By Takezo Trading | www.takezotrading.com

Welcome back, traders! It’s time again for our weekly dive into the Commitment of Traders (COT) data. Here’s exactly what the positioning data is showing us, along with my insights on how it might impact the markets.

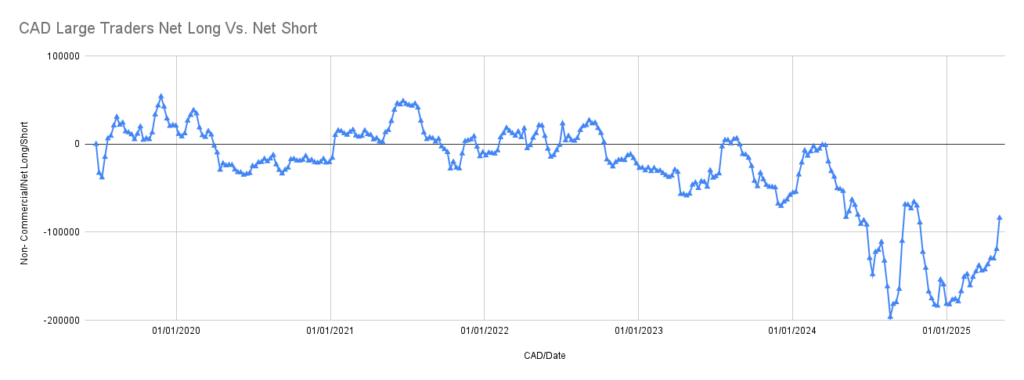

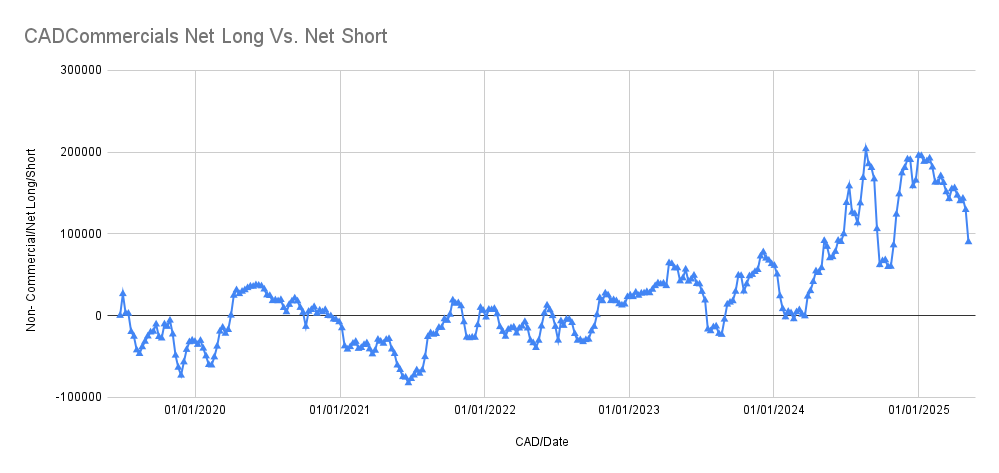

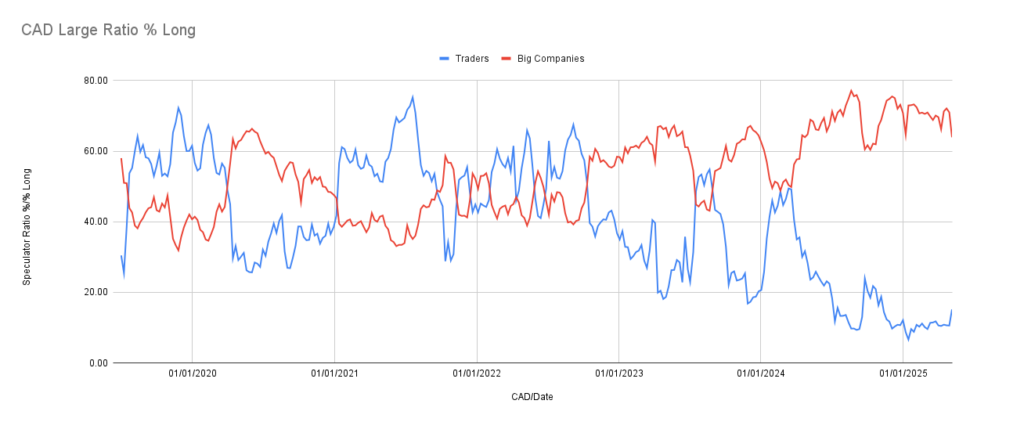

CAD – Canadian Dollar

- Speculators: Net short -70,645 (increased longs by 631, increased shorts by 4,071)

- Commercials: Net long 76,469 (increased longs by 1,415, increased shorts by 268)

With the % long ratio currently at 16%, there’s still significant room for additional long positions. This suggests continued potential for CAD strength in the near term.

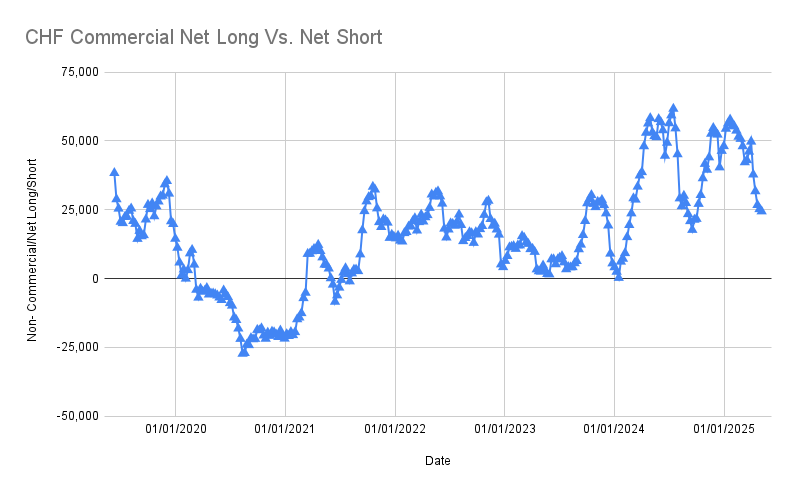

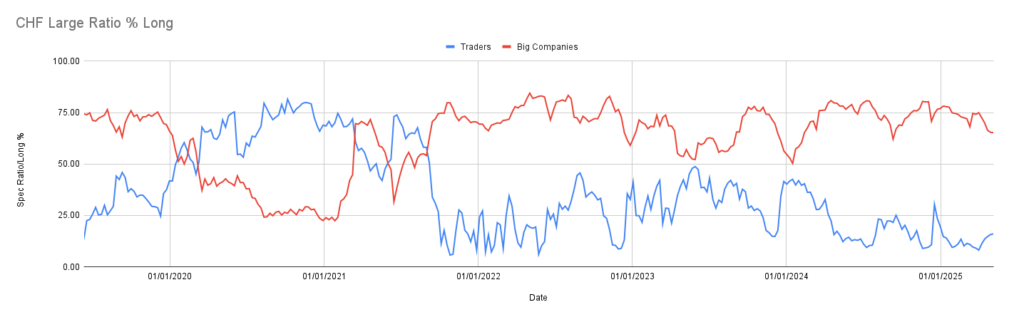

CHF – Swiss Franc

- Speculators: Net short -23,574 (slightly decreased longs by 9, reduced shorts by 749)

- Commercials: Net long 24,432 (decreased longs by 1,348, decreased shorts by 516)

The % long ratio is under 16%, indicating there’s ample space for more CHF longs. CHF strength remains on the radar as positioning still allows further upside.

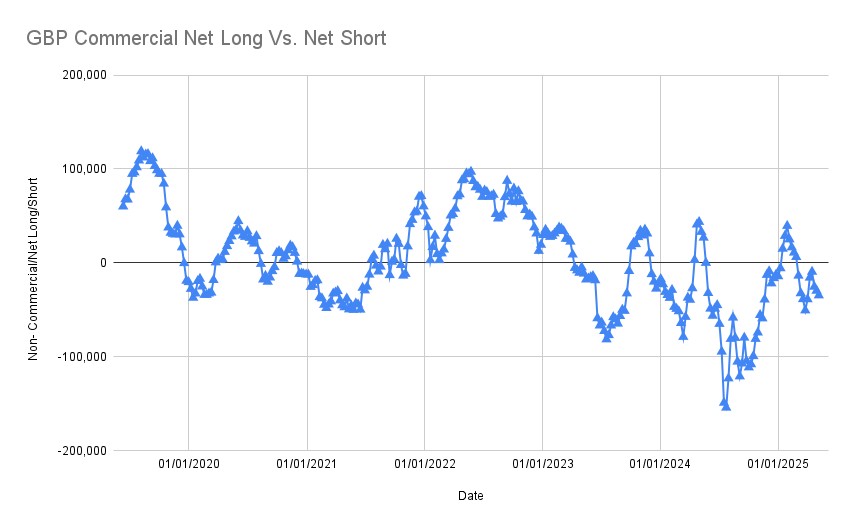

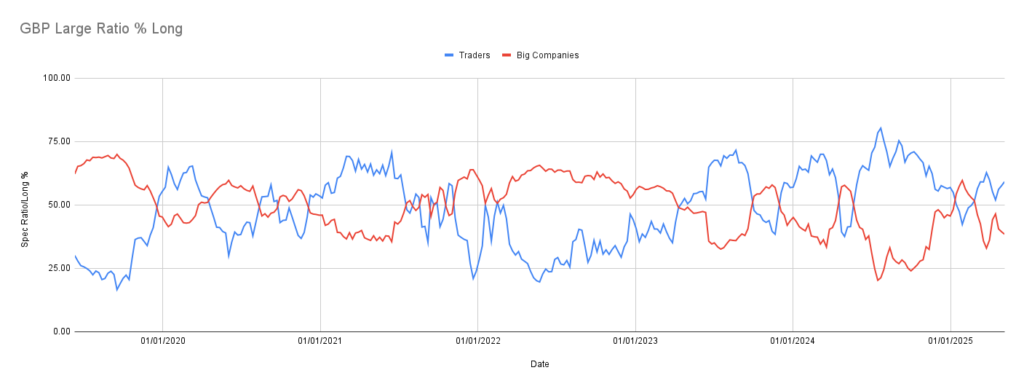

GBP – British Pound

- Speculators: Net long 29,235 (increased longs by 3,320, reduced shorts by 1,956)

- Commercials: Net short -34,736 (increased longs by 2,534, significantly increased shorts by 7,547)

The % long ratio sits at 59%, and I find the COT data less clear for GBP this week. I’ll refrain from basing any trade decisions solely on this data until clearer signals emerge.

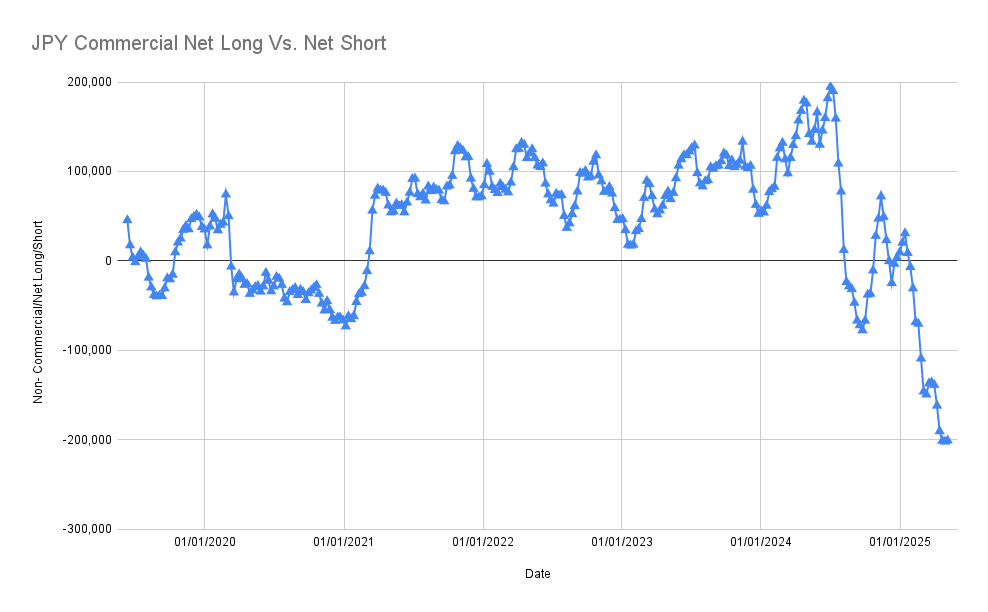

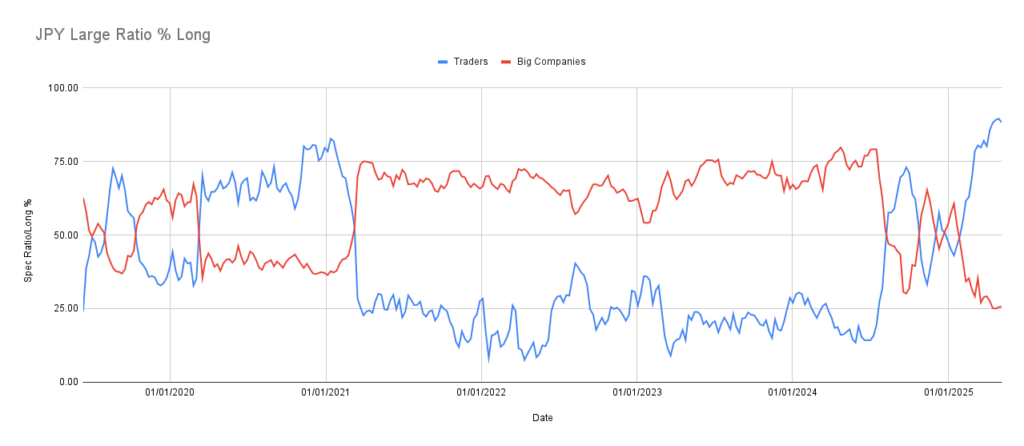

JPY – Japanese Yen

- Speculators: Net long 176,859 (increased longs by 1,211, increased shorts by 3,564)

- Commercials: Net short -200,617 (increased longs by 968, decreased shorts by 317)

JPY’s % long ratio is extremely high at 88%, indicating overbought conditions. I suggest caution with new JPY longs. Given the positioning extremes, bearish momentum could soon emerge.

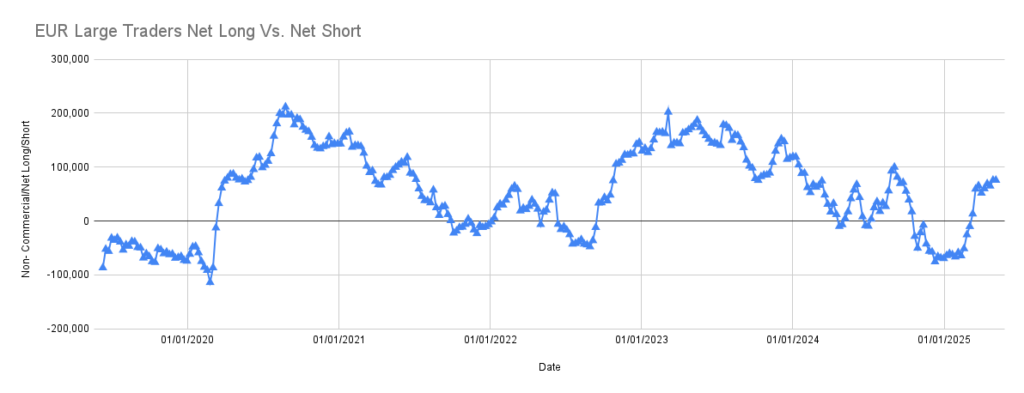

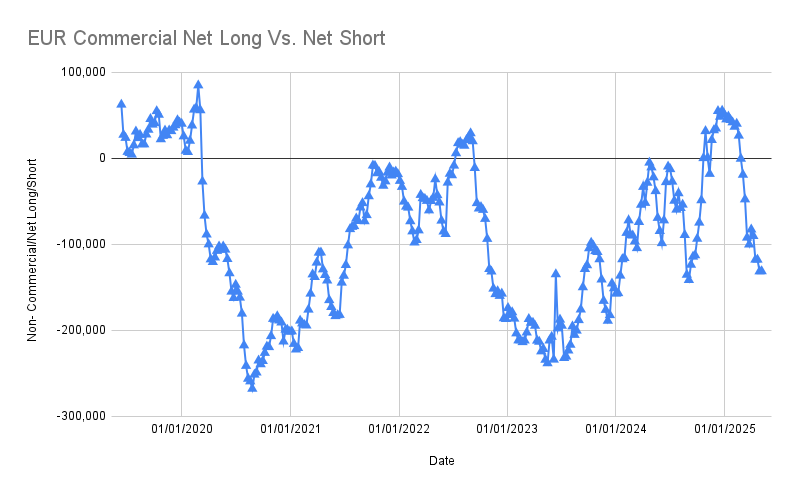

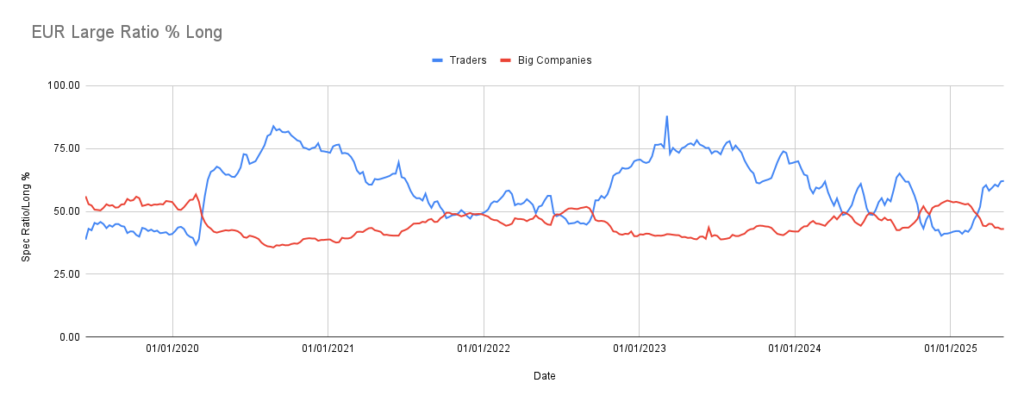

EUR – Euro

- Speculators: Net long 75,719 (decreased longs by 2,196, decreased shorts by 2,118)

- Commercials: Net short -131,339 (increased longs by 3,789, increased shorts by 3,617)

With a % long ratio at 62%, EUR doesn’t present clear signals through this week’s COT data. I’ll avoid using it as the sole basis for EUR trade decisions this time around.

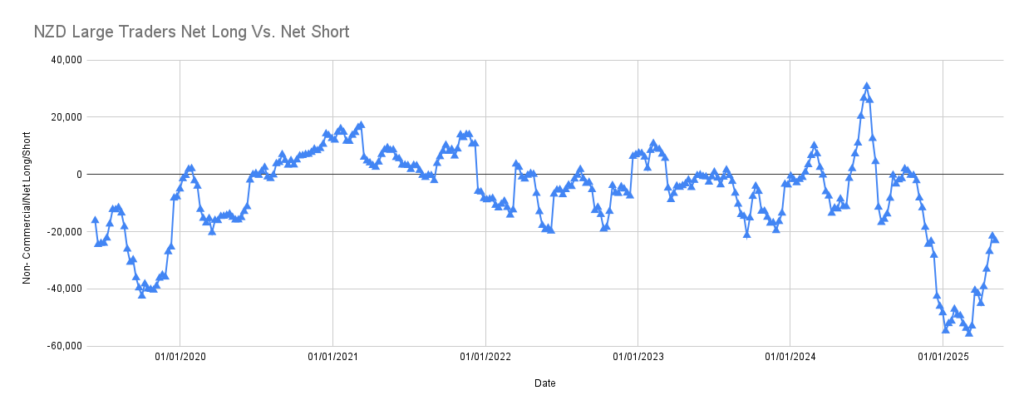

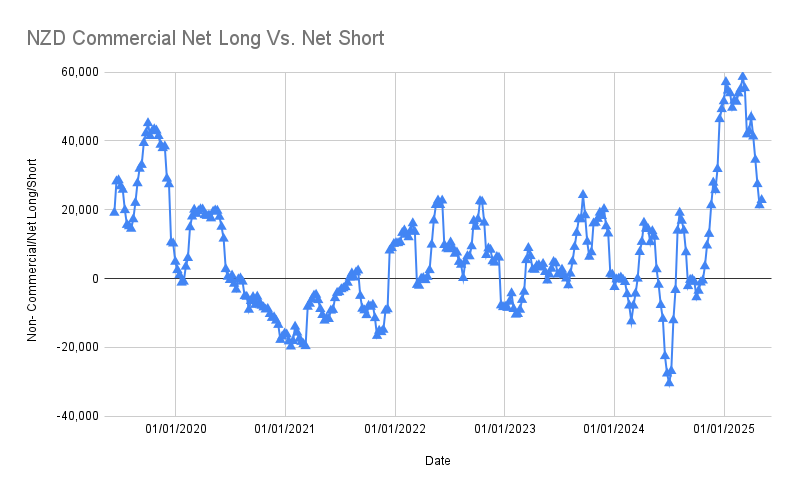

NZD – New Zealand Dollar

- Speculators: Net short -23,135 (decreased longs by 1,982, reduced shorts by 370)

- Commercials: Net long 22,830 (decreased longs by 955, decreased shorts by 2,483)

NZD’s % long ratio has risen to 23%, up from below 20%. There’s considerable room left for further long positioning, supporting potential NZD strength moving forward.

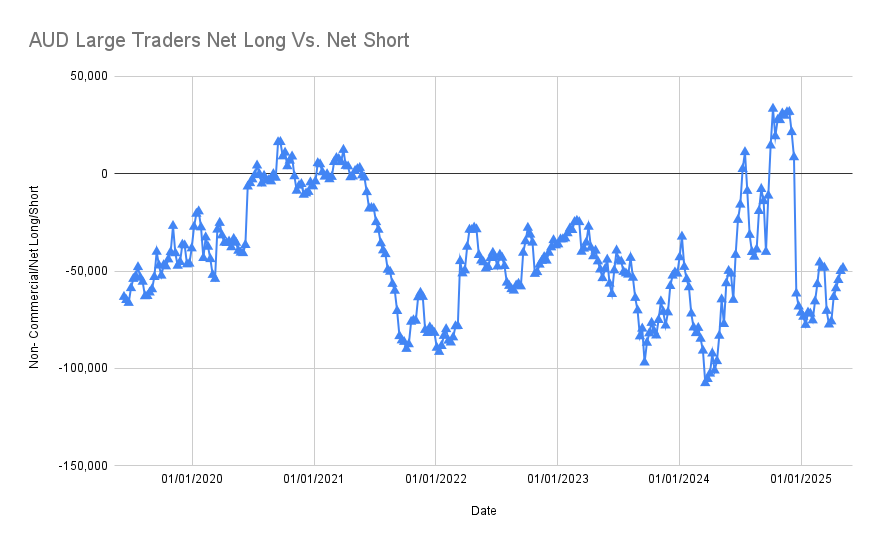

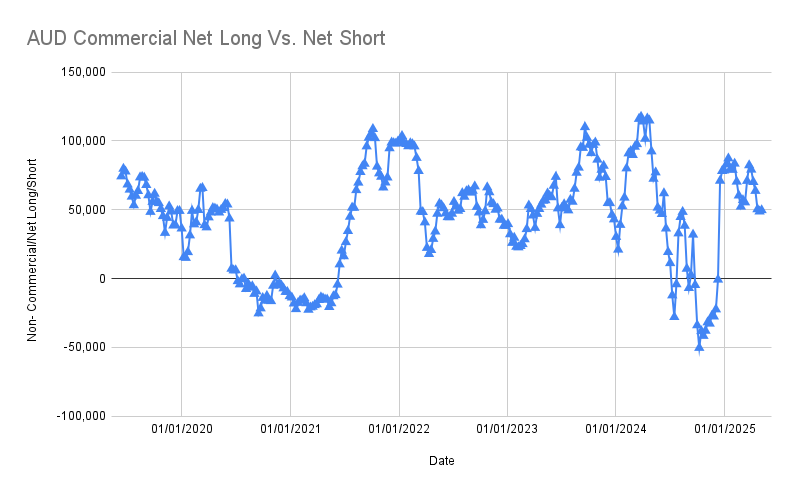

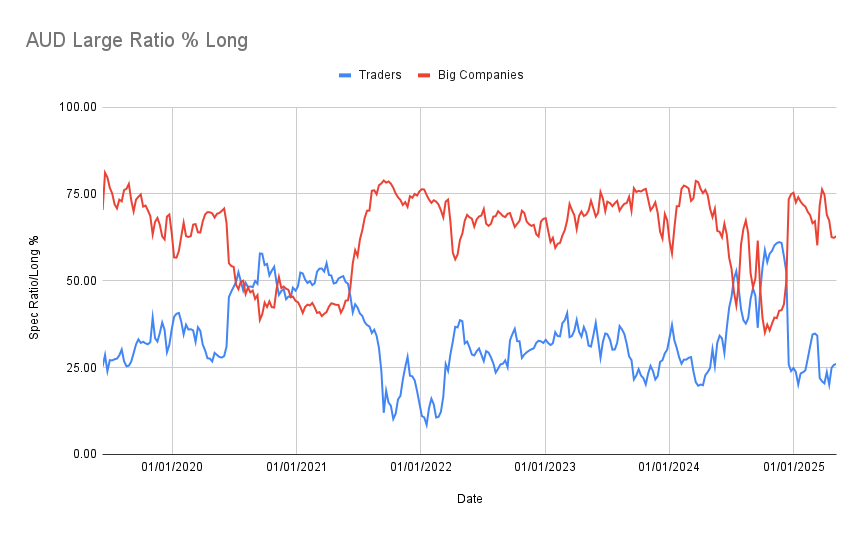

AUD – Australian Dollar

- Speculators: Net short -48,372 (decreased longs by 359, decreased shorts by 1,930)

- Commercials: Net long 49,713 (decreased longs by 1,540, decreased shorts by 2,450)

Similar to NZD, AUD’s % long ratio increased to 26%, indicating substantial space available for more long positions. The positioning supports a bullish outlook for the Australian Dollar.

Final Thoughts

This week’s data highlights strong bullish setups in CAD, CHF, NZD, and AUD, with considerable room for growth. However, caution is advisable for JPY due to its overbought condition, while GBP and EUR remain inconclusive for clear trading decisions based purely on this data.

Stay strategic, trade wisely, and join me again next week for another deep dive into market sentiment.

— Takezo

Data Source: Commodity Futures Trading Commission (CFTC)

For traders interested in a deeper dive or who want to leverage this analysis for trading decisions, I offer the complete raw data set. You can directly purchase the raw data or subscribe to my website for free monthly updates and ongoing access.

Click here to access the data set and subscribe for free updates!