Currency Strength Check-In: What’s Gold Telling Us? (March 2025)

Welcome back to Takezo Trading, where currency trading meets Samurai Tactics. Today, we’re exploring an intriguing way to assess currency strength: comparing currencies against gold. Using gold as a benchmark simplifies the process and provides a clear, unbiased picture of how major currencies are performing. Let’s dive into our currency strength analysis for March 2025.

Understanding Currency Strength Against Gold

When we say “currency strength,” we’re referring to how well or poorly a currency performs relative to gold. A currency weakening against gold means it’s losing purchasing power compared to the precious metal—often indicating broader economic concerns or inflationary pressures. Conversely, a currency showing minimal or no weakening against gold suggests more stability.

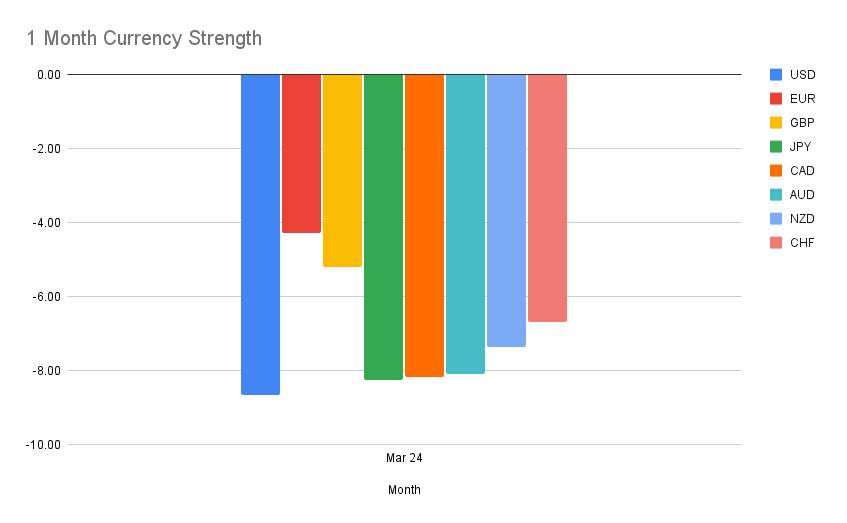

1-Month Performance (March 2025)

March wasn’t kind to any major currency when measured against gold. However, the USD took the hardest hit, showing substantial weakness. Close behind were the Japanese Yen (JPY) and Canadian Dollar (CAD), also significantly weaker. Other currencies like the Swiss Franc (CHF), New Zealand Dollar (NZD), Australian Dollar (AUD), British Pound (GBP), and Euro (EUR) also faced declines, but to a slightly lesser extent. It was a tough month across the board!

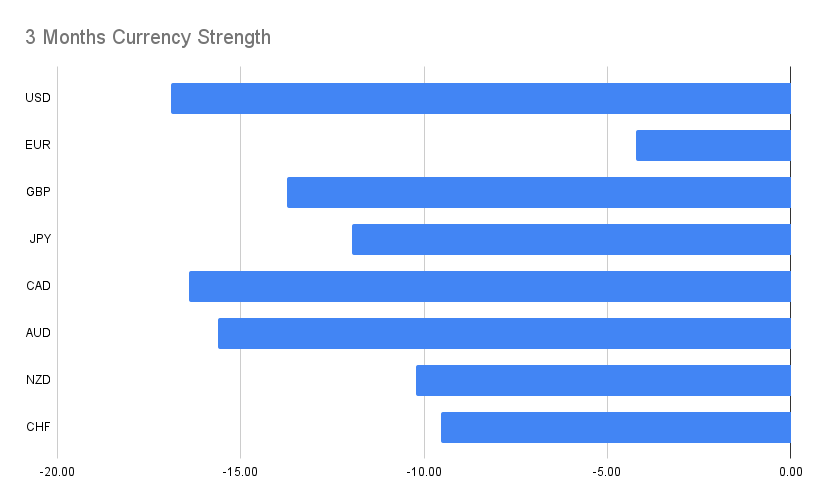

3-Month Performance (January to March 2025)

Zooming out to a three-month perspective, we notice a continuation of weakness, particularly in the USD and CAD, both standing out as notably weak compared to gold. Meanwhile, the JPY, GBP, and CHF weren’t far behind, each showing meaningful declines. Interestingly, the EUR managed to maintain more stability, suggesting that, despite broader market pressures, the eurozone’s currency held up relatively better than its peers.

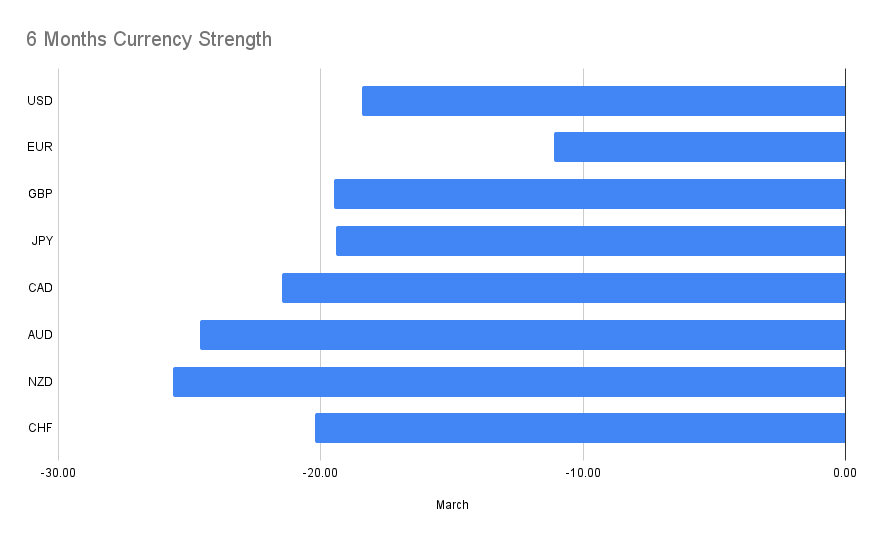

6-Month Performance (October 2024 to March 2025)

Looking at a broader six-month window provides additional insight. Here, the Swiss Franc (CHF) emerges as the weakest performer, facing a significant decline. Closely trailing are the NZD, AUD, and CAD—each under persistent pressure. While still weak, the USD shows marginally better performance over this extended period, hinting at some stabilization compared to recent months. The EUR again stands out as relatively stable, still down against gold but outperforming other currencies in terms of resilience.

The Takeaway

Using gold as a benchmark gives us a clear, straightforward way to assess currency health. Right now, the message is loud and clear: currencies are generally weak, with some notable distinctions. Understanding these nuances helps us navigate the market better and sharpen our strategic focus.

Stay tuned to Takezo Trading for more insights as we continue to apply timeless strategic wisdom to modern financial markets.

Until next time, trade wisely and think strategically.

—Takezo Trading