May 7, 2025 – Takezo Trading Commentary

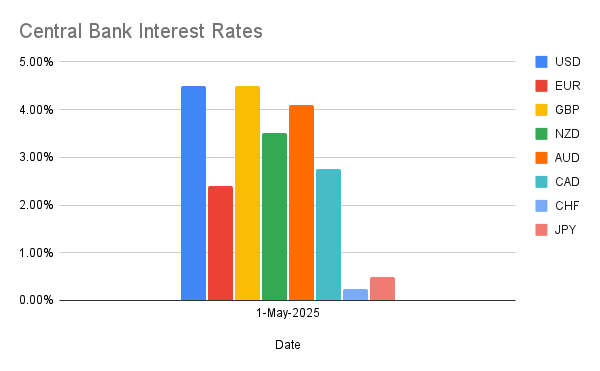

The Federal Reserve today kept interest rates unchanged, maintaining the federal funds rate within the range of 4.25% to 4.50%. But beneath the surface, there’s a growing sense of caution as economic uncertainty continues to climb—largely influenced by international trade tensions and shifting macroeconomic landscapes.

Here’s a clear, concise breakdown of the latest FOMC announcement, what’s changed since their March update, and what traders and market-watchers should keep an eye on.

Holding the Line – Rates Unchanged

The Fed’s decision to maintain its current rate is a clear sign of caution. Despite economic activity showing continued solid expansion and stable employment conditions, the committee is visibly cautious due to elevated inflation levels.

What’s Different from March?

In their March update, the Fed appeared cautiously optimistic, highlighting solid employment and steady growth without significantly heightened concerns. Fast forward to May, and uncertainty has notably increased:

- Inflation remains elevated. While employment remains solid, the inflation pressures persist.

- Rising Risks. The committee now explicitly recognizes heightened risks to both employment and inflation, marking a shift towards greater caution.

The FOMC is signaling more explicitly than before that it’s prepared to adjust policy quickly if necessary, underscoring the rising uncertainty.

Trade Tensions – A Central Concern

Much like their counterparts at the ECB and Bank of Canada, the Fed highlighted international trade tensions—especially those initiated by recent aggressive U.S. tariff policies—as key contributors to increased uncertainty. These external pressures are impacting financial conditions globally, influencing the Fed’s cautious stance.

Monetary Policy Implementation

Key operational points remain consistent:

- Interest on reserves: Held steady at 4.4%.

- Overnight operations: Maintaining a balanced stance through repurchase and reverse repurchase agreements.

- Balance Sheet: Continued reduction in holdings of Treasury securities and agency mortgage-backed securities, adhering to a clear monthly cap strategy.

These operational details reinforce a policy of cautious normalization amid elevated uncertainty.

Final Thoughts – Caution is the Word

The Fed’s current posture is clear: maintain steady rates but stay flexible. It’s a delicate balancing act, driven by uncertainties largely out of their direct control. This cautious approach underscores the importance of watching trade developments closely, as they may well dictate the Fed’s next move.

Stay informed, stay adaptable—and above all, stay strategic.

– Takezo

For traders interested in a deeper dive or who want to leverage this analysis for trading decisions, I offer the complete raw data set. You can directly purchase the raw data or subscribe to my website for free monthly updates and ongoing access.

Click here to access the data set and subscribe for free updates!