The Yield War Beneath the Charts

In trading, most look at price. Few look beneath it.

But for the currency trader who walks the path of Musashi, studying interest rate differentials is like reading the wind before a duel. It reveals where capital is likely to flow, where pressure is building, and where trends may ignite.

This March 2025 breakdown of 10-year government bond yields and their spreads across major economies peels back the curtain on the hidden structure beneath the forex battlefield. If price is the result, yield spreads are the cause.

This post is part of our monthly bond yield and spread series, tracking evolving interest rate landscapes to better understand currency dynamics.

Let’s begin.

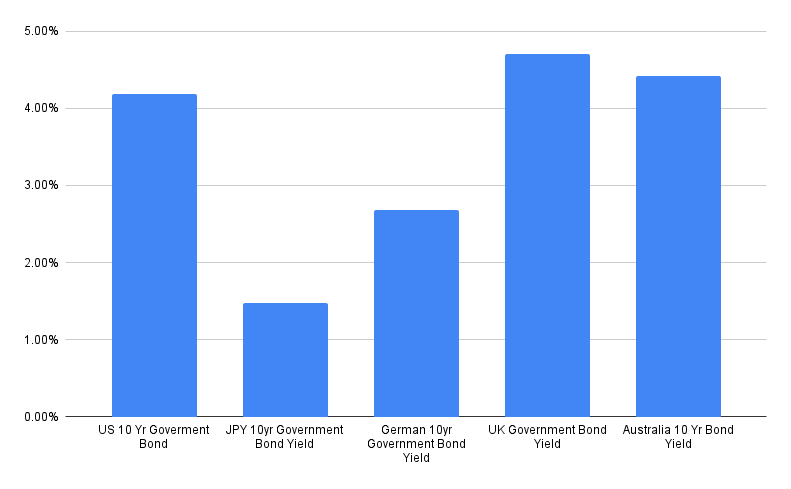

Yield Landscape (As of March 31, 2025)

| Country | 10-Year Yield |

|---|---|

| US | ~4.2% |

| Japan | ~1.4% |

| Germany | ~2.6% |

| UK | ~4.7% |

| Australia | ~4.4% |

From a bird’s eye view:

- The UK leads the yield board, followed by Australia and the US.

- Germany sits in the middle.

- Japan, as expected, remains the lowest.

What This Means for Traders:

- High-yield currencies (GBP, AUD, USD) attract capital.

- Low-yield currencies (JPY, EUR) act as funding bases in carry trades.

- Yield differentials fuel FX momentum when volatility and risk appetite align.

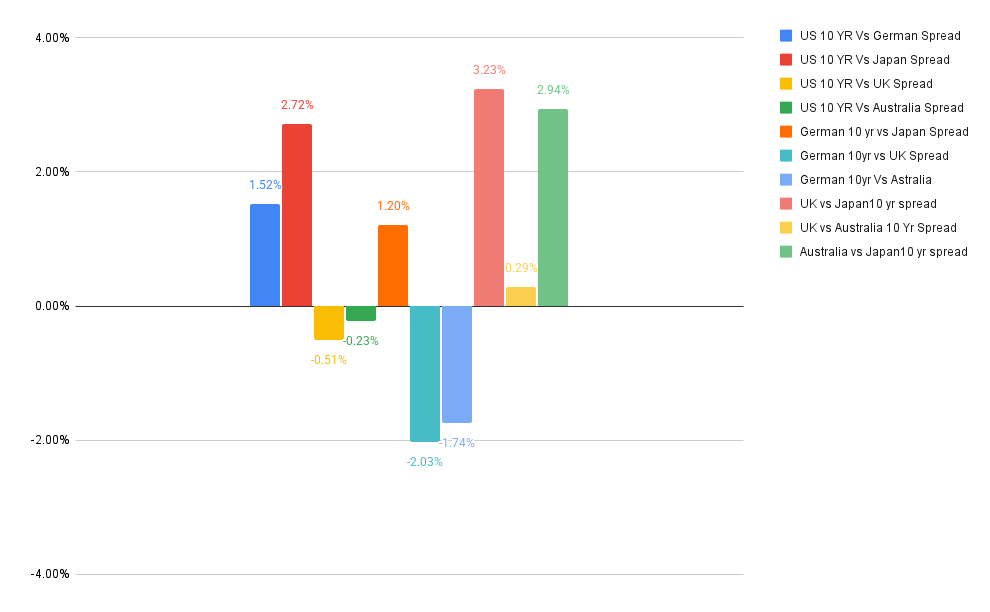

Yield Spreads: Where the Edge Lies

Yield spreads are the trader’s compass. Here are the most critical observations from March 2025:

US Yield Spreads

- vs Japan: +2.72% – Still wide. USD/JPY long bias remains valid.

- vs Germany: +1.52% – Moderate edge to USD, but narrowing trend.

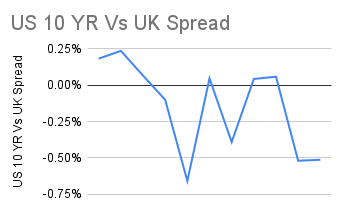

- vs UK: -0.51% – UK now leads. Suggests caution in long USD/short GBP setups.

- vs Australia: -0.23% – Small AUD advantage. AUD/USD may chop or drift upward.

German Spreads

- vs Japan: +1.20% – Modest positive. Not strong enough for decisive EUR/JPY trends.

- vs UK: -2.03% – Deeply negative. Favors short EUR/long GBP.

- vs Australia: -1.74% – Negative. Pressure remains on EUR/AUD.

UK Spreads

- vs Japan: +3.23% – Widest among majors. GBP/JPY is a powerful carry setup.

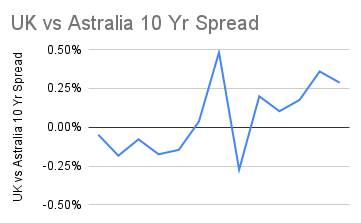

- vs Australia: +0.29% – Slight edge, but fluctuating. GBP/AUD likely rangebound.

Australia vs Japan

- +2.94% – A favorite for carry traders. AUD/JPY remains one of the cleanest trades.

Trend Context: What the Spreads Reveal

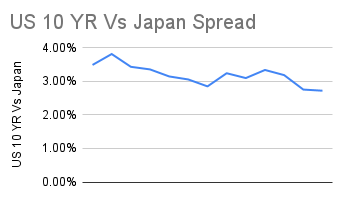

USD vs JPY

- Spread narrowed from ~3.8% to ~2.7% over the year.

- USD still dominant, but JPY weakness could slow if BoJ shifts policy more aggressively.

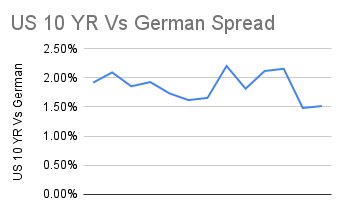

USD vs EUR (Germany)

- Peaked near 2%, now at 1.5%.

- EUR/USD may remain rangebound. No strong directional bias.

USD vs GBP & AUD

- GBP and AUD have overtaken USD in yield terms.

- Watch for strength in GBP/USD and AUD/USD when risk appetite is strong.

GBP / AUD vs JPY

- Spreads remain high and stable.

- Long GBP/JPY and AUD/JPY are still favored strategies.

Strategic Takeaways (Musashi-Style)

“You must understand that there is more than one path to the top of the mountain.” — Miyamoto Musashi

But when some paths are paved with 3% yield advantage, they deserve more attention.

Top 3 Carry Setups

- GBP/JPY: +3.23% – Strongest on the board.

- AUD/JPY: +2.94% – Clean and stable. Commodity tailwinds help.

- USD/JPY: +2.72% – Reliable and liquid.

Rangebound Pairs

- EUR/USD, EUR/GBP, GBP/AUD: Narrowing or volatile spreads.

- These are more suitable for range trading or mean reversion setups.

Final Word: The Way of the Yield Warrior

This isn’t just macroeconomics. This is strategy. The same way a samurai reads his opponent’s footwork, you read spreads — looking for imbalance, opportunity, and asymmetry.

The 10-year yields show where the money is comfortable. The spreads show where the money is moving.

And when you understand that, you’re not just trading. You’re positioning yourself like a general on the battlefield, moving with purpose, precision, and profit.

Trade with edge. Trade with discipline. Trade with honor.

Written by Takezo

Follow the way: www.takezotrading.com | x.com/ @TakezoTrading