Welcome back to Takezo Trading! Today, let’s dive deep into one of the most intriguing and powerful forces behind currency movements—Market Sentiment.

The Emotional Pulse of the Market

Have you ever wondered what truly makes markets move? The short answer: investor psychology. It’s less about the news itself and more about how investors feel when they receive that news. Markets oscillate between two powerful emotions—greed and fear. If investors were completely rational, speculative bubbles would never happen. Yet, history tells us otherwise. Think back to the dotcom bubble of the late ’90s—companies with zero profits or even revenues soared simply because they had “.com” at the end of their names. When sentiment changed from greed to fear in March 2000, it triggered a massive market crash.

That’s market sentiment in action.

Understanding Market Sentiment

So, what exactly is market sentiment? Simply put, it’s the overall attitude of investors toward a particular market or asset—in our case, currencies.

One common tool for measuring sentiment is the VIX index, often dubbed the “fear gauge.” When the VIX hits 30 or above, fear dominates the market. Conversely, a prolonged period below 20 indicates widespread greed.

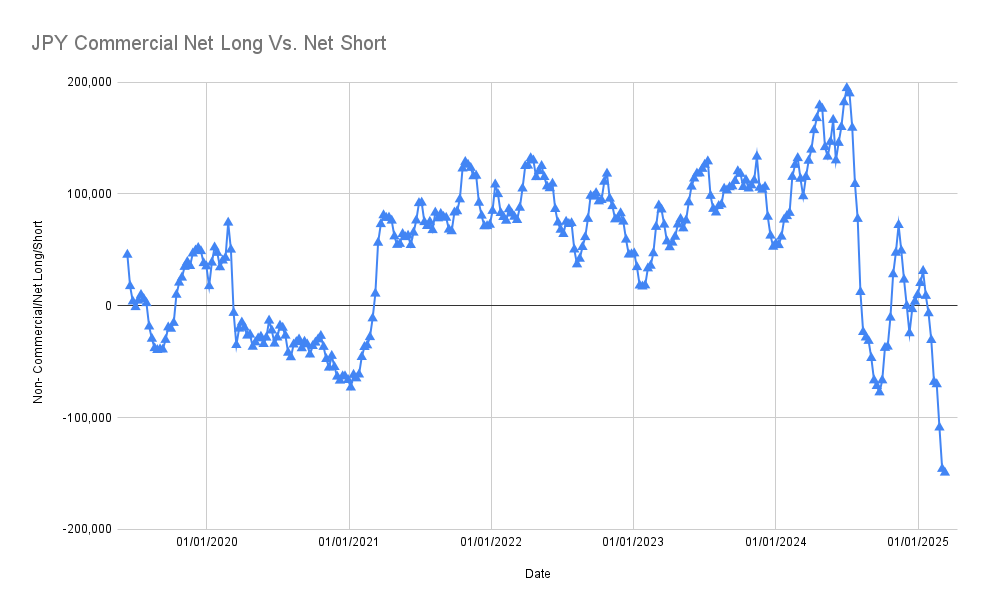

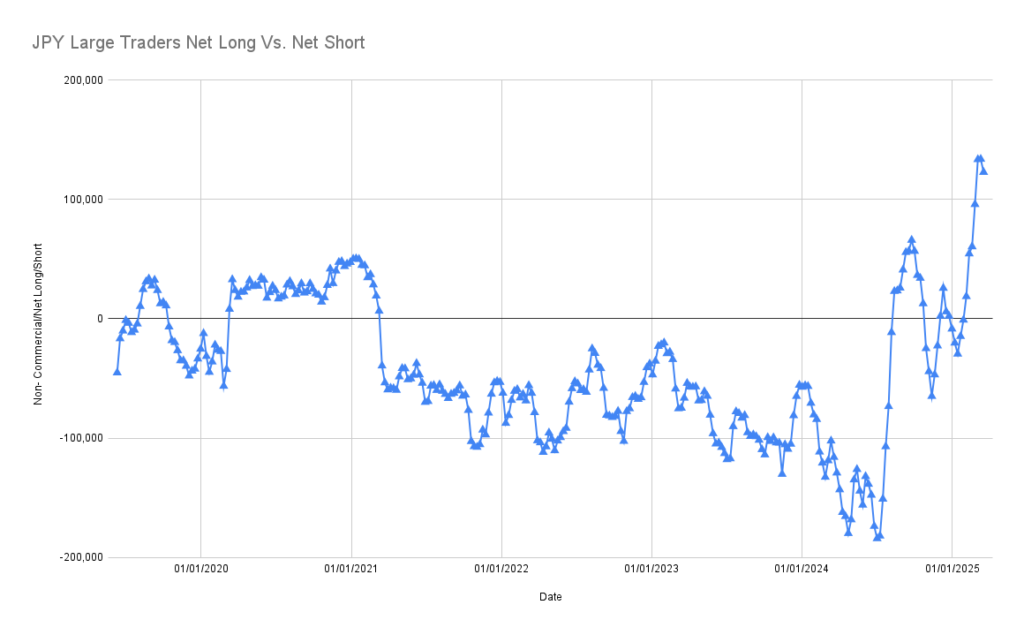

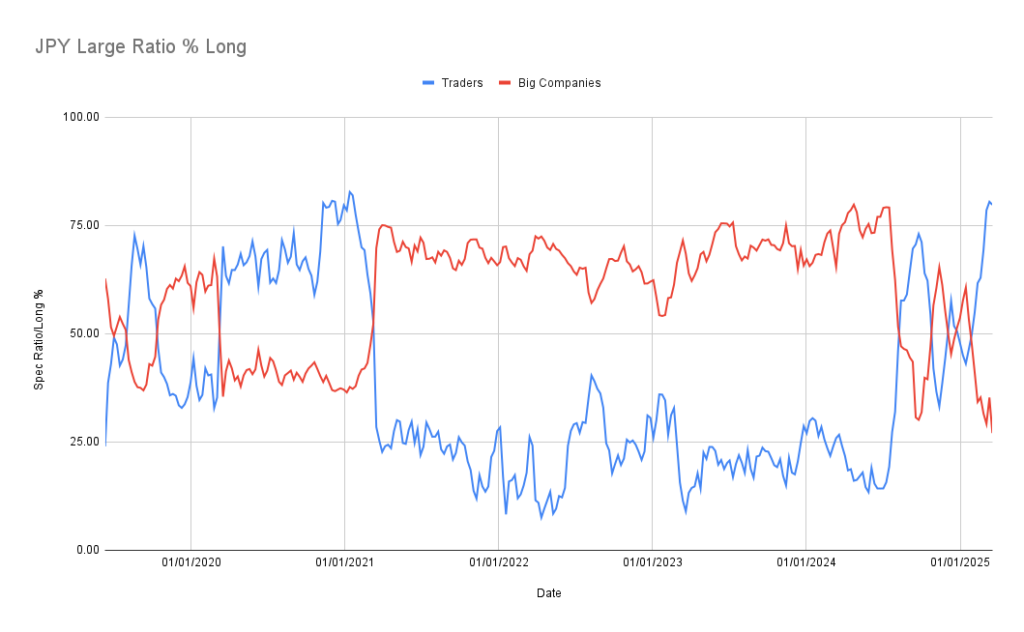

At Takezo Trading, I rely heavily on another powerful tool to gauge sentiment—the Commitment of Traders (COT) report. Released weekly by the Commodity Futures Trading Commission (CFTC), this report tracks positions held by major market players, separating them into two categories:

- Non-commercial traders: Large speculators like hedge funds who follow trends, buying when prices rise and selling when they fall.

- Commercial traders: Large multinational corporations and banks that hedge their risks. For instance, Toyota hedges against currency risk by buying futures contracts. Why? Because Toyota operates factories in the U.S. but earns revenue primarily in Japanese Yen. If the USD strengthens too much, Toyota faces higher operating costs. By locking in a fixed exchange rate through futures contracts, Toyota protects itself from currency fluctuations.

How Do Traders Use the COT Report?

Every week, I analyze the net positions of these trader groups. Here’s how it works:

- Net Long Positions: These represent traders betting that a currency will strengthen. Increasing net longs suggest growing optimism and bullish sentiment. However, if these start declining, it could signal waning confidence, cautioning traders to reconsider bullish positions.

- Net Short Positions: These positions show traders expecting a currency to weaken. Rising net shorts typically indicate bearish sentiment. Conversely, falling net shorts might signal decreasing bearishness, potentially heralding a trend reversal.

- Long/Short Ratios: This ratio indicates the balance between long and short positions. A high ratio suggests traders are predominantly bullish, while a lower ratio reveals bearishness. Extreme ratios (around 80/20) often signal potential reversals due to overbought or oversold conditions.

Real-Life Analogy: Futures Explained with Eggs

Imagine you own a bakery. Each December, egg prices skyrocket due to increased demand. To avoid paying inflated prices, you contact your supplier in October, agree on a price, and pay upfront for eggs delivered in December. This is exactly what a futures contract does—it locks in today’s price for future delivery, saving you from future price increases.

Putting It All Together

When you combine these insights from the COT report—net positions and long/short ratios—with technical and fundamental analysis, you have a powerful toolset. Sudden spikes or drops in sentiment can give traders critical cues for entering or exiting positions.

The Takeaway

Mastering market sentiment through the Commitment of Traders report empowers you to make smarter, more informed trading decisions. Remember, sentiment is not just about numbers—it’s about understanding the collective psychology of market participants.

Stay tuned for more insights and trade strategies. Until next time, trade wisely and stay disciplined!

Happy Trading,

Takezo Trading