Welcome back to this month’s currency strength analysis here at Takezo Trading. As usual, I’m diving deep into the data to help you understand the relative strength of the world’s major currencies by using gold as our trusted benchmark. Why gold? It remains an unbiased and stable reference point, allowing us to clearly compare currencies against each other without noise from external market distortions. Let’s break down April’s results and identify what’s really happening in the currency markets.

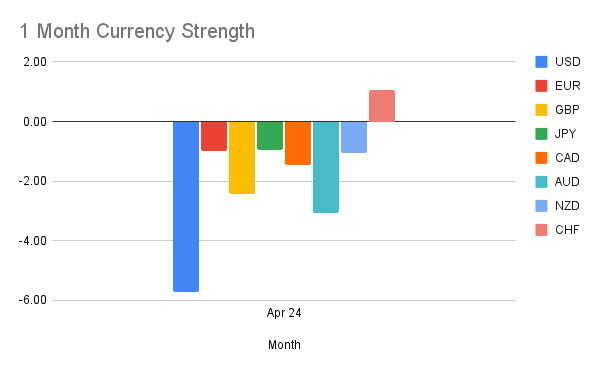

1-Month Currency Strength (April 2025)

In April, we witnessed some fascinating shifts among currencies. The standout performer this month was undoubtedly the Swiss Franc (CHF), which strengthened against gold, clearly signaling a rush to safety and avoidance of the US geopolitical trade war. On the opposite end, the US Dollar (USD) continued its troubling weakness, significantly underperforming every other major currency, although also a safe haven currency, USD is the center of the geopolitical uncertainty caused by tariff and trade war with China.

For the month of April, going long CHF against any of the majors would’ve netted you great profits, on the flip side, shorting the USD was the way to go.

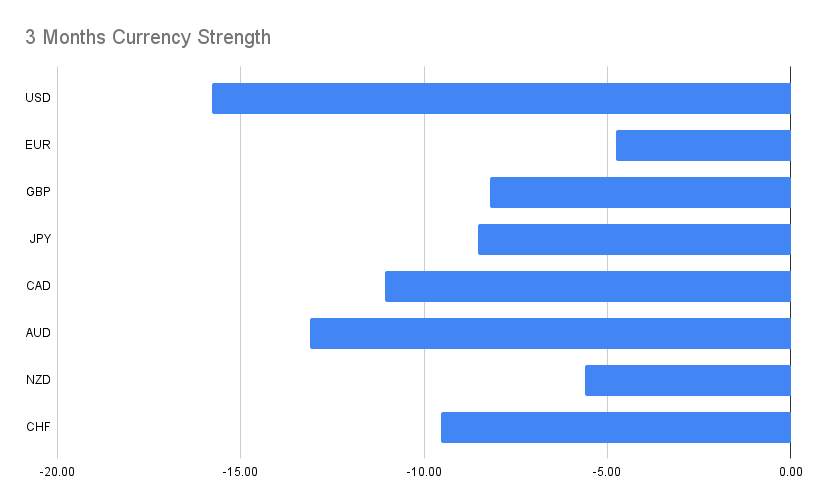

3-Month Currency Strength (February–April 2025)

Expanding our view to three months reveals persistent trends. The USD continued to significantly underperform, reflecting ongoing geopolitical headwinds and investor uncertainty. The Australian Dollar (AUD) and Canadian Dollar (CAD) similarly showed notable weakness, continuing a multi-month downward trajectory.

Here’s the three-month ranking from strongest to weakest:

- Euro (EUR) – relatively resilient, the strongest currency in the longer-term context despite slight weakening.

- Japanese Yen (JPY) – moderate weakness.

- British Pound (GBP) – moderate but consistent weakening.

- Swiss Franc (CHF) – weakening slightly more pronounced than GBP and JPY over three months, despite strong April.

- Canadian Dollar (CAD) – substantial weakening.

- Australian Dollar (AUD) – significant weakening.

- US Dollar (USD) – consistently the weakest performer.

This perspective clearly identifies pairs such as EURUSD and EURAUD as consistently attractive, especially for those looking to leverage the enduring relative strength of EUR compared to more troubled currencies.

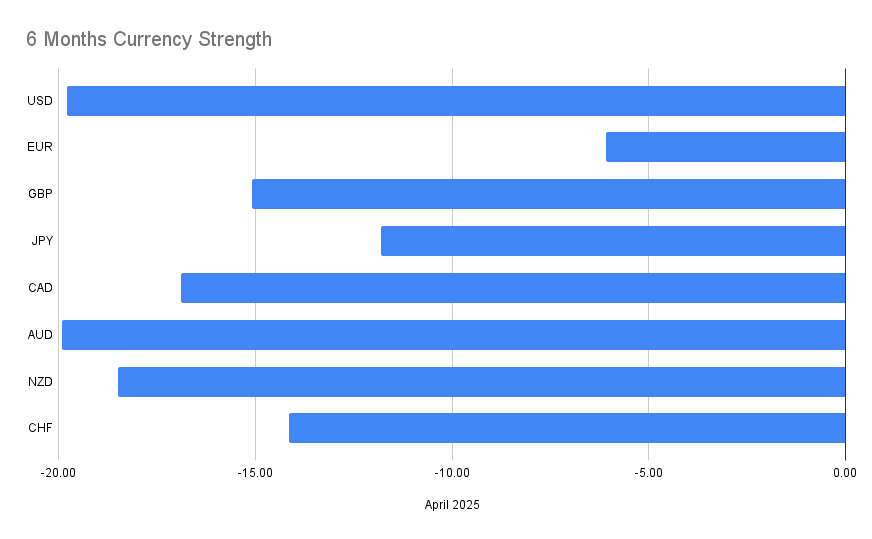

6-Month Currency Strength (November 2024–April 2025)

Over the longer six-month horizon, the picture remains clear. The USD and AUD continue to demonstrate significant and sustained weakness, suggesting deeper structural or economic challenges. Meanwhile, the EUR, CHF and JPY continue showing relative strength, suggesting investor confidence or stronger economic fundamentals in those regions.

Rankings from strongest to weakest over six months:

- Euro (EUR) – displaying impressive resilience and relative strength.

- Swiss Franc (CHF) – despite recent volatility, remains robust.

- British Pound (GBP) – showing some sustained moderate weakness.

- Japanese Yen (JPY) – steady weakening over the longer term.

- Canadian Dollar (CAD) – persistently weakening.

- New Zealand Dollar (NZD) – experiencing continued weakening.

- Australian Dollar (AUD) – notably weak, suggesting persistent economic concerns.

- US Dollar (USD) – the weakest overall, highlighting serious ongoing challenges.

Longer-term traders can clearly see value in pairs such as EURUSD, USDJPY and EURAUD, capitalizing on persistent divergences in strength and weakness.

Final Thoughts

Tracking currencies through gold as a benchmark clearly highlights relative strengths and weaknesses, providing actionable insights for traders. This method allows us to identify clear trends and act on them confidently. April’s data again confirms some ongoing trends (notably the persistent USD weakness), alongside shifts like the recent CHF strength.

I’ll keep monitoring these trends closely each month. Stay tuned for more insights and analysis—always strategic, always actionable.

Thanks for reading, and trade wisely!

— Takezo Trading

For traders interested in a deeper dive or who want to leverage this analysis for trading decisions, I offer the complete raw data set. You can directly purchase the raw data or subscribe to my website for free monthly updates and ongoing access.

Click here to access the data set and subscribe for free updates!