May 2025 – Takezo Trading Commentary

The Reserve Bank of Australia (RBA) has decided to cut the cash rate target by 25 basis points, bringing it down from 4.10% to 3.85%. This move reflects cautious optimism on domestic inflation trends coupled with heightened vigilance due to escalating global trade and geopolitical uncertainties.

Let’s break down the key points from the RBA’s latest monetary policy update, highlight the main shifts from their previous March report, and explore strategic implications for traders and investors.

A Strategic Rate Cut

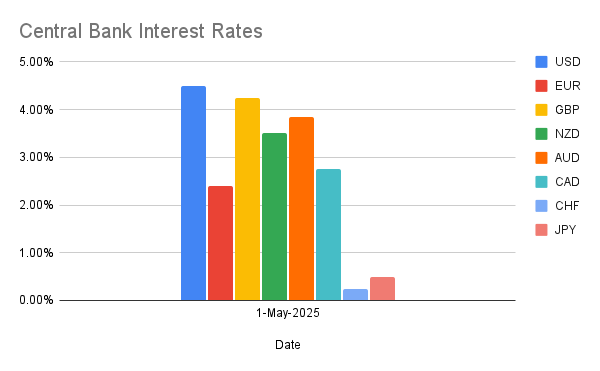

The RBA’s decision to lower rates demonstrates its intent to support economic stability amidst moderating inflation and increasing international volatility. The headline numbers:

- Cash Rate Target: Reduced to 3.85% from 4.10%

- Inflation Outlook: Moderating significantly, with headline inflation at 2.4%—well within the target band of 2–3%.

Key Differences from March Report

In March 2025, the RBA held steady, cautiously monitoring inflation and employment dynamics. Fast forward to May, and there are notable shifts:

- Clearer Disinflation Path: March quarter inflation dropped to 2.4% from previously higher levels, showing sustained progress towards the central inflation target.

- Heightened Global Risks: Increased international uncertainty, particularly around trade policy shifts led by U.S. tariff announcements, now weigh heavily on global and Australian economic prospects.

- Domestic Demand Mixed: Despite some recovery in private domestic demand and real household incomes, weak demand in specific sectors has restricted businesses from passing costs to consumers effectively.

Unpacking the Global Uncertainty

Recent trade tensions, notably intensified by U.S. tariff actions, have introduced significant uncertainty:

- Market Volatility: While financial markets have rebounded somewhat after tariff announcements, uncertainty persists.

- Economic Impact: Potential delays in expenditure by households and businesses due to uncertain trade outcomes.

These external factors have led the RBA to adopt a more cautious stance, reflected in their rate reduction.

Labour Market and Wage Dynamics

The RBA noted ongoing tightness in labour markets:

- Employment Strength: Continued employment growth and low labor underutilization.

- Wage Growth Softening: Although wages growth has moderated, high unit labor costs due to weak productivity growth persist.

Stay prepared, adaptable, and strategic.

– Takezo

Data Source: https://www.rba.gov.au/statistics/cash-rate/