By Takezo Trading | www.takezotrading.com

Welcome back, traders! It’s time to dig into this week’s Commitment of Traders (COT) data and uncover what the market positioning is revealing about potential currency moves.

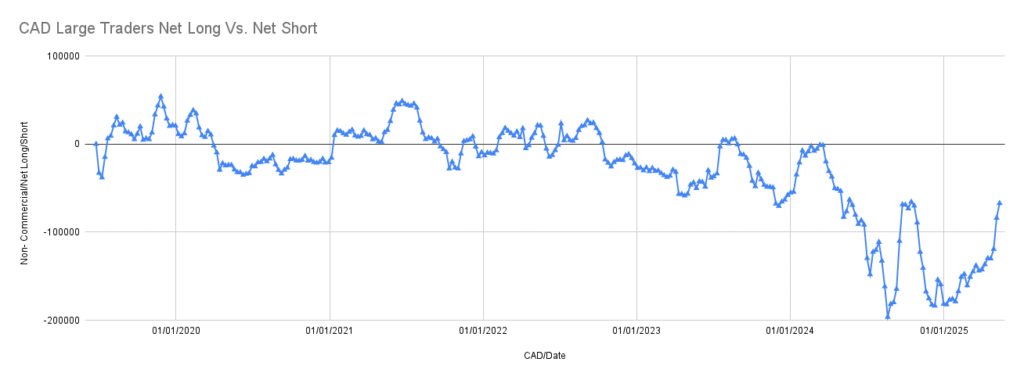

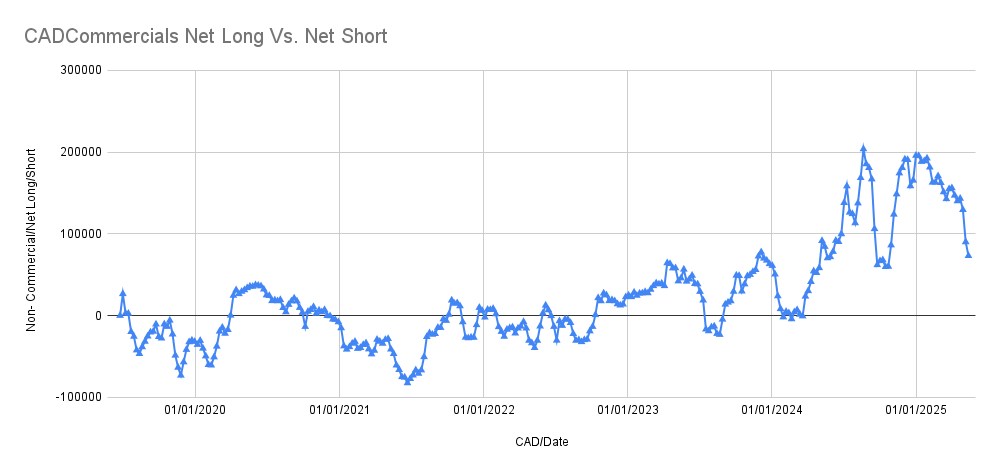

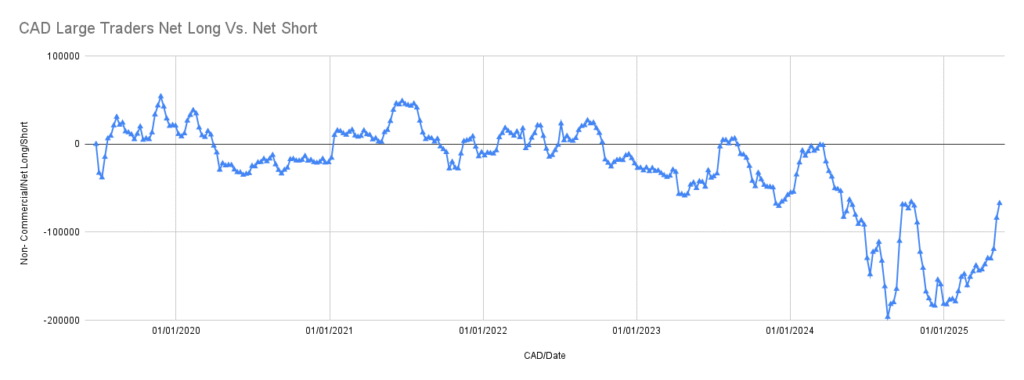

CAD – Canadian Dollar

- Speculators: Net short -82,156 (increased longs by 6,573, significantly increased shorts by 18,084)

- Commercials: Net long 91,895 (increased longs by 3,231, increased shorts by 12,195)

The % long ratio sits at 18.07%, showing plenty of space for further buying activity. The data indicates continued potential for CAD strength, with room for more long positions to emerge.

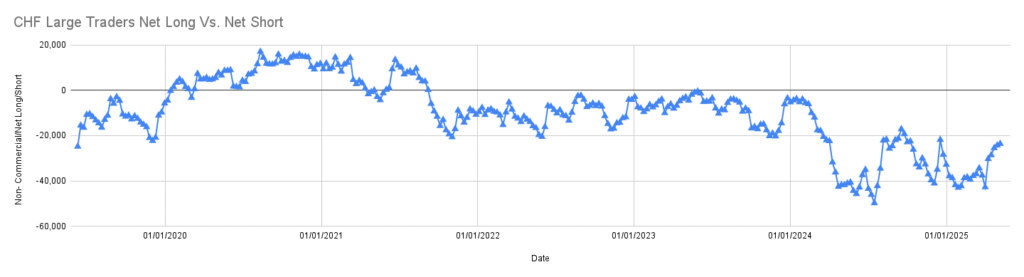

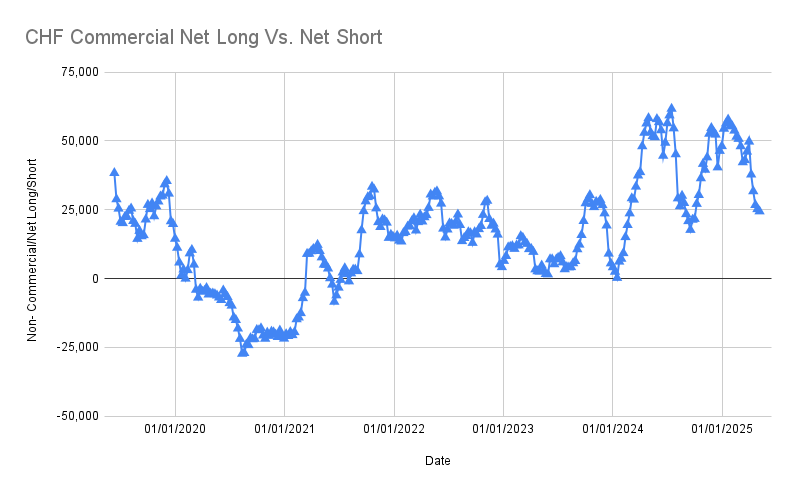

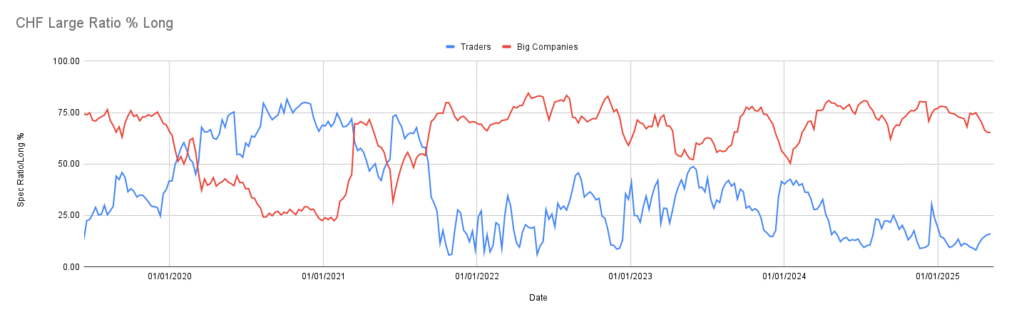

CHF – Swiss Franc

- Speculators: Net short -23,069 (increased longs by 1,885, increased shorts by 1,380)

- Commercials: Net long 22,999 (decreased longs by 1,266, increased shorts by 167)

CHF’s % long ratio remains below 20%, specifically at 19.61%. This setup suggests ample room for further bullish moves in CHF, positioning the currency well for potential strength.

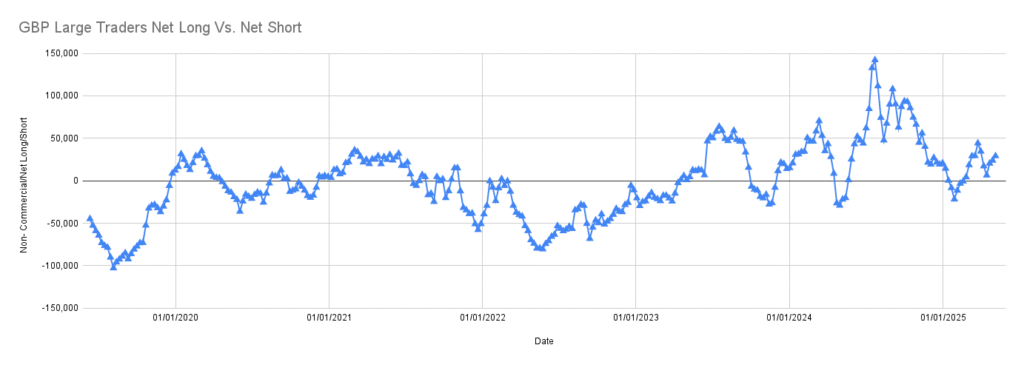

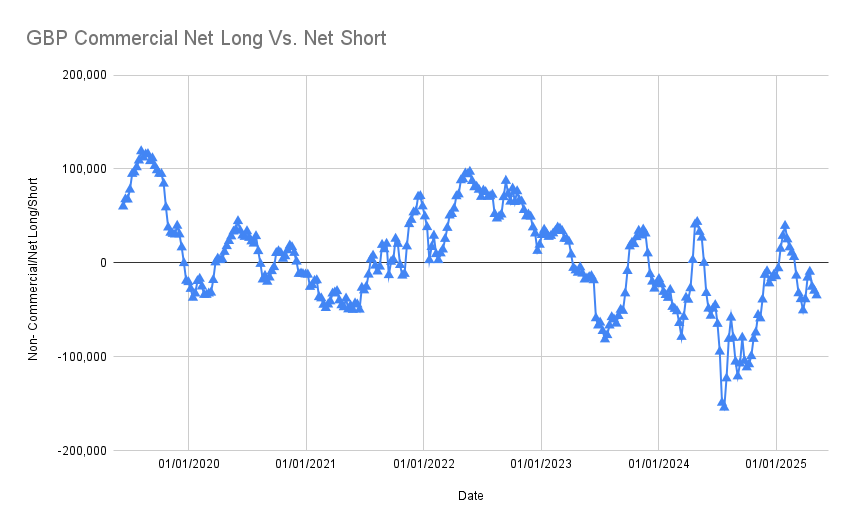

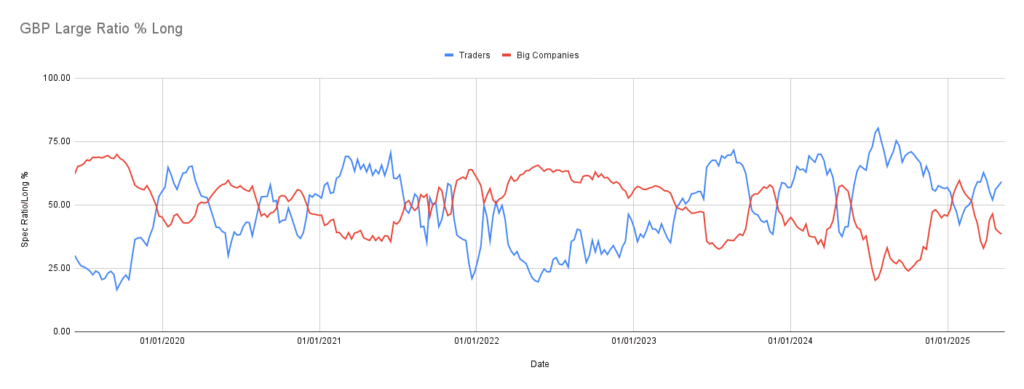

GBP – British Pound

- Speculators: Net long 27,216 (decreased longs by 4,844, decreased shorts by 2,825)

- Commercials: Net short -32,059 (decreased longs by 1,961, decreased shorts by 4,638)

The % long ratio is at 59%. Given this, I won’t rely on GBP’s current COT data for any trade confirmations or decisions this week. Clearer signals are needed before acting on GBP.

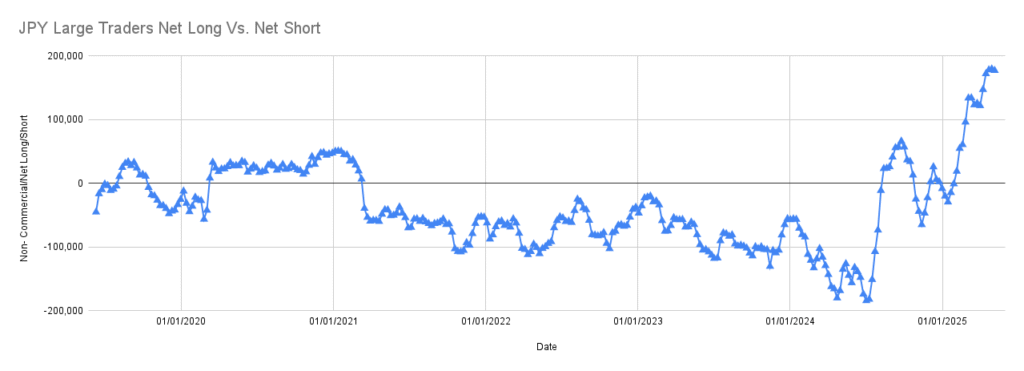

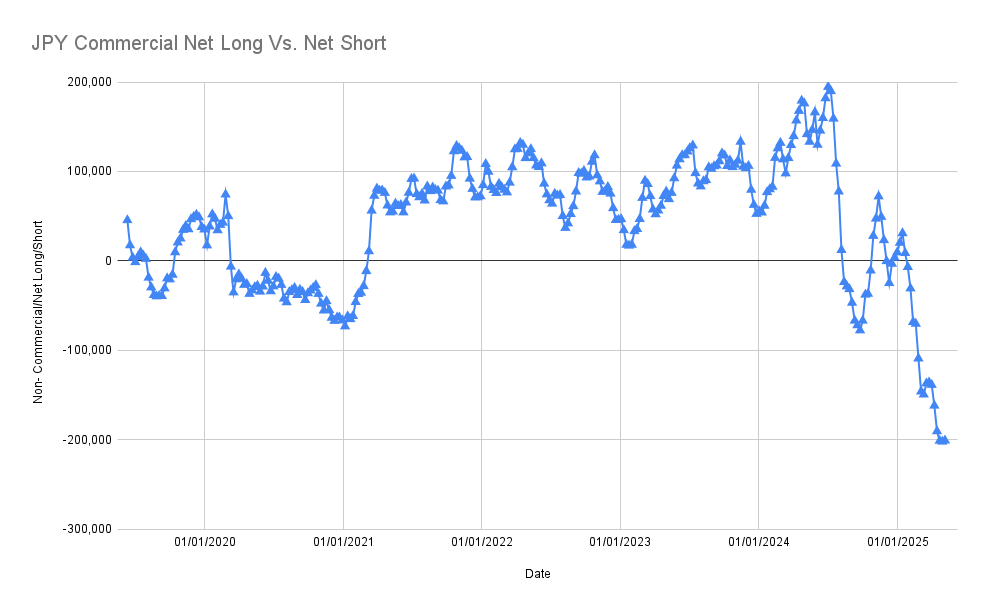

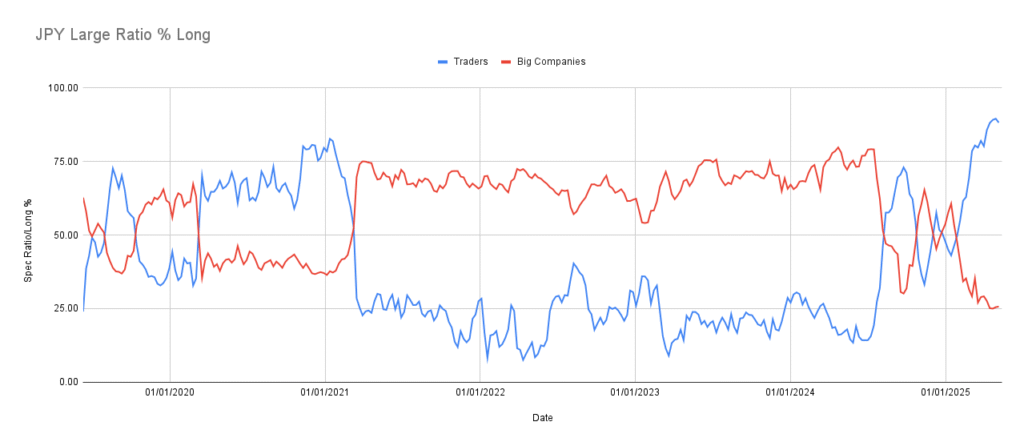

JPY – Japanese Yen

- Speculators: Net long 172,268 (decreased longs by 9,782, decreased shorts by 5,191)

- Commercials: Net short -184,891 (increased longs by 968, decreased shorts by 317)

JPY is extremely overbought with a % long ratio of 88%. I’d strongly advise caution in placing any new long positions. The positioning suggests a potential shift towards bearish momentum ahead.

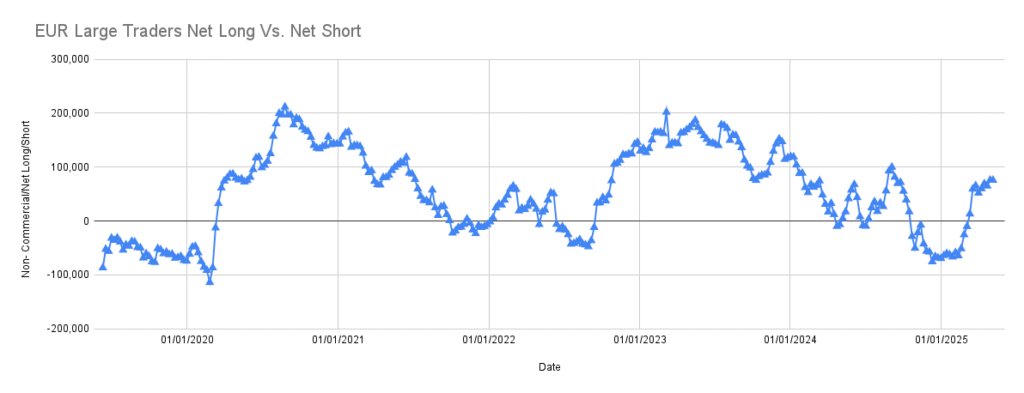

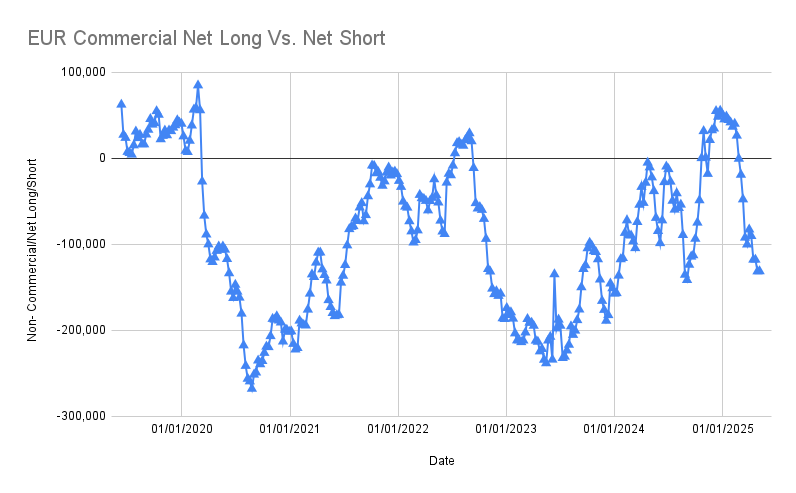

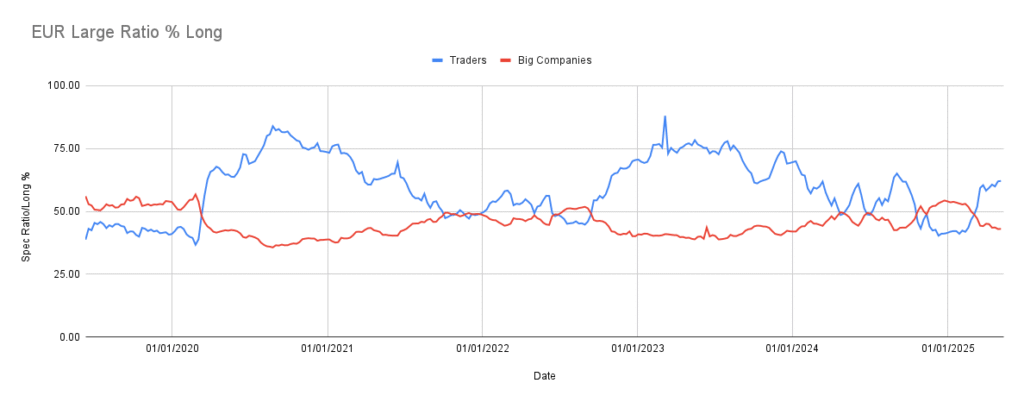

EUR – Euro

- Speculators: Net long 84,774 (significantly increased longs by 15,357, increased shorts by 6,302)

- Commercials: Net short -134,282 (increased longs by 1,125, increased shorts by 4,068)

EUR’s % long ratio sits at 62%. Similar to GBP, this data does not offer strong trading signals or clear directional bias, so I won’t use this for current EUR trade decisions.

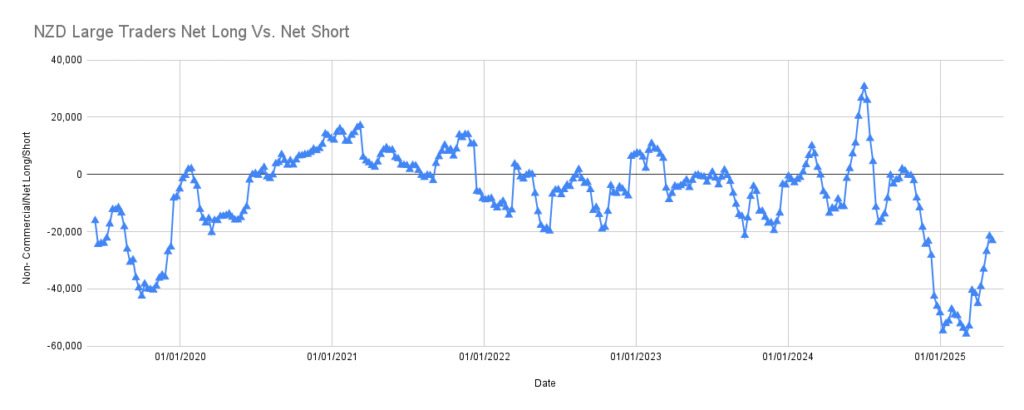

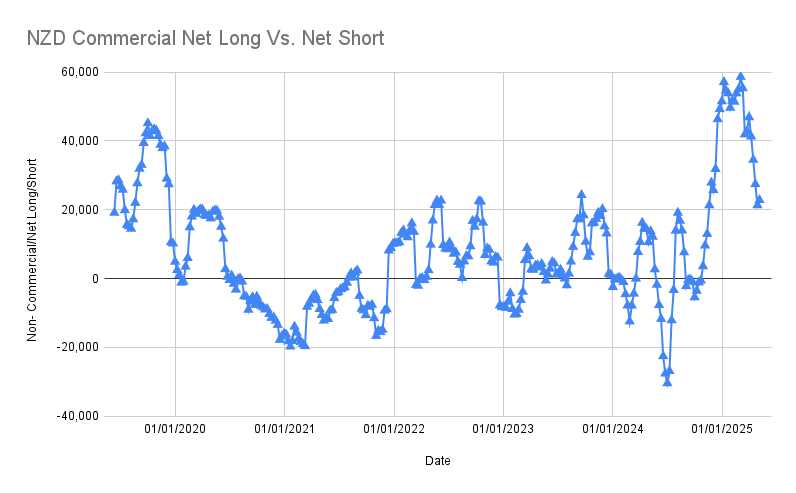

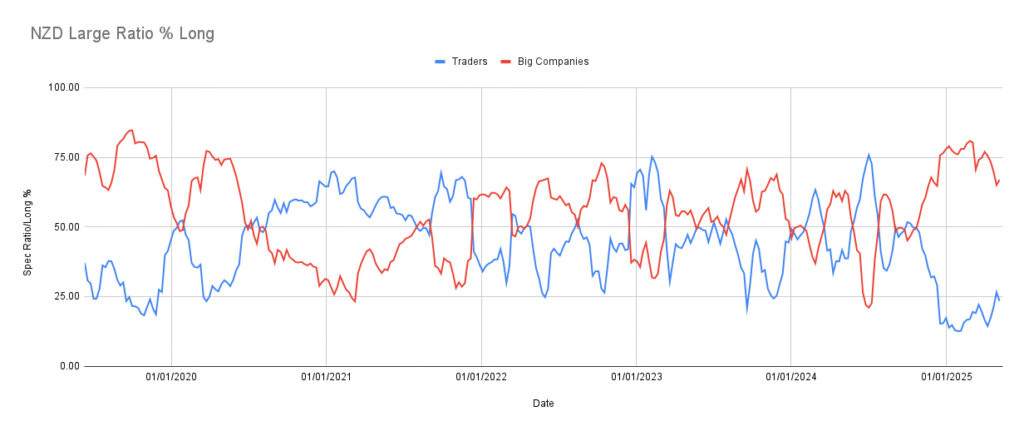

NZD – New Zealand Dollar

- Speculators: Net short -22,612 (slightly increased longs by 19, decreased shorts by 504)

- Commercials: Net long 22,116 (increased longs by 205, increased shorts by 919)

With the % long ratio rising to 23% from under 20%, NZD still has considerable room for additional bullish positioning. This setup continues to support potential NZD strength.

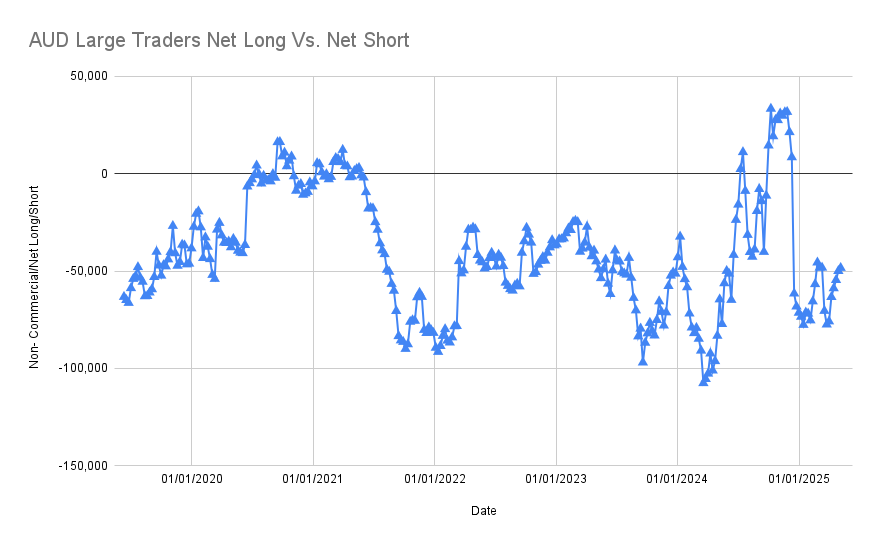

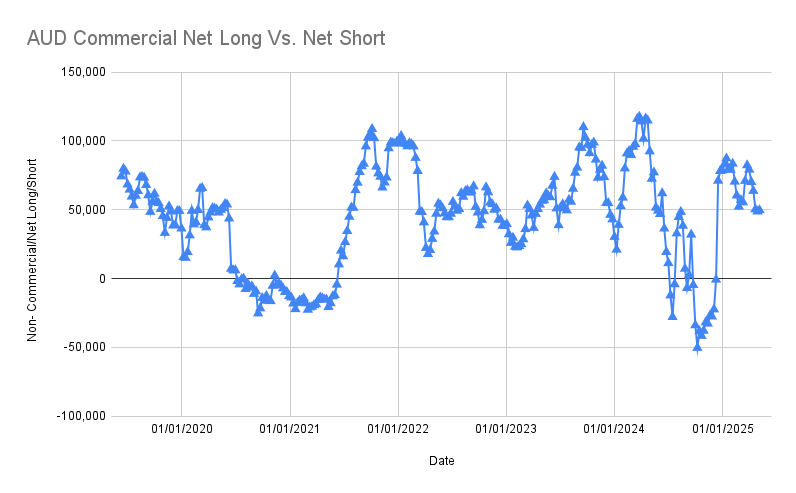

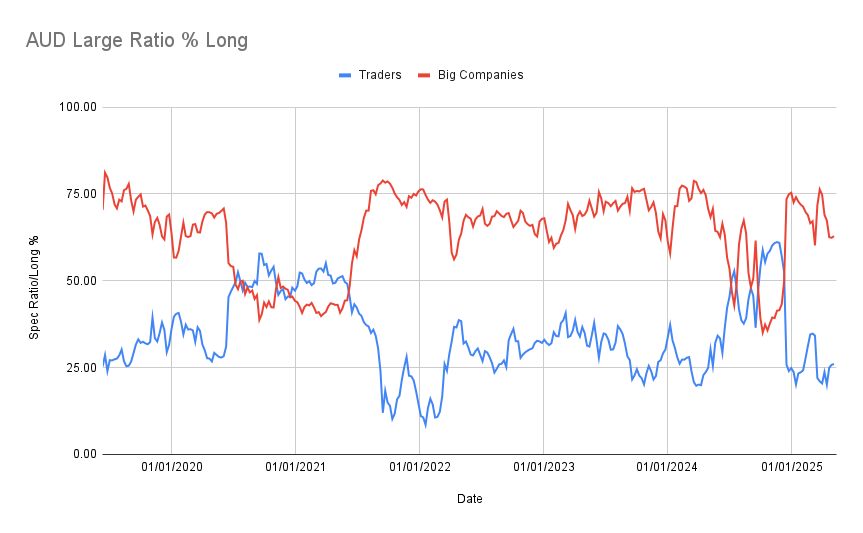

AUD – Australian Dollar

- Speculators: Net short -49,346 (decreased longs by 736, decreased shorts by 238)

- Commercials: Net long 50,883 (decreased longs by 1,575, decreased shorts by 2,745)

AUD’s % long ratio increased to 25.42% from approximately 20%. There’s substantial room for more long positions to build, suggesting further bullish potential in AUD.

Final Thoughts

This week’s key takeaways:

- CAD, CHF, NZD, and AUD setups remain strong with room for bullish growth.

- JPY positioning signals caution due to extreme bullish sentiment.

- GBP and EUR provide no clear actionable insights from current data.

Stay patient, keep an eye on positioning shifts, and trade smart. See you next week for another update!

— Takezo

Data Source: Commodity Futures Trading Commission (CFTC)

For traders interested in a deeper dive or who want to leverage this analysis for trading decisions, I offer the complete raw data set. You can directly purchase the raw data or subscribe to my website for free monthly updates and ongoing access.

Click here to access the data set and subscribe for free updates!