As we close out April 2025, it’s crucial for traders and investors to keep a close eye on central bank decisions, bond yields, and their spreads. These elements not only influence currency movements but also signal broader economic expectations. In this month’s analysis, I’ll break down key trends and insights drawn from the latest data.

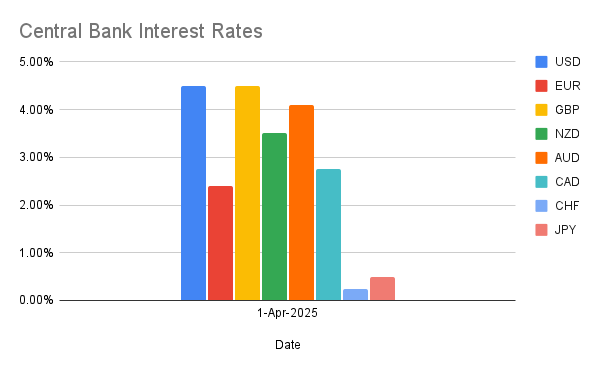

Central Bank Interest Rates Snapshot

Understanding central bank interest rates gives traders a direct insight into monetary policy direction. Central banks continue to grapple with inflation control and economic growth, setting the tone for currencies and bond markets.

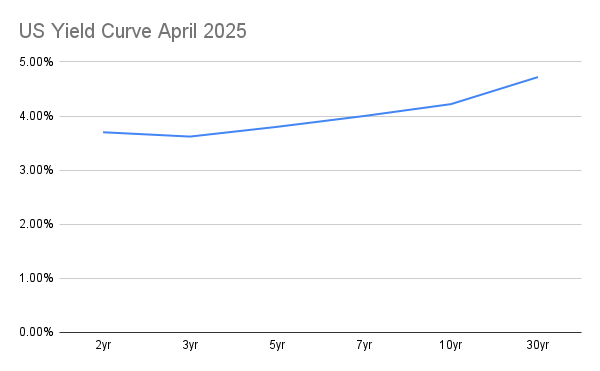

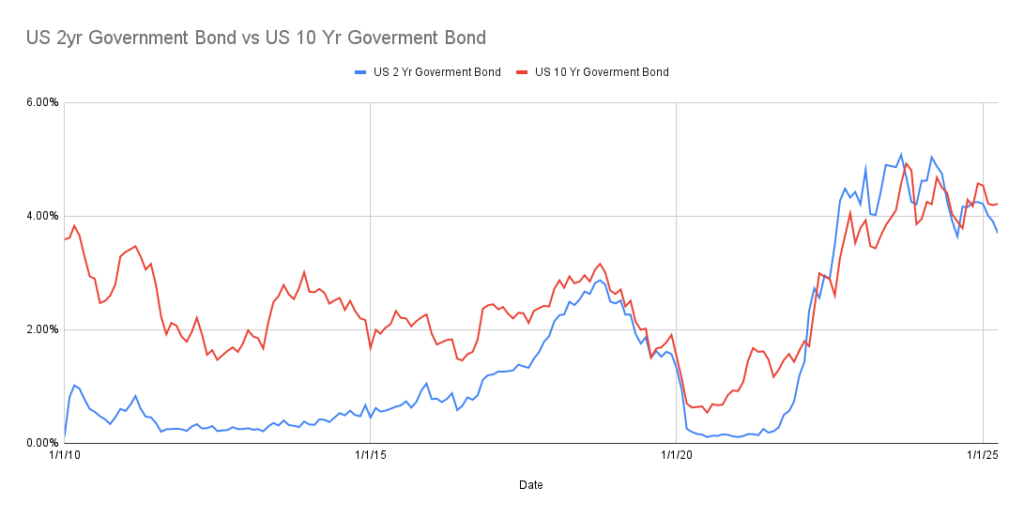

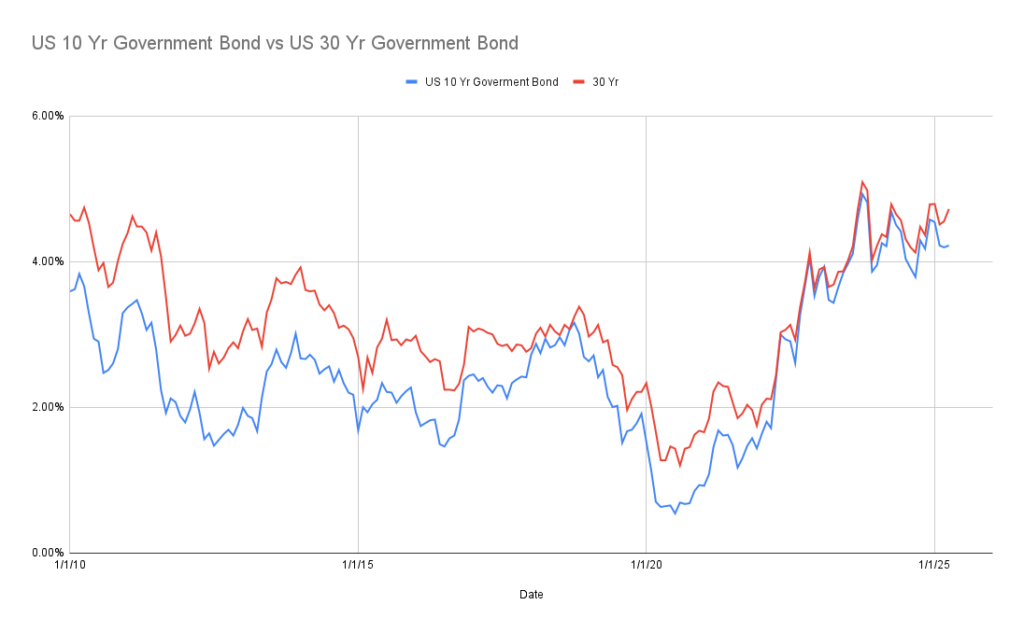

US Yield Curve: A Gauge of Economic Health

The US yield curve, particularly the spread between the 2-year and 10-year government bonds, remains a critical indicator of economic sentiment. Currently, we’re observing persistent inversion trends, traditionally viewed as a harbinger of economic slowdown or recession. A comparison between the 10-year and 30-year yields also provides valuable insights into long-term economic expectations.

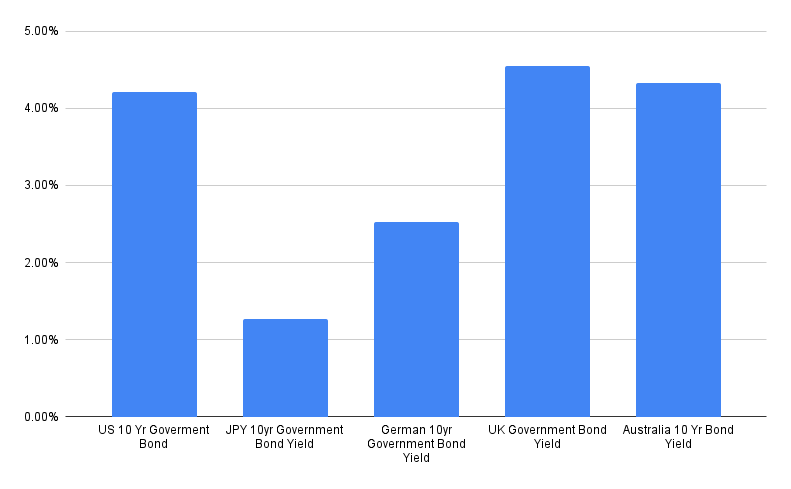

Major Currencies and 10-Year Bond Yields

Bond yields for major currencies offer a perspective on relative economic strength and risk perception. Here’s a quick summary of the current landscape:

- US Bonds remain a reference point, with yields reflecting expectations of continued economic volatility.

- German Bonds, as a benchmark for European sentiment, continue to show cautious optimism amid mixed economic signals.

- UK Bonds indicate moderate stability, influenced significantly by ongoing political and economic developments.

- Japanese Bonds persistently low yields underscore Japan’s long-term struggle with deflationary pressures.

- Australian Bonds provide insights into commodities-linked currencies, with yields responsive to global demand dynamics.

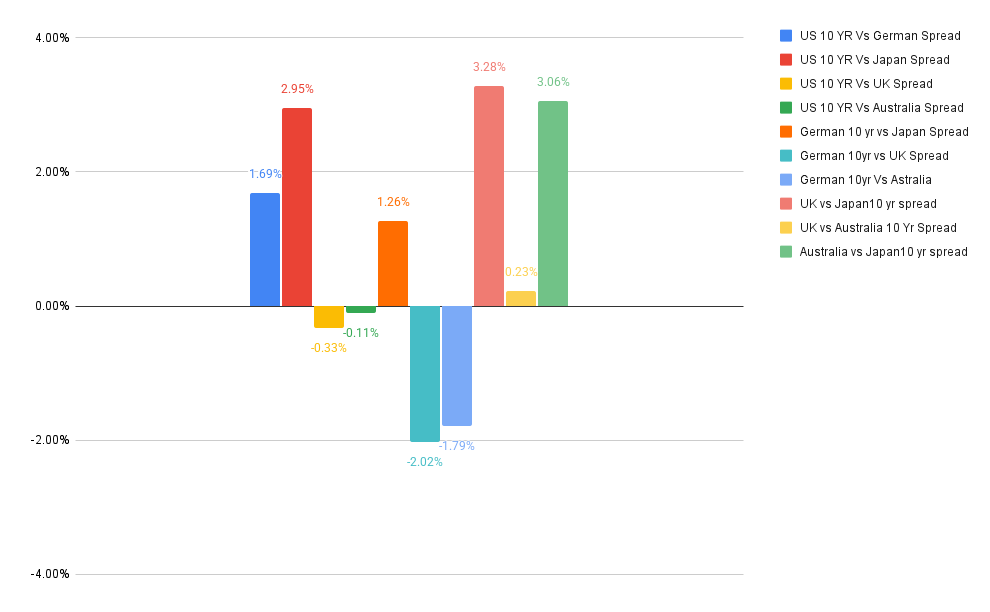

Key 10-Year Yield Spread Trends

Analyzing spreads between major economies can pinpoint shifts in economic momentum and currency strength.

- German 10-Year vs. Japan 10-Year: Spreads widening here may hint at greater Euro strength relative to the Yen, influenced by divergent central bank policies.

- German 10-Year vs. UK 10-Year: A narrowing spread might indicate closely aligned economic trajectories or market uncertainty affecting both regions similarly.

- UK 10-Year vs. Australia 10-Year: Observations in this spread highlight the interplay between European stability and commodity-driven economic fluctuations in Australia.

- US vs. Australian Bonds: Spreads indicate the nuanced relationship between US monetary policy and Australian economic conditions driven by global commodity cycles.

- US vs. German and Japanese Bonds: Trends here reinforce the US bond market’s role as a global barometer and its attractiveness as a safe haven asset during uncertain economic times.

Practical Trading Insights

Understanding these spreads can help traders:

- Gauge currency strength and weakness more accurately.

- Identify potential shifts in central bank monetary policies.

- Predict capital flow directions, especially during periods of geopolitical tension and economic uncertainty.

This detailed view of interest rates, yield curves, and bond spreads equips traders and investors with strategic insights necessary to navigate volatile markets effectively.

For traders interested in a deeper dive or who want to leverage this analysis for trading decisions, I offer the complete raw data set. You can directly purchase the raw data or subscribe to my website for free monthly updates and ongoing access.

Click here to access the data set and subscribe for free updates!