Markets Gripped by Geopolitical Risk, Safe Havens Light Up

One of the most underappreciated truths in global finance is this: markets hate uncertainty. And right now, uncertainty is everywhere. From the spike in volatility to historic highs in gold, from the surge in Japanese yen positioning to the quiet strength of the U.S. dollar—it’s becoming increasingly clear that we are in the early stages of a broad-based flight to safety. The only question that remains is: how long will it last, and where will the capital go?

The Geopolitical Spark: Trump’s Tariffs

Let’s start with what lit the match.

Former President Trump’s renewed push for sweeping tariffs has shaken the global trade outlook. Markets are treating this like a slow-moving car crash—predictable, but still dangerous. This isn’t just a political headline. It has real economic consequences. Tariffs impact inflation, supply chains, and trade balances, especially for export-heavy economies. In the FX world, that sends ripples across every major currency pair.

Speculators Seeking Safety: What the COT Data Says

The April 15th Commitment of Traders (COT) report shows a clear theme: speculators are shifting into safe-haven assets.

Here’s the snapshot:

- JPY: Net longs jumped to 171,855—a massive move, with speculators increasing longs by 22,005 contracts. This signals confidence in the yen’s role as a safe haven, especially when paired with its ultra-low bond yield (10yr at just 1.29%). Japan isn’t offering yield—it’s offering shelter.

- CHF: Net shorts sit at -28,584, but speculators are increasing their long exposure steadily. The Swiss franc is often a bolt-hole for capital during global stress, but its market size is a limitation. As noted in the COT breakdown, this may prompt SNB intervention if the franc strengthens too much, too fast. https://takezotrading.com/commitment-of-traders-update-april-15th-2025/

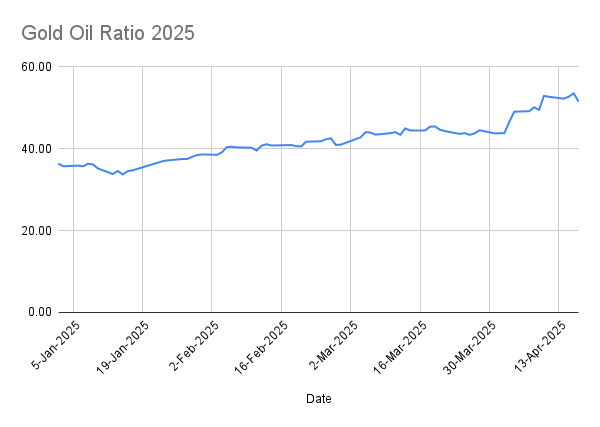

- Gold: The Gold/Oil ratio remains above 50, driven primarily by gold prices over $3,000/oz. That’s not a small signal—it’s a blaring alarm. A high gold/oil ratio typically reflects recession fears or a rush into precious metals during panic. This is not inflation-based demand. This is safety demand.

- VIX: The volatility index has stubbornly held above 30. That’s elevated territory. We haven’t seen it sit this high without a major risk event since the early pandemic years.

This isn’t scattered movement—it’s coordinated fear.

What About the USD?

The irony is that the source of most of this geopolitical stress—the United States—is also seen as the ultimate safe haven.

Unlike the CHF or JPY, the U.S. dollar has the size. It can absorb the world’s capital in a way no other asset can. But the recent data doesn’t show speculators piling in just yet. That doesn’t mean it won’t happen—it may just be delayed.

This brings us to the bond market.

Yield Curve Watching: Is the USD Strength Delayed?

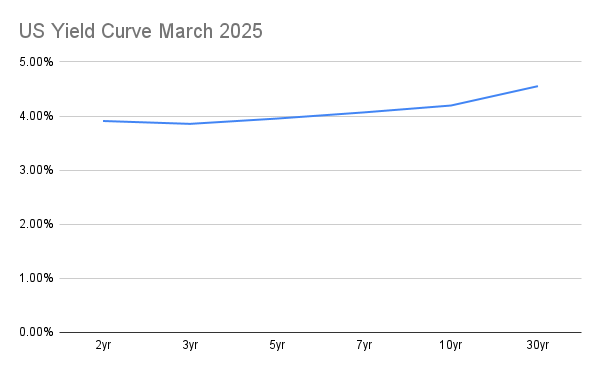

As of the end of March 2025, the U.S. yield curve began to flatten, suggesting uncertainty about the Fed’s path forward. Here’s what traders are watching:

- Short-Term (5-Year): The market is favoring shorter maturities. That’s classic behavior during periods of heightened risk. Investors want yield but don’t want to be locked in for long.

- 10-Year vs. 30-Year: If the yield curve continues to flatten—or worse, inverts again—we may see another rush into longer-term U.S. Treasuries, which could finally trigger the overdue USD rally.

In times of real crisis, capital flows not to yield, but to liquidity and trust. And U.S. Treasuries—regardless of political drama—still dominate both categories.

So, Are We in a Flight to Safety?

The answer is: yes. All signs point to capital making its way toward safety. The early indicators are already flashing:

- JPY and CHF speculators are leaning long

- Gold is surging while oil lags

- VIX is signaling stress

- U.S. Treasuries are being bought with increasing urgency

We might just be in the opening chapter of a larger macro shift.

Final Thoughts: Watch the Yield Curve

The story isn’t done. What happens next will largely depend on where the capital goes. If we see continued flattening or inversion at the long-end of the U.S. yield curve, expect a stronger USD to follow.

The markets have shown you their hand: they’re uneasy, they’re cautious, and they’re searching for cover. The next COT report, the next yield curve print, and the next political escalation could set the tone for the rest of the year.

Takezo Trading

Data Source: Commodity Futures Trading Commission (CFTC)