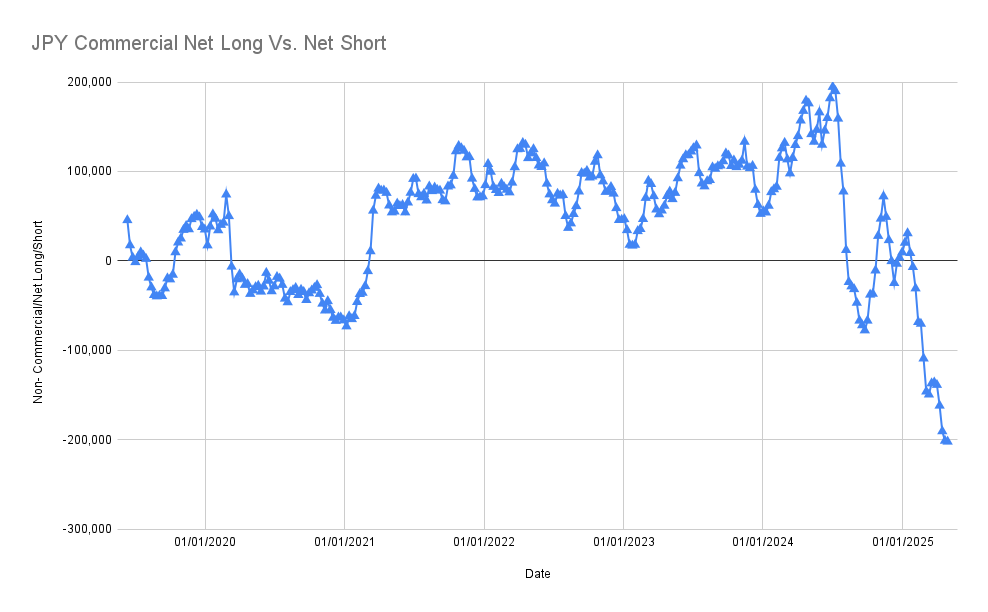

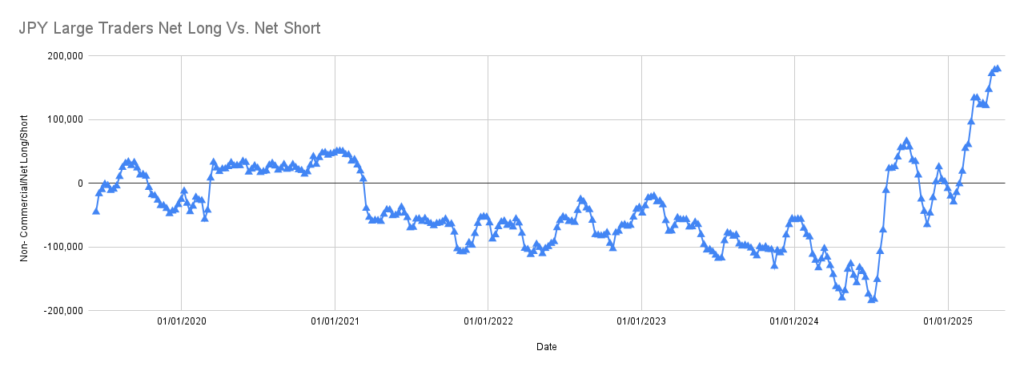

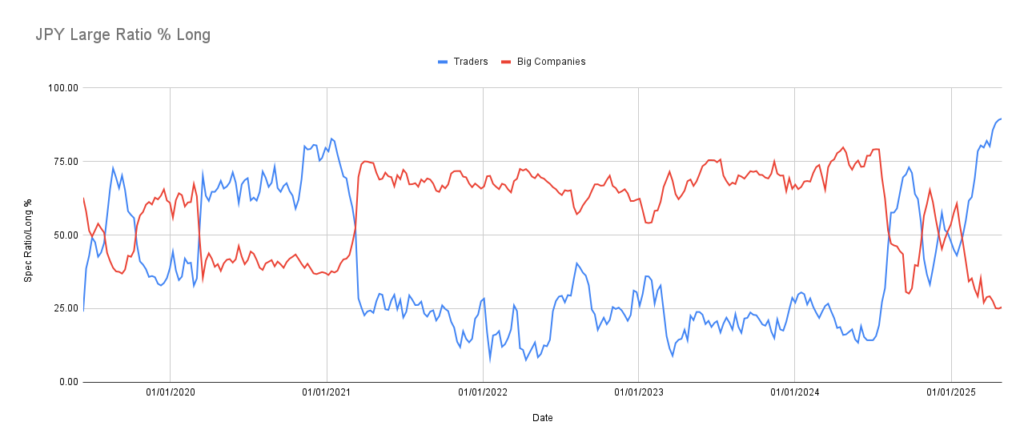

JPY – Japanese Yen

- Speculators: Net long 179,212 (increased longs by 424, decreased shorts by 974)

- Commercials: Net short -201,897 (increased longs by 4,611, increased shorts by 5,586)

JPY’s % long ratio is at an extremely high 90%, signaling overbought conditions. I’d exercise caution with initiating new long positions. The current positioning may soon trigger bearish momentum.

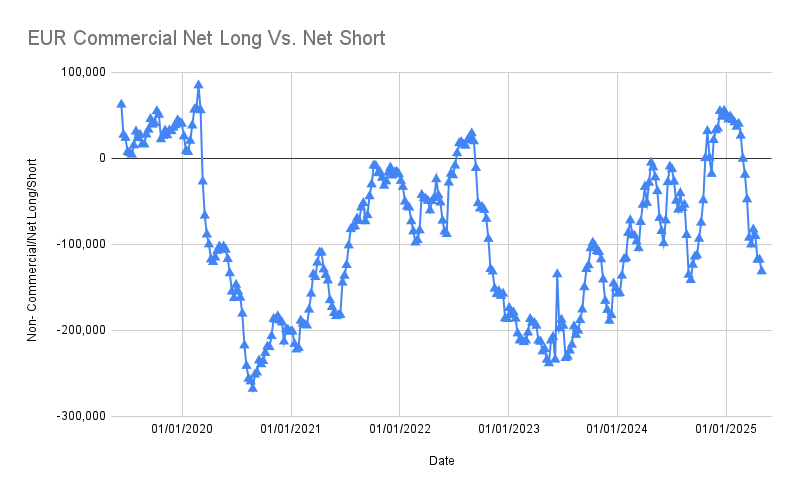

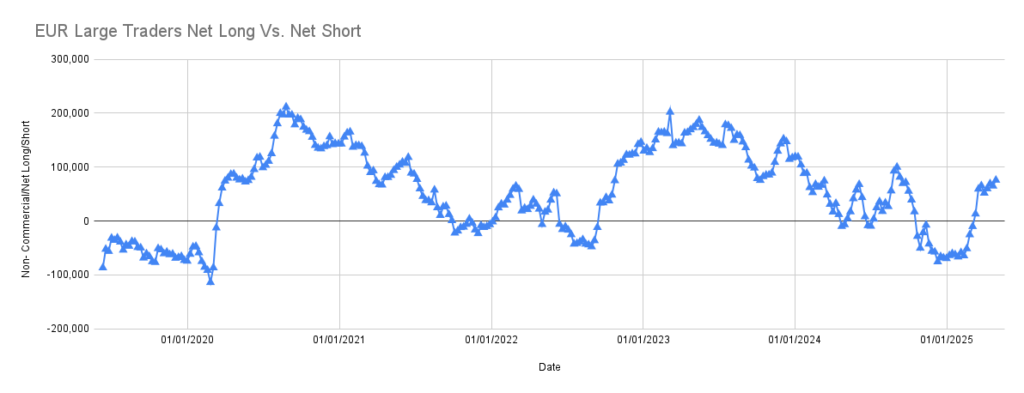

EUR – Euro

- Speculators: Net long 75,797 (added longs by 183, decreased shorts significantly by 10,586)

- Commercials: Net short -131,511 (increased longs by 489, significantly increased shorts by 14,059)

With a % long ratio of 62%, EUR positioning doesn’t offer clear trade signals this week. I’m sidelining EUR from my trading decisions based solely on this COT data.

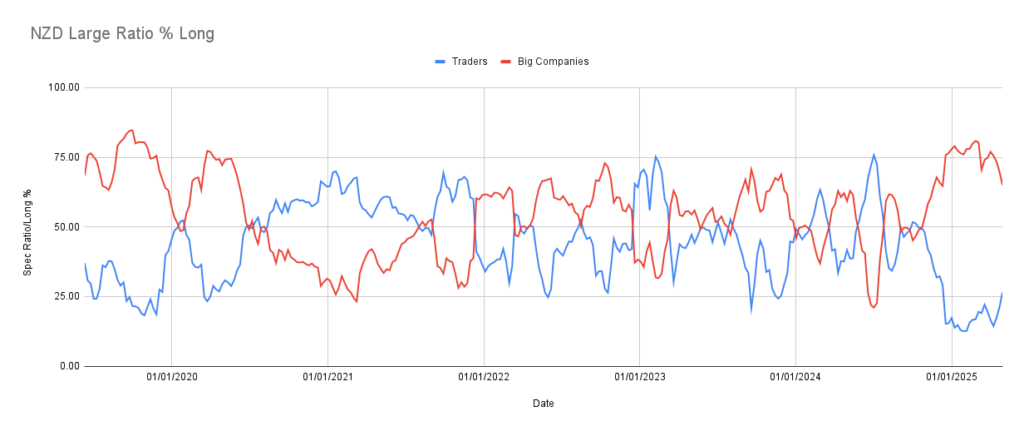

NZD – New Zealand Dollar

- Speculators: Net short -21,523 (increased longs by 2,273, reduced shorts by 3,099)

- Commercials: Net long 21,302 (decreased longs by 2,263, increased shorts by 3,884)

NZD’s % long ratio has risen to 27%, up from under 20%. There’s plenty of room for new long positions, which aligns nicely with recent bullish price action. NZD appears well-positioned for further gains.

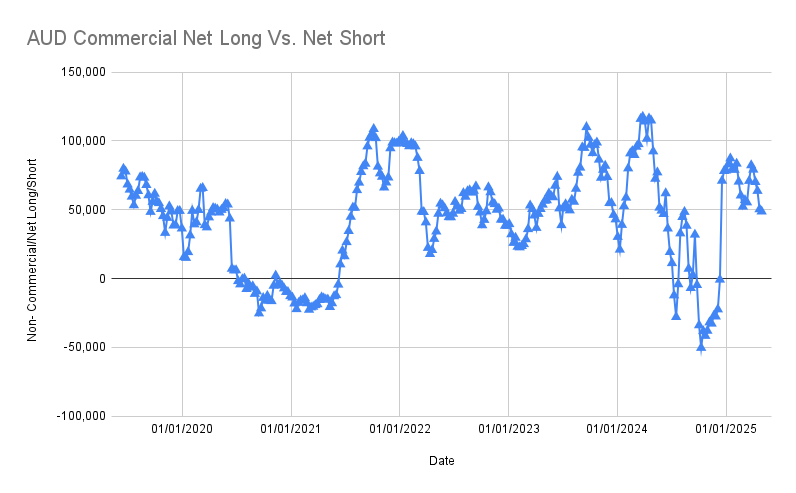

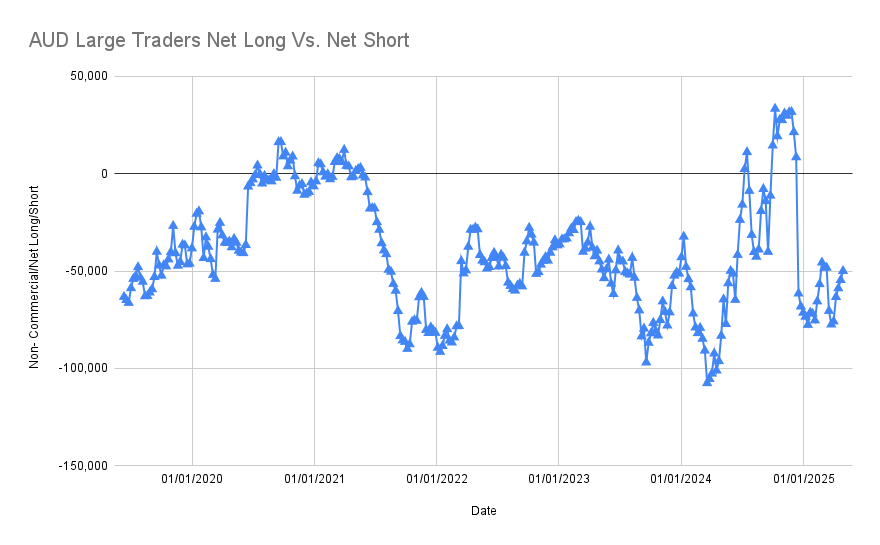

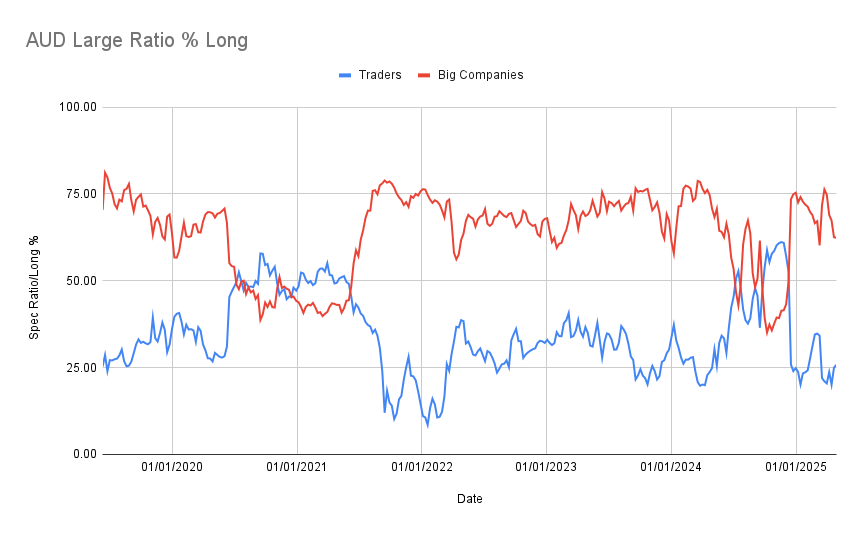

AUD – Australian Dollar

- Speculators: Net short -49,943 (decreased longs by 573, decreased shorts by 5,212)

- Commercials: Net long 48,803 (decreased longs by 2,504, decreased shorts by 877)

Similar to NZD, AUD’s % long ratio increased to 26%, up from around 20%, indicating significant space for long positions. This data supports a bullish outlook for AUD, suggesting potential upside.

Final Thoughts

This week, the CAD, CHF, NZD, and AUD setups look promising, each showing potential room for bullish moves based on positioning extremes and reversals. Conversely, JPY is flashing cautionary signals, while EUR and GBP remain unclear, so I’ll remain patient until clearer signals emerge.

Trade smart, and stay tuned for next week’s insights.

— Takezo

Data Source: Commodity Futures Trading Commission (CFTC)

For traders interested in a deeper dive or who want to leverage this analysis for trading decisions, I offer the complete raw data set. You can directly purchase the raw data or subscribe to my website for free monthly updates and ongoing access.

Click here to access the data set and subscribe for free updates!